The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases, it will be trading the trend. In other cases, it will be trading support and resistance levels during more ranging markets.

Big Picture 27th October 2019

In my previous piece last week, I forecasted that the best trade would be long of GBP/USD upon the British Parliament approving a Brexit deal. This never happened so there was no trade.

Last week’s Forex market saw the strongest rise in the relative value of the Canadian Dollar, and the strongest fall in the relative value of the British Pound, but the values were small.

Fundamental Analysis & Market Sentiment

Fundamental analysts are still split over whether the recent quarter-point cut in the U.S. interest rate will be the last cut for a while, or whether the Federal Reserve will follow up with a further quarter-point cut over the near term.

The U.S. economy is still growing, but there are increasing fears of a pending recession, with the FOMC opining that the probability of a recession has grown. However, the U.S. Dollar Index rose a little last week.

Last week saw the British Pound and Euro remain in focus. The Brexit date is still legally due this Thursday, but the European Union has agreed to an extension in principle which was requested by the British Parliament and, seemingly, the British government. The European Union has indicated they wish to wait for the British Parliament to decide Monday whether it will call a general election before deciding upon the date. The Pound and Euro has been falling as there is now more chance of a “no deal” Brexit although that scenario remains very unlikely.

The ECB’s monthly policy statement was very dull, giving no new item of interest, and the Euro hardly reacted to it.

Stock markets have continued to advance, especially the U.S. market. The benchmark S&P 500 Index is just a little off its all-time high price. Sentiment is broadly risk-on, but that remains fragile.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows last week printed an inside bullish candlestick, but it remained below the new resistance level at 12355, closing near its high with average volume, closing below its price from 3 months ago. These are mixed signs, but the odds still favor Dollar bears.

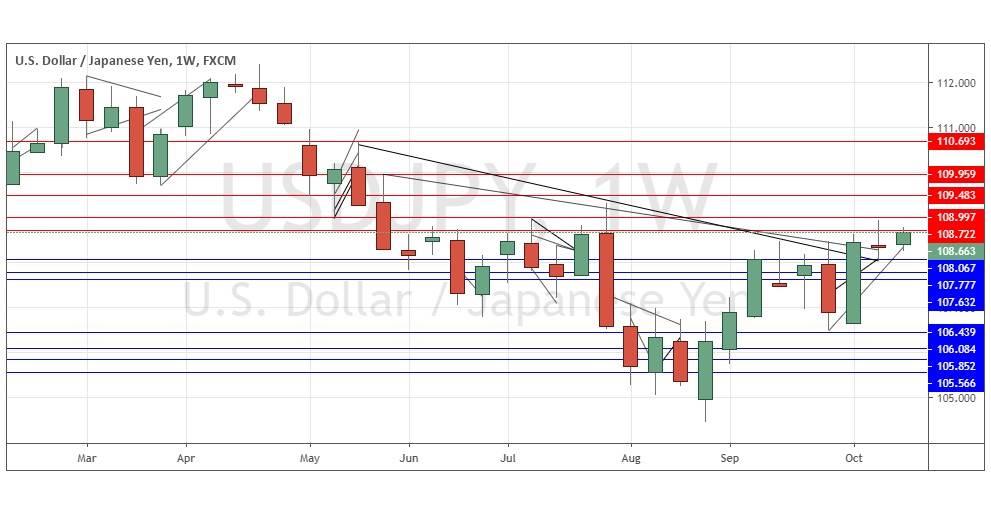

USD/JPY

The weekly price chart below shows last week printed an inside bullish candlestick, but it remained below the resistance level at 108.72, closing near its high on below-average volume. It seems poised to make a very significant bullish breakout as this price area is a long-term pivotal level. Therefore, I see opportunities for a long trade entry if the price can get established above 109.00.

Conclusion

This week I forecast the best trade will be long of USD/JPY following a bullish daily candlestick closing above 109.00.