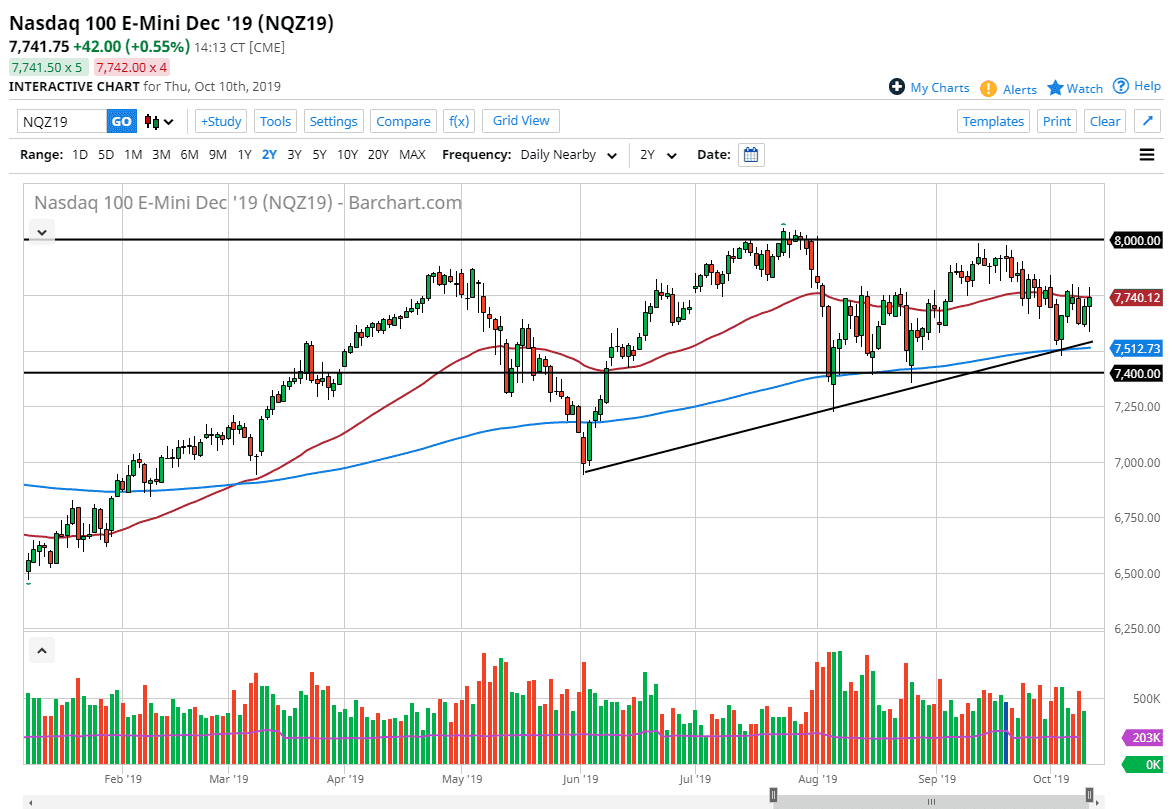

The NASDAQ 100 initially fell during trading on Thursday, reaching down towards the uptrend line underneath. Ultimately, we did turn right back around to show signs of strength though, as the market not only went positive but crashed into the 50 day EMA again. All that being said, we did not break out above the highs over the last couple of sessions, so not much can be said about whether or not we can continue to go higher. This will continue to move based upon trade headlines and of course rumors about the trade conversation at so. At this point, the market will be held hostage to Twitter.

That being said, if we do break out above the highs from the last couple of days, then the market could go looking towards the 8000 handle. The 8000 level above is massive resistance, as it was a major high recently, and it should be pointed out that the most recent high didn’t quite make it to the previous one so we do have to worry about that.

That being said, the uptrend line underneath continues offer support, just as the 200 day EMA well. Ultimately, the fact that we have bounced the way we have suggest that there are plenty of people willing to step in and buy. Even after that being the case, the reality is that the earnings season is coming out next week, and that of course will move the market participants in one direction or the other. Ultimately, the market looks very likely to continue to find a bit of a move to the upside but that doesn’t mean that is going to be easy. I suspect that a short-term pop probably comes after some type of delay in tariffs or other such minor movement in the US/China trade negotiations. That being said, if we get bad returns from the negotiation, then we could look to break down below the uptrend line which could send this market down to the 7400 level and of course we break down below there the market really could start to unwind as it would slice through the last vestiges of the support that has kept this market alive. If the market were to turn around and rally and break above the 8000 handle, then obviously we will have had a lot of positivity and it would be a continuation of the longer-term trend.