The NASDAQ 100 has gone back and forth during the trading session on Monday which might have been a little bit skewed due to the fact that it was Columbus Day. That being said, the market is awaiting earnings season, and some of the banks will announce their earnings overnight. While that won’t necessarily affect the NASDAQ 100 directly, that overall attitude that will show itself in the S&P 500 will most certainly have a bit of a psychological effect on this market.

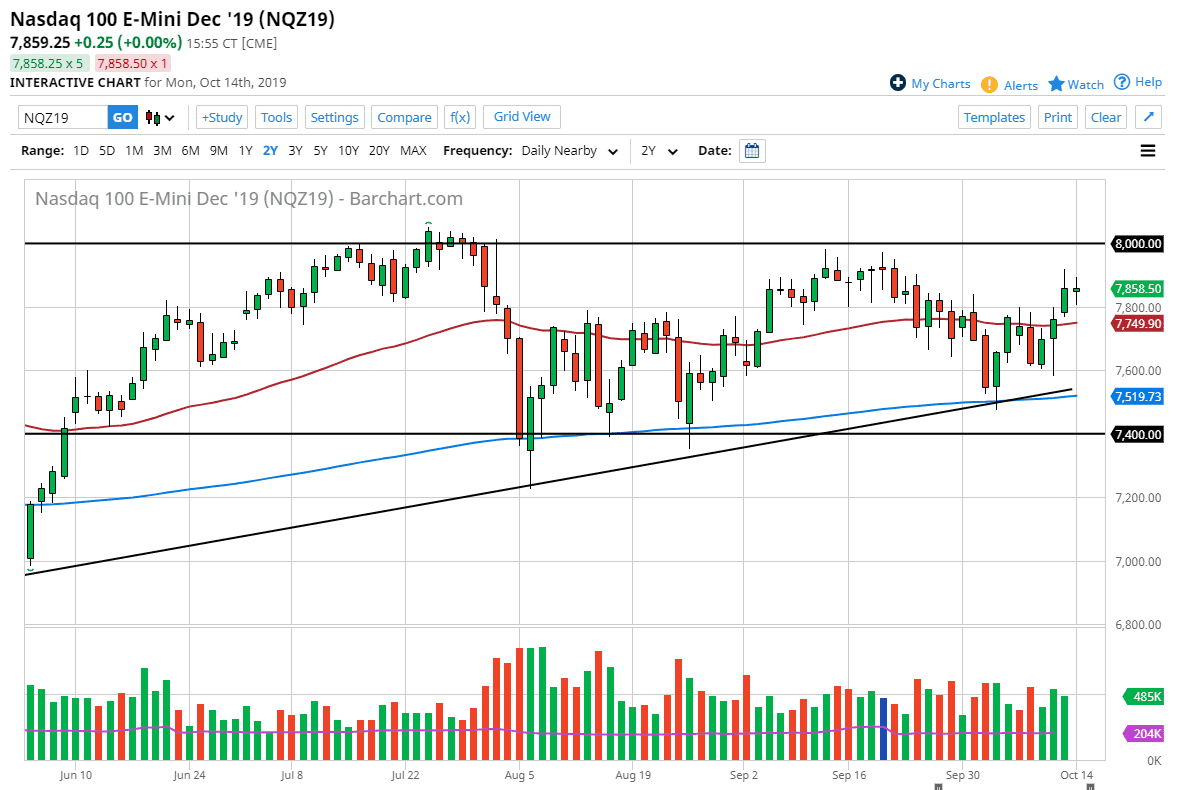

To the downside, if we were to reach towards the 50 day EMA, which is closer to the 7750 level, and therefore we could see a bit of structural support, and furthermore it is starting to turn a little bit to the upside. Ultimately, this is a market that continues to see a slight uptrend, but slight being the key word there. The 7600 level underneath should continue to offer support, just as the 8000 level should offer resistance. Looking at the chart, it’s probably best to wait for pullbacks in order to pick up a bit of value in this market. After all, we aren’t talking about technology stocks in the short term, but the overall attitude of the market will continue to be where we focus.

Looking at the US/China trade talks, they went nowhere and therefore we are where we started just a few weeks ago in the NASDAQ 100. Keep in mind that a lot of these stocks are going to be highly sensitive to the US/China situation, which seems to be more of the same. They will be the occasional headline that could throw the market around but as we enter earnings season people will actually start to pay attention to things like profit, which is a completely different game, one that is typically easier to play. With that, as we get key earnings over the next several days, then we should get a bit of an opportunity. Right now I don’t think we have one, so it will simply move right along with the greater stock market in general. Ultimately, if we did break down below the uptrend line that could change a lot but doesn’t look like anything that’s going to be threatened anytime soon. If we were to break above the 8000 level that would obviously be very bullish. I don’t think it happens soon either.