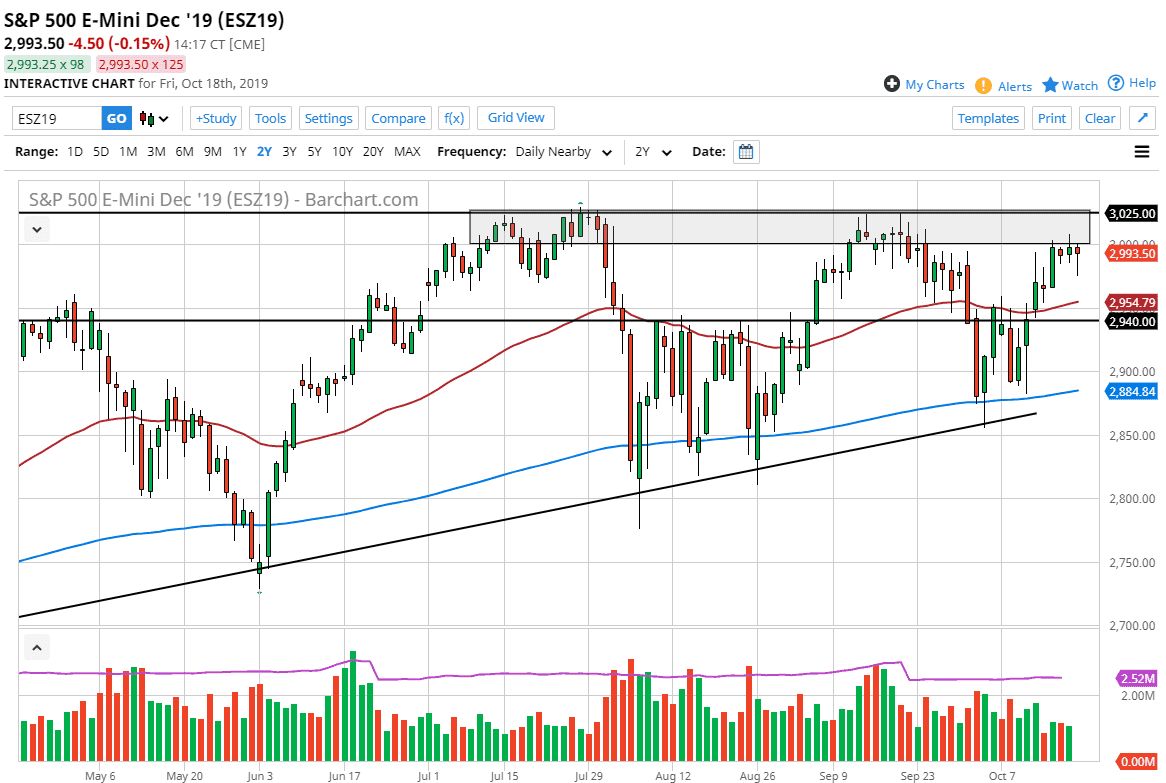

The S&P 500 initially fell during trading on Friday, as traders headed towards the weekend. This makes sense, because quite frankly there is a massive barrier above that has been difficult to crack for some time. This barrier extends from the psychologically important 3000 handle to the 3025 level or so. That being said, the market did try to take it out and although it failed it had a nice recovery later in the day. The question is whether or not that recovery was something substantial, or was it just simply short covering their positions heading into the weekend? My suspicion is that it’s a little bit of both.

Large order flow at the end of the day is typically institution such as pension funds jumping into the marketplace, so I quite often will go long on days where it looks like the S&P 500 is starting to take off in the last hour. It’s a quick trade that I do occasionally, but it’s not something I look to do all the time. Quite frankly, it’s something I do when it happened to be sitting at the charts at the right time.

That being said, there’s also the possibility that shorts were covering their position because quite frankly every time this market looks like it’s about to fall apart, it rallies and continues to go higher. The longer-term structure looks very much like an ascending triangle, and it does in fact suggest that if we could break out to a fresh, new high, this market could really start to take off. That is my base case scenario right now, not based upon any type of good economic news or that I believe things are suddenly going to be better, but rather the Federal Reserve is probably going to do whatever it takes to prop this market up.

Having said that, I don’t necessarily want to buy here. I like buying dips, just as several other people seem to during the trading session. I’d rather see a real dip, something closer to the 50 day EMA but I recognize that if we do break out to the upside it’s time to start buying then as well. Currently I have no plans on selling the S&P 500 but that of course can change at any time. Being patient and waiting for the right opportunity is the best advice anyone has ever given me, and is definitely something to think about in this market.