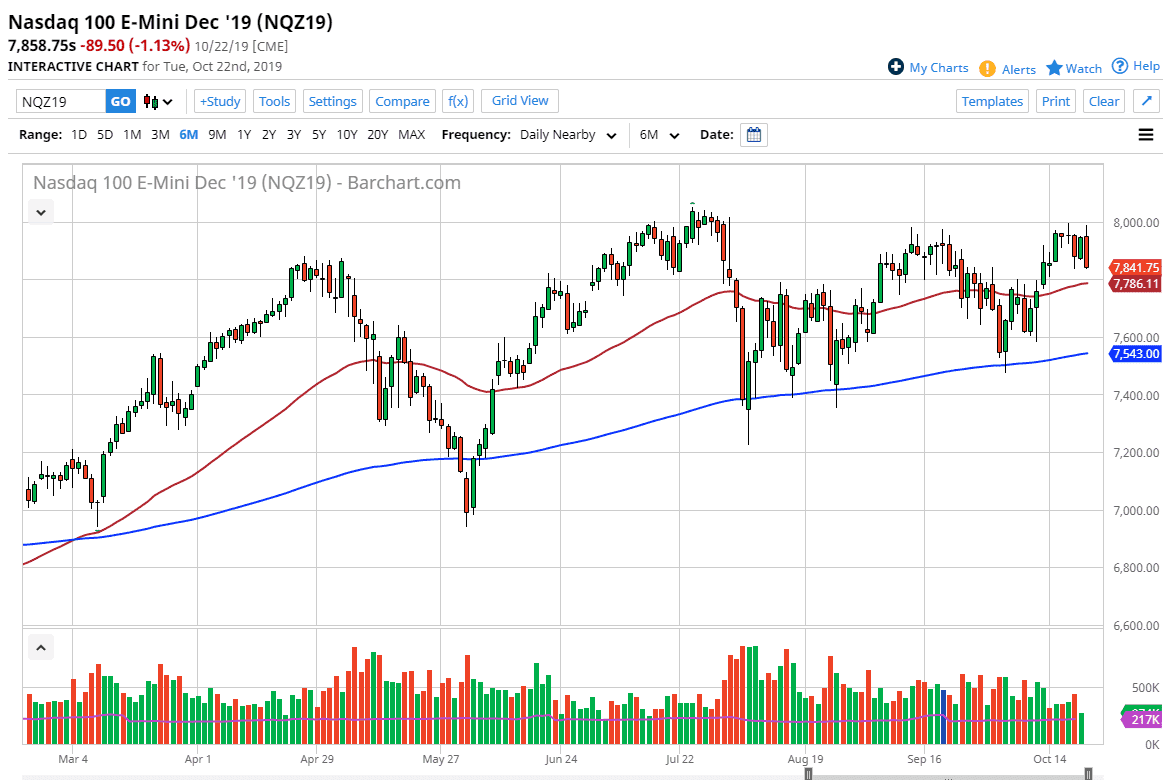

As we have seen time and time again, the 8000 level has offered quite a bit of bearish pressure, and as a result we have sold off pretty drastically during the day. At this point, the market has closed at the very bottom of the range and that normally means that you will see a bit of follow-through. If that’s going to be the case it’s likely that we go looking towards the 50-day EMA, which is painted in red on the chart. The 7790 level is an area that will cause a bit of support based upon that and the resistance that has shown in the past. All things being equal, this is a market that should continue to find buyers on dips and even though things looked a bit bad towards the end of the day, those who are a bit more patient will be looking for an opportunity to buy the NASDAQ 100 “on the cheap.”

Longer term, the market has shown itself to be resilient, and of course the US stock markets in general continue to offer a lot of value for those who are willing to take a bit of time and wait for a bounce. We may get a day or two of negativity, but longer term it’s likely to find an opportunity to be a buying opportunity just waiting to happen. Even if we do break down below the 50-day EMA, the market will then go looking towards the 200-day EMA which is closer to the 7500 level. There’s also an argument to be made for the 7600 level being supportive anyway, so I like the idea of buying dips on signs of support. I do feel that it is only a matter time before it happens, and therefore I’m not even looking at the idea of shorting this market.

The alternate scenario of course is that we break out to the upside. I don’t see that, at least in the short term. However, if it were to happen then obviously that would be very bullish on as well. If you look at the chart, you can make an argument for either an up-trending channel or an ascending triangle. Both of those are larger and longer-term bullish signals, so I think it’s only a matter of time before we take off. With that, simply looking for value is the way to go forward.