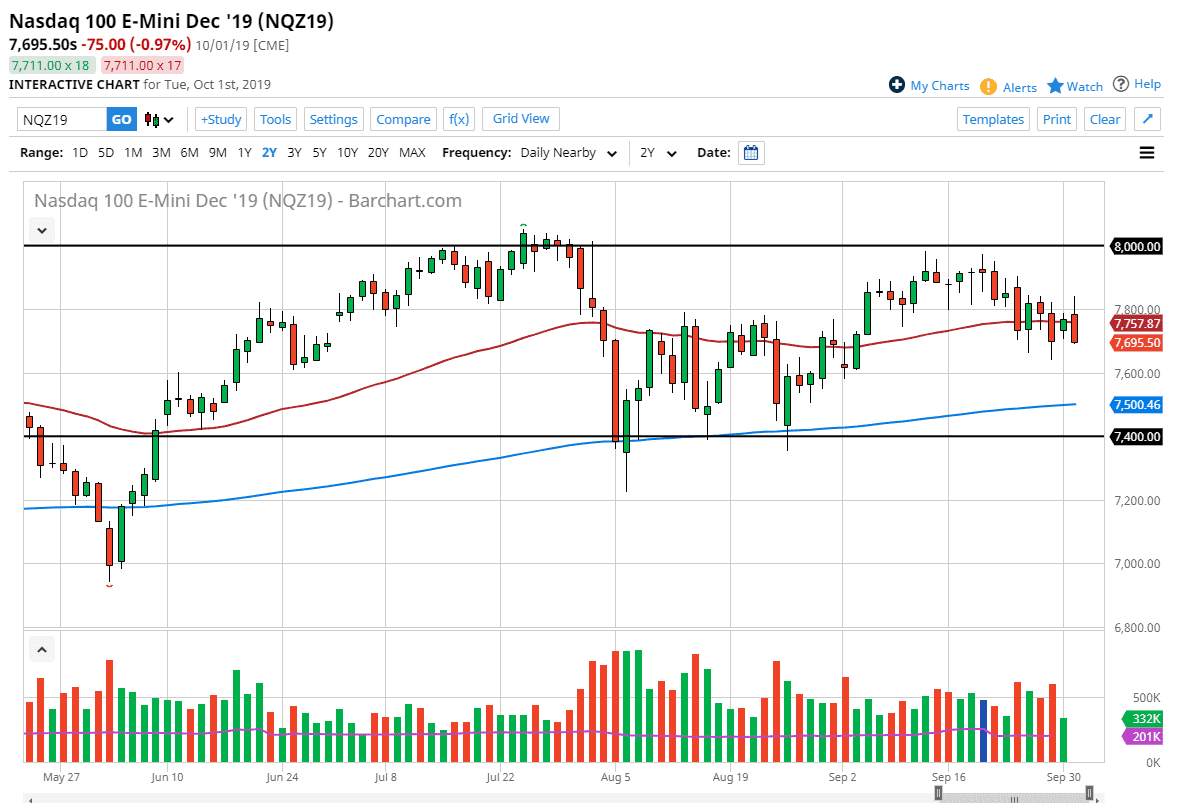

The NASDAQ 100 initially tried to rally during the trading session on Tuesday, but then broke down rather significantly to fall apart. At this point, the market looks like it will probably continue to the downside as the market close so poorly. The NASDAQ 100 of course is very sensitive to the overall US/China trade situation and as technology goes back and forth across the Pacific, so goes this index. All things being equal, the market should find support just below, but if it does not then it’s likely we go looking towards the 7600 level, possibly even the 200 day EMA which is currently sitting at the 7500 level.

To the upside, the 7800 level should cause a significant amount of resistance but breaking above there it’s likely that the market continues to go higher. Ultimately, if the market does break to the upside it’s the 8000 level that will offer the “ceiling in this market overall. A break above the 8000 level could continue to go much higher, but ultimately it would take a significant shift in momentum to make that happen. We are currently dancing around the 50 day EMA, which of course attracts a lot of attention in general.

Looking at the chart, I think it’s likely that we continue to go back and forth overall, as there are a multitude of issues that are causing this market to be very choppy to say the least. I anticipate that the volatility is only going to get worse, especially considering that we are heading toward the US/China trade talks which can have a lot of influence on what happens next.

If we were to break down below the 7300 level, that would be a complete crushing of the overall uptrend, but I don’t expect to see that happen in the short term. It looks to me like we are simply going to chop back and forth and even though it was a very poor finish for the day, it’s likely that we continue to see a lot of back-and-forth simply because we have not left the range that we had been in over the last several days. Short-term traders will continue to be attracted to this back-and-forth action but longer-term traders may be better served waiting for some type of supportive daily candle stick. Expect mass confusion, as we are trading on the latest headlines at this point.