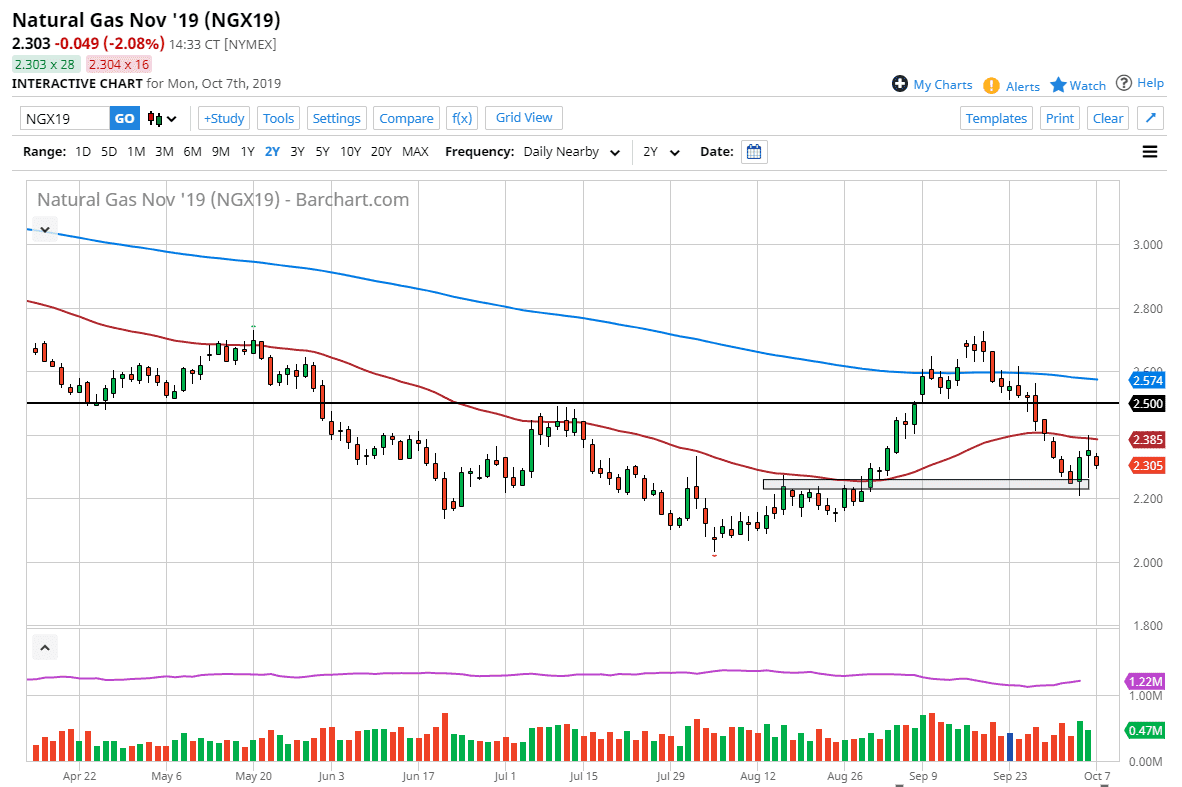

Natural gas markets gapped slightly lower to kick off the trading session on Monday, and then fell towards the $2.30 level. However, when you look at the candle stick from the previous session, you can see that we did in fact see a lot of bullish pressure, and the fact that we would pull back a little bit on Monday isn’t a huge surprise, after all we had fallen quite a bit. However, it’s likely that the market is going to continue to find support underneath, especially near the $2.20 level, assuming we even get down there. I think short-term pullbacks will continue to be buying opportunities, so it’s likely that traders will jump in and push to the upside.

We are starting to see cooler temperatures in the northern part of the United States, and while not enough to draw down inventory drastically, it is the beginning of the season that will demand much more natural gas going forward. If that’s going to be the case, it’s likely that we will see higher prices. The forward month that is currently being traded is November, which of course is a relatively cold month. This normally kicks off a move for a couple of months, breaking above the recent highs and perhaps showing signs of impulsivity going forward. This typically will last until just after New Year’s Day, so I suspect that between now and then it’s very unlikely that I would be selling.

Pullbacks continue to offer value, and what should be a very bullish trend. This doesn’t mean that we won’t have the occasional negative day, but ultimately if you just bought natural gas for the last few months of the year, that alone could be a basic trading strategy. Granted, occasionally you get a relatively warm winter that works against the price of the market, but so far we are not seen signs of weather forecasts suggesting that. With that in mind, I believe that we will eventually break above the 50 day EMA which is painted in red, go looking towards the $2.50 level, taking out the 200 day EMA which is painted in blue, and then going beyond. If we were to somehow break down below the $2.20 level, I suspect there will be massive amounts of support near the psychologically and structurally important $2.00 level. That being said though, I do not believe that happens.