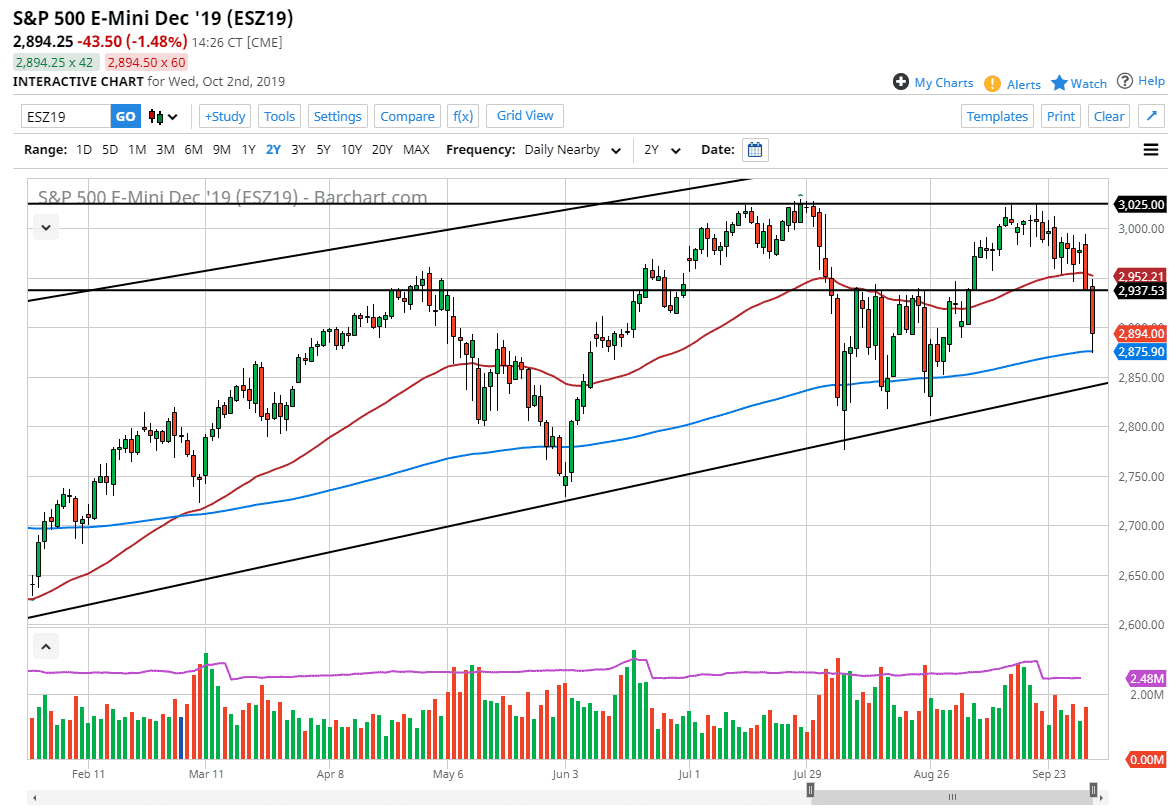

The S&P 500 has fallen quite a bit during the trading session on Wednesday, slamming into the 2875 handle. What is crucial about that is the fact that the 200 day EMA is right there as well. The fact that we have bounced from there shows that longer-term traders are looking at this as a market that should be bought on dips as it offers value. I believe that the S&P 500 will continue to be supported by the Federal Reserve, but as we are looking at the jobs number on Friday, I also anticipate that we will probably go back towards the 2940 level as the market is trying to readjust itself in a bit of mean reversion ahead of that massive economic announcement.

However, if we were to break down below the 200 day EMA and then the uptrend line underneath, we could break down towards the 2800 level, followed by the 2750 level. At this point, the market is kind of hanging by a thread, but when you step back you see that we are still very much in a significant uptrend channel. That being said, you can also make an argument of a “double top” be informed, but that’s not necessarily convinced until we get below the uptrend line.

I suspect that there is they may be a bit quiet, with the slate grind higher more than anything else. This market breaking above the 2940 level would be explosive and very bullish, and any time this market starts to show signs of serious trouble, Donald Trump will jump on Twitter and say something to juice the algorithmic traders. I suspect we are getting relatively close to that happening, but you have to be aware of the fact that can happen at any time, so all things being equal I suspect there’s probably more of a chance of a rally than anything else. The market has been extraordinarily resilient in the face of a multitude of issues, and the fact that we have not seen a massive volume spike tells me that this pullback is probably just going to offer plenty of opportunity for those willing to take advantage of it. However, if we do break the downtrend line the “trapdoor” opens and we go much lower. Expect volatility, but Thursday itself might be relatively quiet as we await the news.