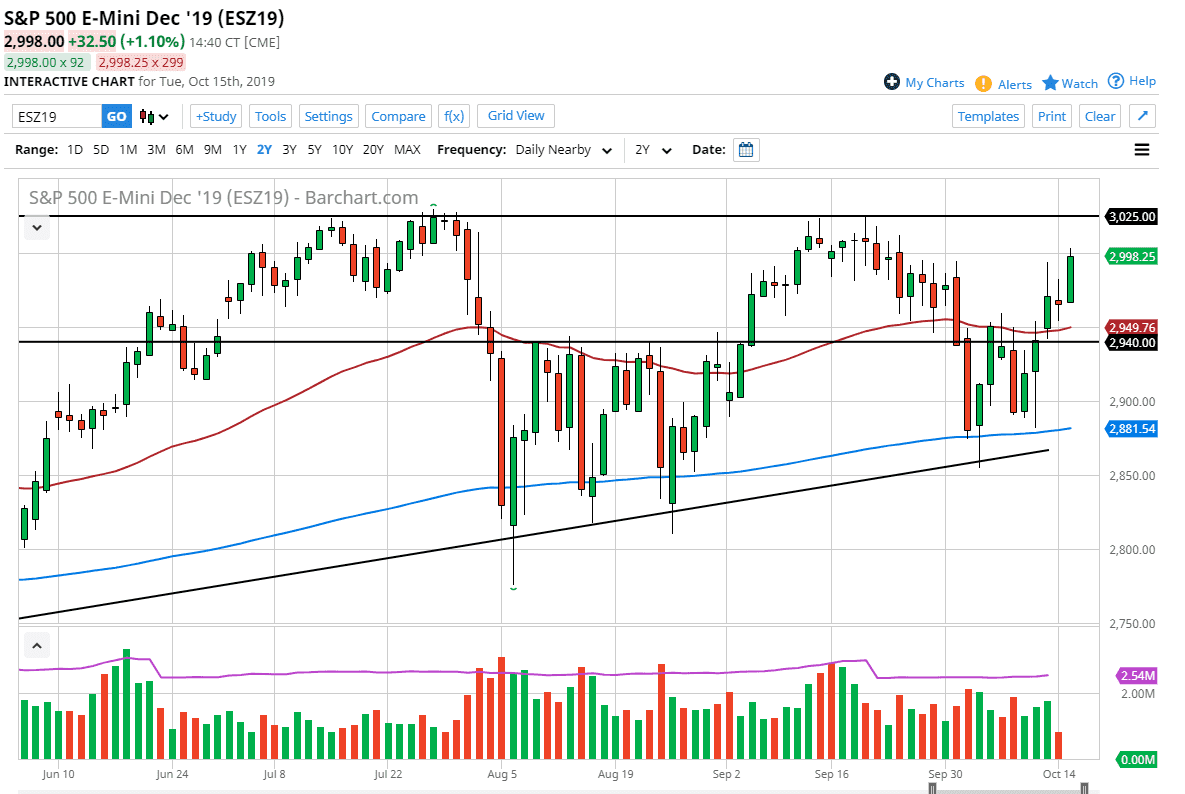

The S&P 500 rocketed to the upside during the trading session on Tuesday as banks reported solid earnings ahead of the bell. By doing so, the market tested the 3000 level, an area that of course causes a certain amount of psychological and structural resistance. The area between 3000 and 3025 should continue to be a difficult barrier to break, and although this market does look very bullish I would fully anticipate some type of pullback as we approach that area because of the obvious resistance.

To the downside it’s likely that the 50 day EMA continues offer support, and therefore I do not anticipate that the market is going to be straight back down, but a negative day or two is most certainly in the offering as we are in earnings season now. Beyond that let’s not forget about the US/China trade spat which is looking more and more like it wasn’t exactly solved as the Chinese want to talk about certain things, but they don’t want to purchase agricultural products until those tariffs that are set to be implemented are cut off. At this point, it’s only a matter time before some type of negativity enters the market based upon that situation and smacks the S&P 500 right back down.

The candle stick is rather bullish though, so that shouldn’t be ignored. However, it should also not be ignored that we closed right at the psychologically and structurally important 3000 handle, and I think that probably speaks volumes more than anything else. What does that say? It says exactly what you think it does: we are in line for more of the same, meaning that pullbacks will be bought but a breakout seems unlikely. We may eventually get that break out but we need some type of catalyst to make it happen, which is probably more likely to come from the Federal Reserve than it is from the US/China trade talks or even earnings call over the next couple of weeks. As long as the Federal Reserve is willing to bend to the will of Wall Street, there is going to be a good chance that we eventually do take off to the upside. That being said, it’s going to be difficult and there will be several pullbacks that you can take advantage of between now and then to get better pricing and value.