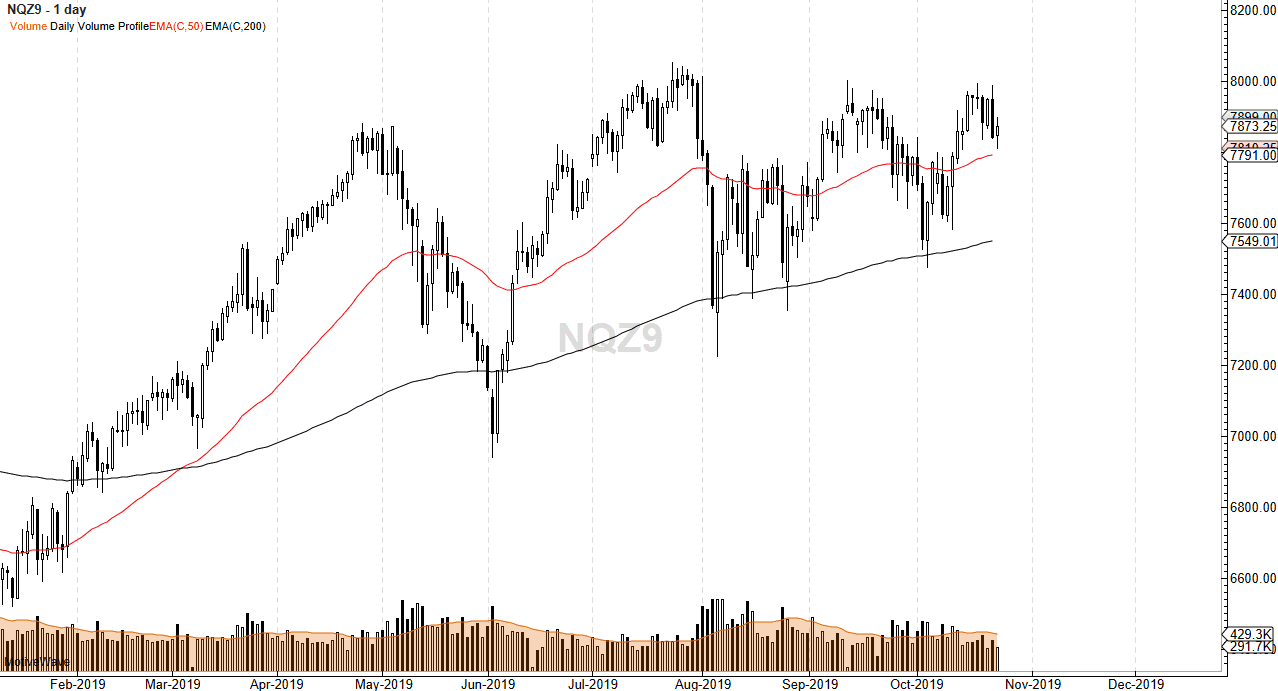

The NASDAQ 100 initially pulled back in trading on Wednesday, testing the 50-day EMA. The 50-day MA has offered a significant amount of support, and it looks as if we are ready to continue going higher given enough time. If that’s going to be the case, then the 8000 level will be targeted. This is an area that continues to offer massive resistance, so at this point we simply are going back and forth and trying to consolidate enough inertia is a breakout to the upside.

The other side of the equation would be a break of the 50-day EMA, perhaps sending the market down to the 7600 level. That is an area that sits just above the 200-day EMA which determines the longer-term trend. Obviously, that would attract a lot of attention as well, and the only thing that you need to pay attention to more than everything else is that the market continues to grind to the upside every time it drops. More importantly, it also continues to make “higher lows.” In other words, we are without a doubt in an uptrend going forward, so even if we do pull back it’s very likely that we will find plenty of buyers.

If we can break out above the 8000 level for any significant length of time, that probably opens the door to the 8200 level. That would be a major break of resistance, and a ton of momentum would enter the marketplace. On the other hand, pullbacks occasionally happening to the downside are a lot less volatile, has the market is essentially much like a beach ball held under water, once it gets released, it will shoot straight up in the air.

We are in the midst of earning seasons of the course has its influence on this market as well, as traders are trying to figure out where the economy is going. We also have the Federal Reserve cutting interest rates rather soon, and now market participants will pay quite a bit of attention to not only the interest rate decision but perhaps more importantly the accompanying statement that will give traders an idea as to whether or not the Federal Reserve will be hawkish or dovish going forward. That loose monetary policy should help support this market over the longer term. As far as trading is concerned, I prefer to buy the dips going forward.