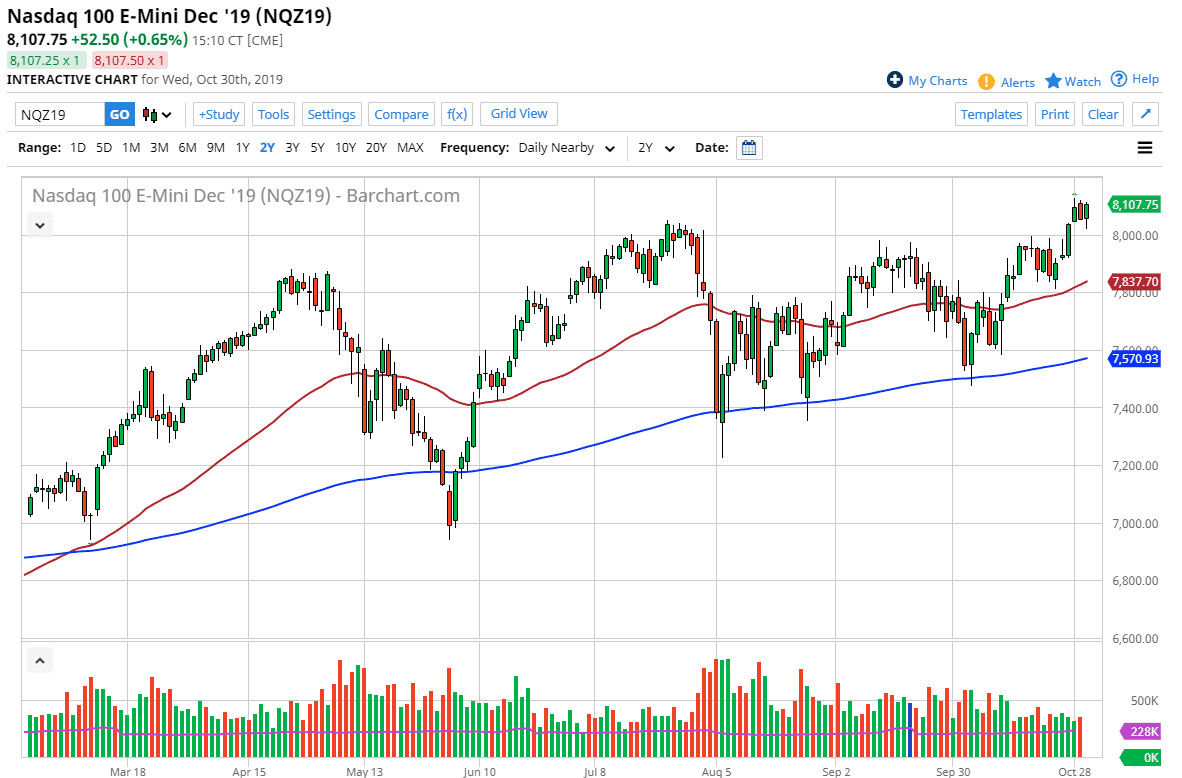

NASDAQ 100 traders initially sold off during the early part of the session, but the 8000 level has offered a significant amount of support. Ultimately, this is a market that has broken towards the highs again, and that suggests that we are going to continue going much higher. With this, short-term pullbacks continued offer value and it looks as if the 8000 level will begin to offer a bit of a “floor” in the market as well. I don’t have any interest in shorting this market and believe that any dip at this point needs to be looked at as a potential buying opportunity.

While the Federal Reserve cut interest rates, the next thing they said is that they were essentially going to be neutral at this point, as the economy needs time to react to the liquidity measures that the central bank has already done. In general, the Wall Street traders out there expected this, and now that they have gotten their latest bit of sugar via interest-rate cuts, buying on dips can continue going forward. Beyond this, the US/China trade situation continues to get a bit better, or at least more consolatory. If that’s going to be the case that it makes quite a bit of sense that the NASDAQ 100 would rally as it has so many technology companies attached to it that do business in both the United States and China.

Looking at the chart, not only is the 8000 level crucial, there is also the 50 day EMA underneath it should offer quite a bit of support. At this point in time, it’s likely that we will continue to see volatility and noisy trading, but we have just broken out of an ascending triangle, which could measure for a potential move to the 8800 level over the longer term. Don’t get me wrong, that’s not going to happen anytime soon, but it is the long-term target, and could be seen later in the year. Buying dips continues to work as there is so much bullish pressure in this market. I don’t have any interest in shorting, I think those days are long over and now that we have broken above significant resistance, we are ready to see a significant move going forward. Expect volatility, but most certainly with an upward slant over the longer term.