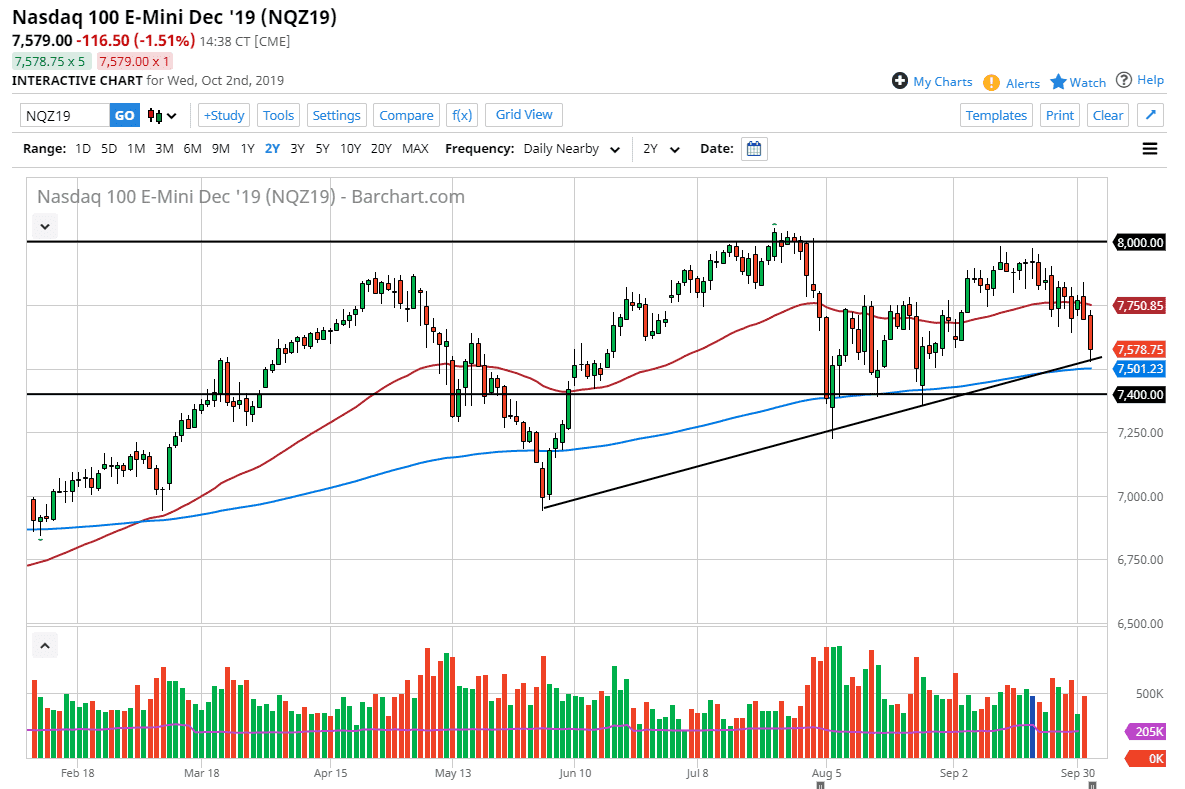

The NASDAQ 100 broke down rather significantly during the trading session on Wednesday, slamming into the 7575 region. At this point, the market looks like the uptrend line is going to hold, especially considering that the 200 day EMA underneath should continue to support this market. As we await for the jobs number on Friday, it’s very likely that the Thursday session will be relatively quiet as we are trying to figure out where to go next. Obviously, the jobs number will have a significant effect on stock markets around the world, as the American consumer is the biggest driver of growth right now.

Looking at this chart, the 200 day EMA should cause quite a bit of support, just as the 7400 level will as well. In other words, it’s not just the uptrend line that should support this market. Yes, we have made a slightly lower high but I think a bounce is about to do. Having said that though, if the market breaks down below the 7400 level I would become aggressively short of this market as we should go looking towards the 7250 handle, and then perhaps down to the 7000 level after that.

The candlestick of course looks very negative, but we did bounce a little bit at the end of the day right where we needed to. With that being the case, the market is likely to see a certain amount of resiliency here, and therefore I think value hunters have come back in. More importantly, large order flow came into the market to the upside at the end of the session, so it’s likely that we will go looking towards the 50 day EMA but it’s going to be more of a grind than anything else.

At this point, I suspect Thursday will be quiet but then we may have more traction on Friday as to which direction we are going to head. That being said, it’s likely that the market will eventually make a decision, but I think it won’t be until after the 8:30 AM announcement on Friday. At this point, I anticipate a slow and gentle grind to the upside between now and then barring some type of headline coming out. Again though, I believe just as in the S&P 500, we may get a bit of presidential interference in the form of a tweet rather soon.