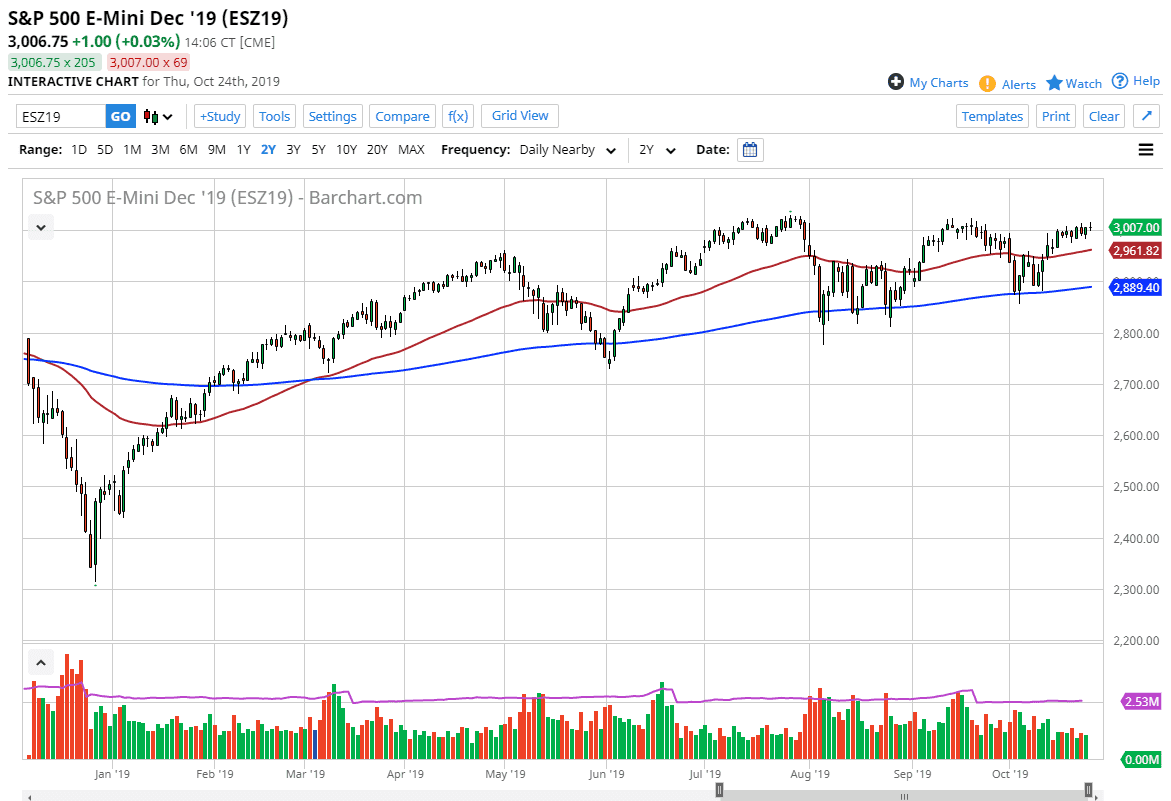

The S&P 500 has done very little during the trading session on Thursday, as we continue to press the all-time highs. Earnings season continues to be a very frustrating situation for most people, as the market simply cannot break out. At this point in time it’s likely that we will continue to see a lot of buying pressure every time we pull back, as we have seen over the last several months. This is a market that is trying to form an ascending triangle and that of course is a buying opportunity. Overall, I like the idea of buying dips and will continue to look at this market as such. We are in the middle of earnings season so that could be a catalyst as well.

If we were to break to a fresh, new high, then it’s likely that the market should come down to a move towards the 3100 level, then possibly even higher than that. The 50-day EMA underneath continues offer support, and I think that will be the best way going forward. All things being equal it’s likely that the market will continue to be very noisy, so you should be very cautious about the position size that you are taking on. I essentially look at this as a “beach ball underwater” type of situation, meaning that eventually once we break the water line, we will shoot straight up in the air.

All things being equal, we will eventually get the breakout that’s necessary but in the meantime looking for value if the only thing you can do.This is the type of market that will put you to sleep but with the Federal Reserve coming out with an interest rate decision next week, that might be the next catalyst. It comes down to whether or not the Federal Reserve will be dovish enough to get market participants excited. If they fail to be dovish enough, then the stock markets might break down. All things being equal this is a market that will continue to cause a lot of headaches in the short-term, but longer-term and certainly looks as if investors are not shying away from the S&P 500. I have no interest in shorting right now, and at this point it continues to be a scenario where although we aren’t always going to be positive, selling opportunities tend to be very short natured indeed.