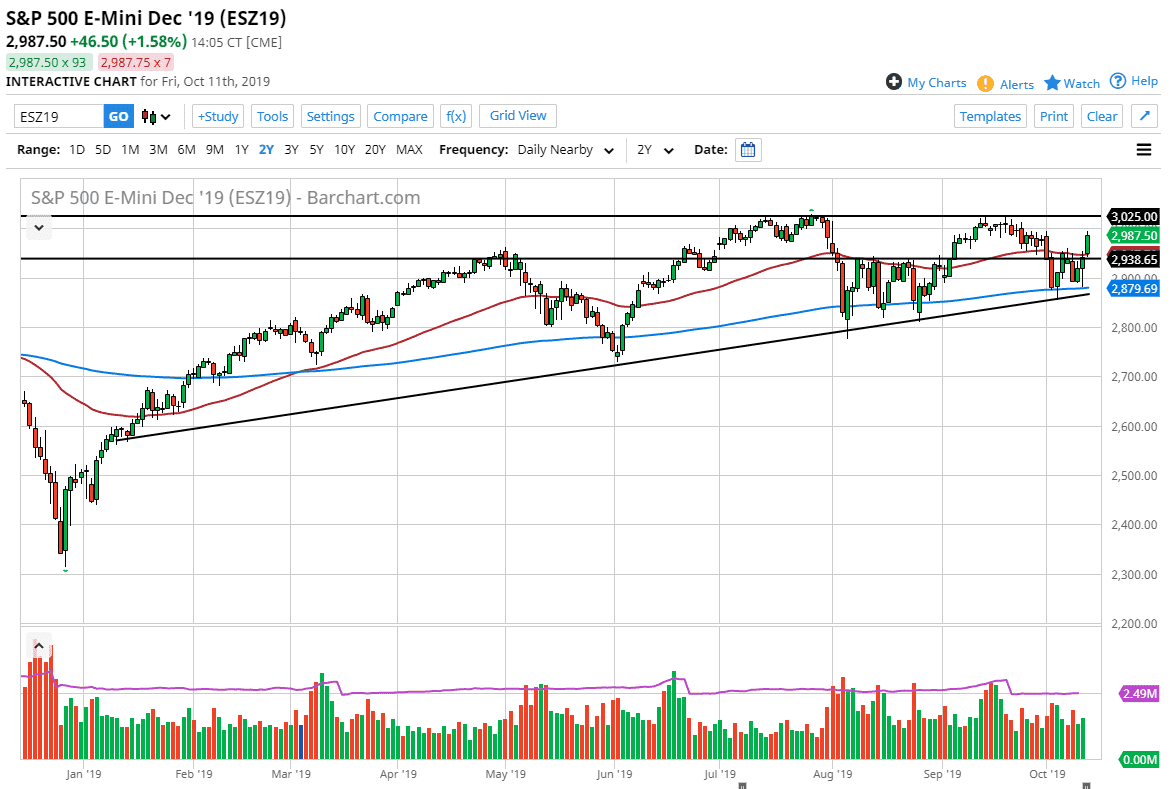

The S&P 500 has rallied a bit during the trading session on Friday, breaking above the 50 day EMA based upon the hope that the Americans and the Chinese could get some type of deal done. I don’t think that’s going to happen, but I do expect some type of delay and tariffs and that’s probably about what the market expects. That being said, I don’t know how much more upward movement we will have in the short term. The 3025 level has been rather resistive, so it is going to be difficult to break above. If we do, then the market is likely to continue going much higher, breaking out for a much bigger move.

If we pull back from here it’s likely that the 2940 level will continue to offer support, right along with the 50 day EMA which is presently flat in that region. The uptrend line has held this market up for quite some time, and that should be respected. The 200 day EMA is just above that level, so think of it as a “support zone” that is keeping this market up. Ultimately, this is a market that still offers buying opportunities on short-term dips but the headlines coming out of the weekend could throw this market into complete disarray. With that, I would anticipate a lot of volatility and perhaps noise, but ultimately this is a market that will need to make some type of decision based upon the US/China trade situation. However, as soon as we get that out of the way, we then have earnings season.

When I look at this chart, it is still very much in an uptrend and therefore it’s likely that we continue to see a lot of back-and-forth, and I would assume that we are essentially in a range, but we are getting closer to the top of it so I would not be surprised at all to see this market pull back, but I don’t necessarily think that it’s the beginning of the end so to speak. That being said, if we were to break above the resistance barrier at the all-time highs again, then it opens up the door to the 3100 level, perhaps even higher than that. A break down below the uptrend line would open up the door down to the 2800 level, and then possibly even as low as the 2700 level.