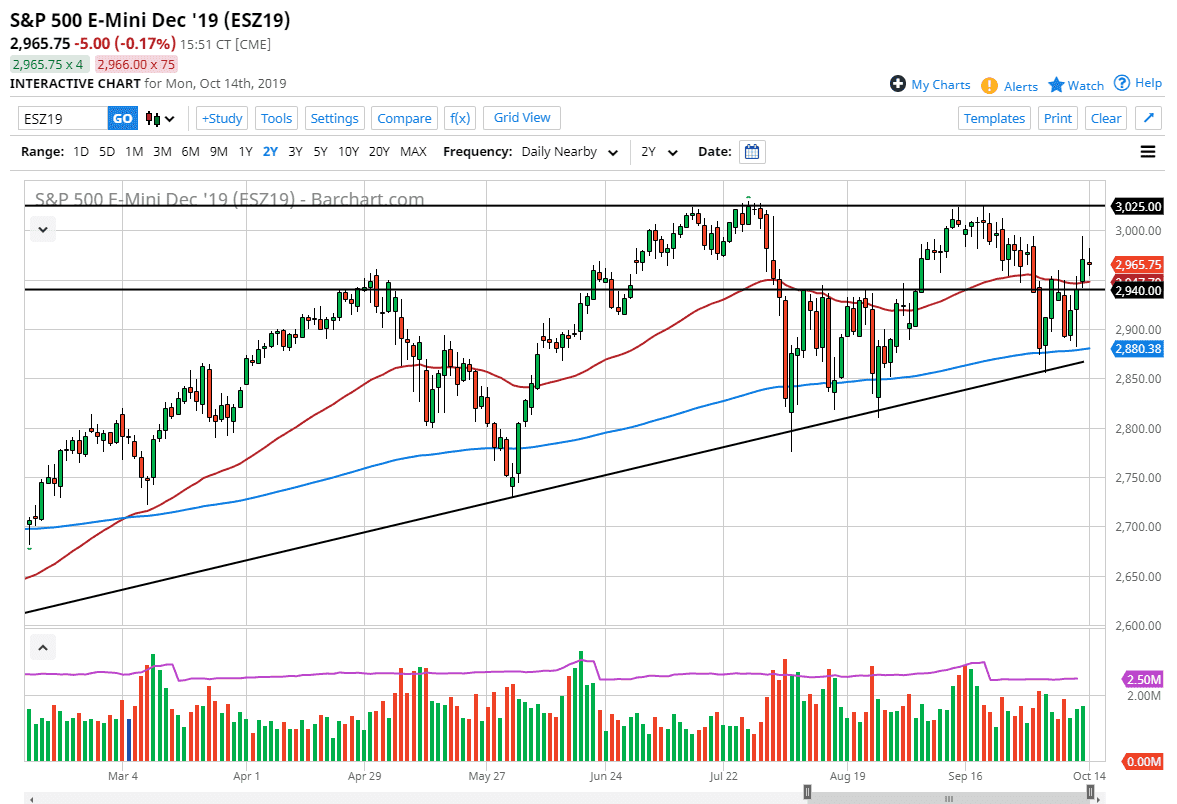

The S&P 500 did almost nothing during the trading session on Columbus Day, which is a minor holiday in the United States. With that being the case, the 50 day EMA underneath should offer a bit of support, but it’s obvious that the area between 3000 and 3025 offers a significant amount of resistance. Longer-term, this is a market that has rallied to the upside ever so slightly, but it’s been more of a grind and a fight higher than anything else. With that being the case, I like the idea of buying dips, which I do think could be very possible in the short term.

The 200 day EMA underneath at the 2880 handle is massive support, assuming we even get down there. The trend line underneath continues to keep this market afloat, and therefore you should pay attention to that as well. I think that we see more of the same that we have seen of the last 18 months, simply that the market doesn’t have anywhere to be. This is a market that continues to move on a multitude of issues, and now that we are heading into earnings season, things will only get more convoluted.

US/China trade relations dominate the headlines, but there will be the occasional earning that throws the market into disarray as well. Banks report overnight, so that of course could have a significant effect on the S&P 500, but it is probably only a matter of time before a Tweet comes out or some type of headline that throws the market in the opposite direction of wherever it heads. In other words, you simply cannot trust a bigger move in this market anymore, as the last two years especially have been extraordinarily volatile. When you zoom out to a longer-term time frame, you can see we simply have been chopping around, and the 2940 level is essentially “fair value” at this point from what I see. I think the market will continue to bounce back and forth to that area from extremes, and that’s essentially how I playing this market: a bit of a “reversion to the mean” type of scenario. That doesn’t mean that it’s going to be easy it’s going to be quite difficult. All things being equal I’m looking for buying opportunities on dips though, because although we haven’t exactly been extraordinarily bullish, there is still an upward slant.