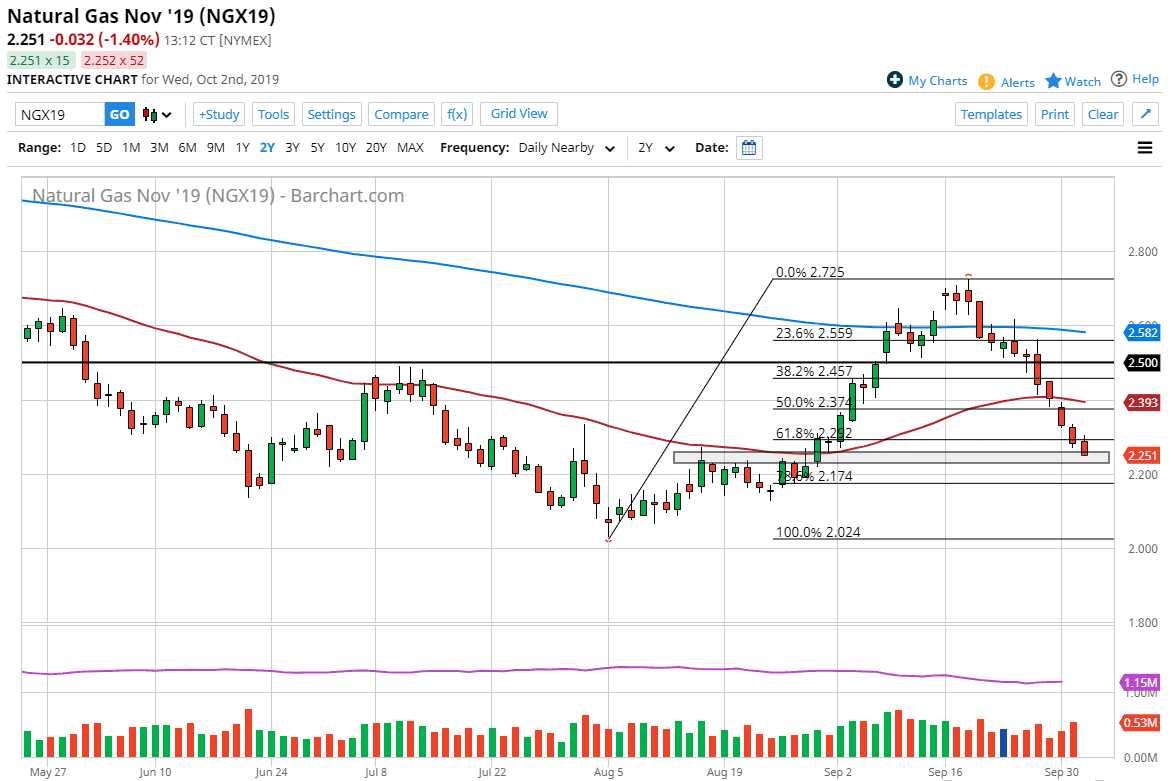

Natural gas markets continue to fall, as the Wednesday candle was negative as well. In fact, we close towards the bottom of that candlestick which typically means you should see a bit of follow-through. However, the idea of shorting here is a great way to lose money because you have missed the trade. I have missed the trade, and I’m the first person to admit that. However, we are approaching an area that should be supportive, and with the inventory figures coming out during the day it’s possible that we may see a bit of a bounce. I don’t think that demand will have picked up enough in the last week to turn the market around based on that alone.

I believe at this point the market has a lot of structural support in this general vicinity from the previous breakout, so that’s something that should be paid attention to. As we are heading into the later part of the year, currently trading the November contract, it does make sense that the market will continue to bounce from this general vicinity given enough time because demand will pick up drastically as far as heating demand is concerned in the United States and the EU. This is a cyclical trade that I take advantage of every year, and therefore it’s likely that we will continue to see that pattern repeated, but it should be noted that it is very noisy just ahead of that move. The question now is whether or not that’s what we have seen over the last several weeks?

If we were to break down below the $2.20 level, then it’s possible that the $2.15 level gets tested next. I’d be very surprised to see that level broken down through, and if we did it’s possible that we may not get the Winter pop at all. Obviously though, whether has a huge part to play in the natural gas markets, so once the cold weather comes, you will see a sudden spike in this market as we do every year. It’s simply a matter of paying attention to weather reports for places like Boston, New York City, and Amsterdam. All things being equal, I am simply waiting for some type of daily close that is bullish to get involved. I am not trading intraday at this point.