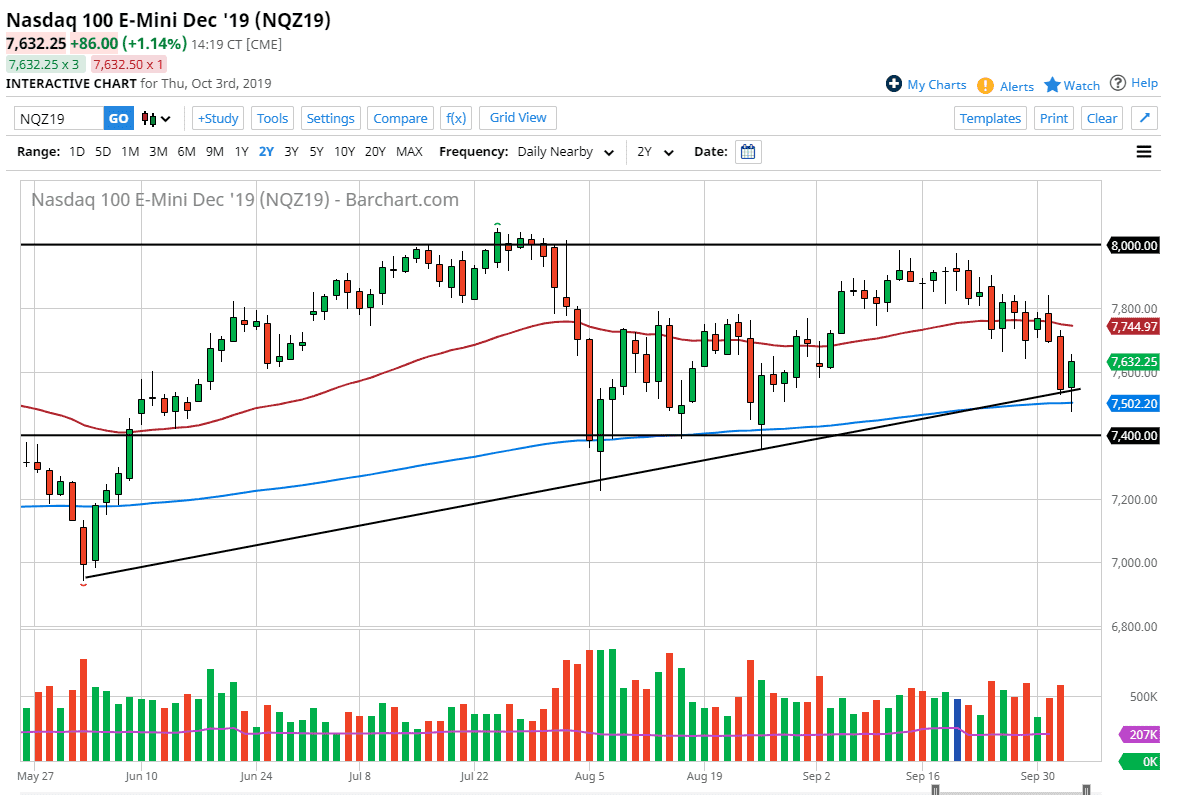

The NASDAQ 100 initially fell during the Thursday session, breaking below the 200 day EMA after the miss in ISM Non-Manufacturing PMI numbers. That being said though, we have recovered quite nicely as the 200 day EMA has attracted enough value hunting to turn the market back around. Beyond that we also have a nice uptrend line underneath that should continue to push this market higher as well. Also, it seems as if Wall Street has become giddy again about the idea of more cheap money being thrown into the system by the Federal Reserve.

We have seen expectations for rate hikes in December rise during the trading session, so it’s likely that we will continue to see this market reach to the upside, even if we get some type of bad employment figure. This is because it will just solidify the idea of interest rate cuts, which has been the most important thing when it comes to markets for the last 10 years or so. Economics have very little to do with what happens, and it’s all about cheap money. Obviously, that will come to an end but it hasn’t come to an end yet.

To the upside I suspect that the 7750 level could cause some issues, perhaps extending all the way to the 7800 level. Above there, then the market goes looking towards the 8000 level which of course is the recent highs. To the downside, we not only have the uptrend line and the 200 day EMA, but the 7400 level has been pretty significant as well. With that being the case, I like the idea of buying short-term dips, as the market is trying to find its footing and go higher from here. The NASDAQ 100 is very sensitive to the US/China trade situation as there are so many technology companies right in the middle of that mass. If that can sort itself out over the next couple of weeks, that would be the best thing that could possibly happen. Chinese officials are flying into Washington DC October 10, so I suspect there’s also the possibility that the market might try to stay somewhat afloat based upon hopes of a breakthrough. In other words, I’m rather bullish, at least in the short term because the market simply are designed to go higher over the longer-term anyway. This doesn’t mean that it will in the next 24 hours, but odd seem to favor it.