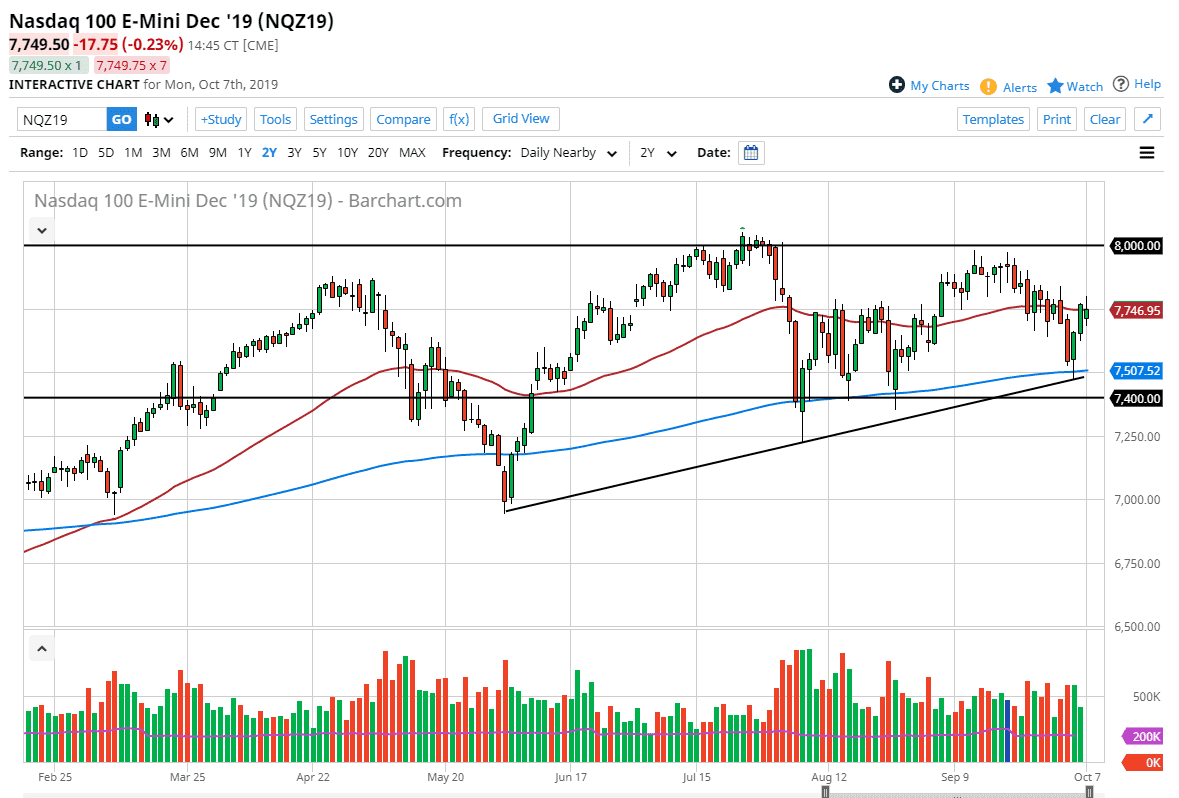

The NASDAQ 100 tried to rally during the trading session on Monday, indeed keep some of the gains after gapping lower. However, quite a bit of the buying pressure subsided later in the day, as the market broke down below the 50 day EMA. By forming the shooting star, it suggests that the market is ready to roll over completely, perhaps reaching down towards the bottom of the Friday candlestick before reaching towards the 200 day EMA underneath at the 7500 region. What’s even more interesting about that area is that the uptrend line is just below, so that also should offer plenty of support.

The alternate scenario of course is that if we break above the top of the candle stick for the trading session on Monday, then we could go looking towards the 8000 handle above. While I do think it’s very possible that happens longer term, the reality is that the NASDAQ 100 is going to be very sensitive to the US/China trade situation, which looks to be very dicey at best. As technology companies are especially sensitive to US/China trade, this market will tend to move right along with the overall attitude of those negotiations.

China has already suggested that it wasn’t going to limit property theft, which of course is the main problem the Americans bring to the table. As long as there is theft of intellectual property and the forced transfer of proprietary systems by US companies doing business in China, the Americans will not budge. This will continue to be a weight around the neck of the markets. The other side of the equation of course is that the Federal Reserve is likely to accommodate the markets as much of a need, so this is a “push pull” type of situation going forward. I think all things been equal though, we get short-term weakness followed by a bit of a bounce. Beyond that, we have earnings season starting next week which of course will attract a lot of attention, so that could cause volatility going forward but in the short term it certainly all about the Chinese being in the United States having this conversation. Unfortunately, algorithmic and computer-based trading will pick up headlines from Twitter and rumors to kick the market around. Because of this, position sizing should be very small as there will be sudden jerks and launches in the market.