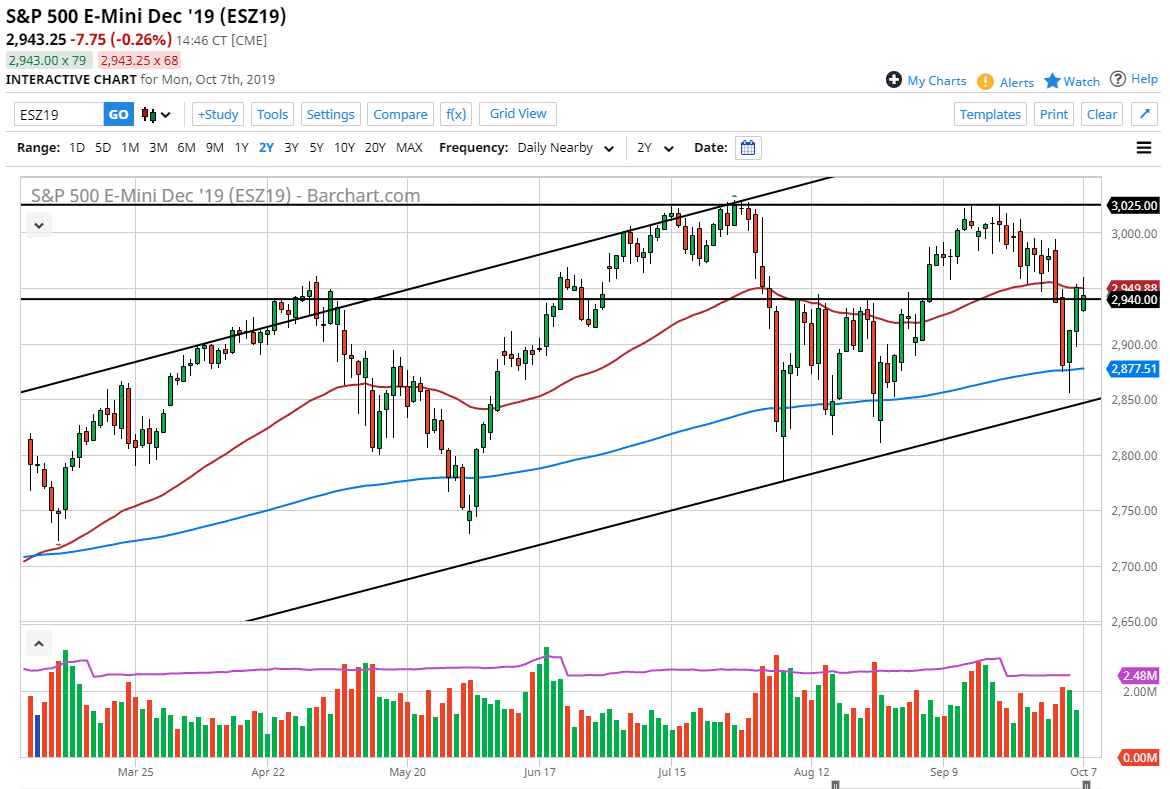

The S&P 500 initially gapped lower during the trading session on Monday in the futures market, broke higher, clearing the 50 day EMA before turning around. The fact that we ended up doing that and forming a bit of a shooting star of course is a negative sign, as the 2940 level has been an area that has been important more than once. Beyond that, the 50 day EMA it looks as if it is trying to offer significant resistance, and then of course is not a good sign.

Think about what’s coming up though, which of course is the US/China trade talks. While earnings season starts next week, the reality is that the trade talks have much more currency when it comes to determining the directionality of the market. If we break down below the daily candle stick for the session on Monday, it’s very likely that the market will go looking towards the 2900 level underneath. The alternate scenario of course is that we break above the top of the candle stick from the Monday session, sending the market towards the 2975 handle.

The 3000 level above of course is resistance as well, extending about 25 points to the upside. If we can take that level out, the market is ready to go much higher but obviously it’s going to take a lot of good news for that to happen. I do not expect the Americans and the Chinese to come up with any type of trade deal, so it’s very likely that there’s more risk to the downside than the upside in the short term. Having said that, even if we do break down the 200 day EMA at the 2877 level should offer support, just as the uptrend line at the 2850 handle should. In other words, this is a market that has a lot of noise on both sides, and therefore I think we will continue to dice back and forth just as we have for months in this market, without any real ability to make a longer-term move. If the Americans and the Chinese somehow come together with terms of the trade though, that obviously will shoot this market through the roof and we could have a significant buying opportunity. I suspect the odds of that being less than 10%, so I anticipate a lot of choppy and somewhat heavy trading.