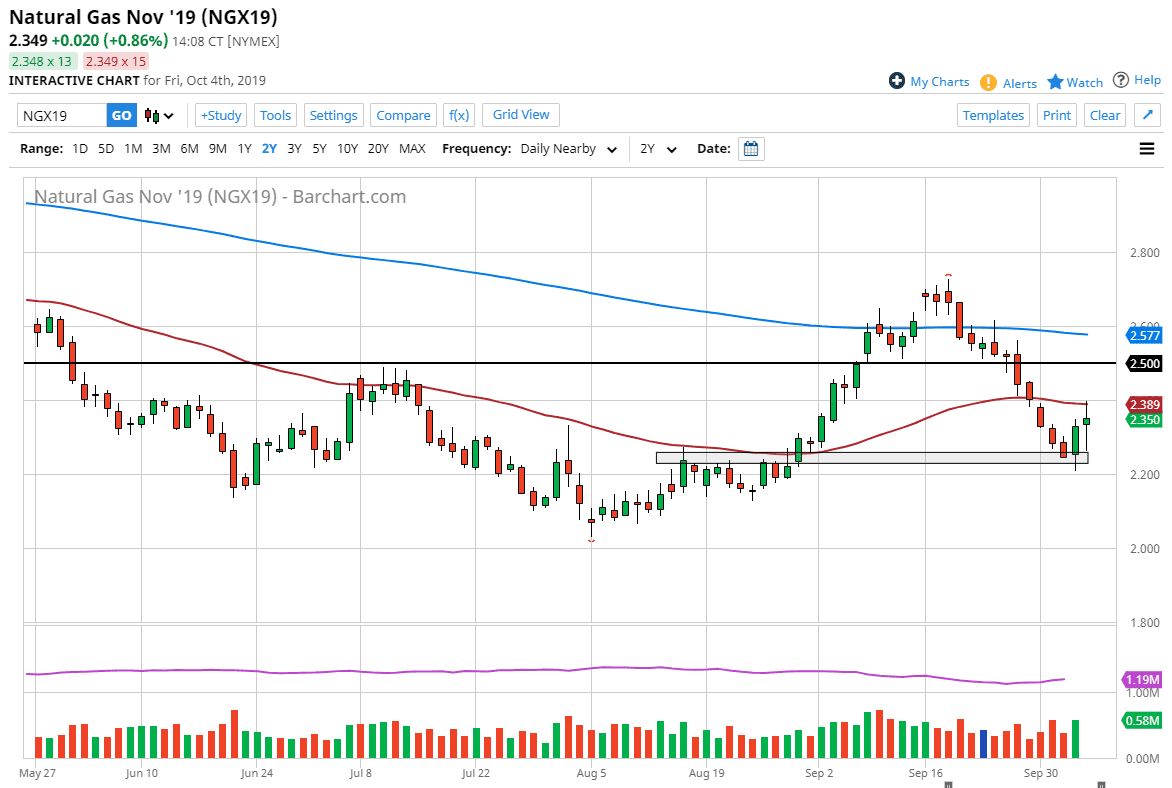

The natural gas markets initially fell during the trading session on Friday, reaching down towards the significant $2.20 level. That level has now offered quite a bit of support over the last couple of days, and then bounced quite significantly during the trading session as well to crash into the 50 day EMA. That being the case, we ended up forming a bit of a hammer, which of course is a bullish sign.

If we were to break down below the candle stick from the Thursday session, it could wipe out a lot of the bullish pressure, but at this point I think it’s obvious that natural gas is trying to start the Winter pop that we see every year. If we can break above the 50 day EMA, then I think the market goes looking towards the $2.50 level, perhaps even all the way to the 200 day EMA and the relatively short term. Longer-term, I think we will probably go looking towards the $3.00 level, perhaps even the $3.50 level.

At this point in time it’s likely that demand will start to pick up as temperatures start to drift lower in the northern hemisphere. Ultimately, that’s one of the biggest cyclical trades in this market every year, somewhere around now buyers step in and push this market up drastically until the beginning of the month of January. At that point, futures markets will start to pay attention to spring, and therefore start selling off as temperatures are expected to be warmer. At this point, every time we pull back from here I think buyers will step in, and it’s more or less going to be a “buy on the dips” type of scenario. This doesn’t mean that we go straight up in the air, but certainly there should be a lot of buying pressure underneath on the whole. If you have the ability to play the CFD market, it may be easier for a longer-term standpoint. However, the futures markets are very expensive and could be difficult to hang onto a longer-term position. However, if you have the proper account size it certainly can be done.

At this point I don’t have any interest in shorting and I think that the market may have bottomed for 2019. That being said, if we did break down below the $2.20 level, the $2.00 level will be a major support as it was the low of the year so far.