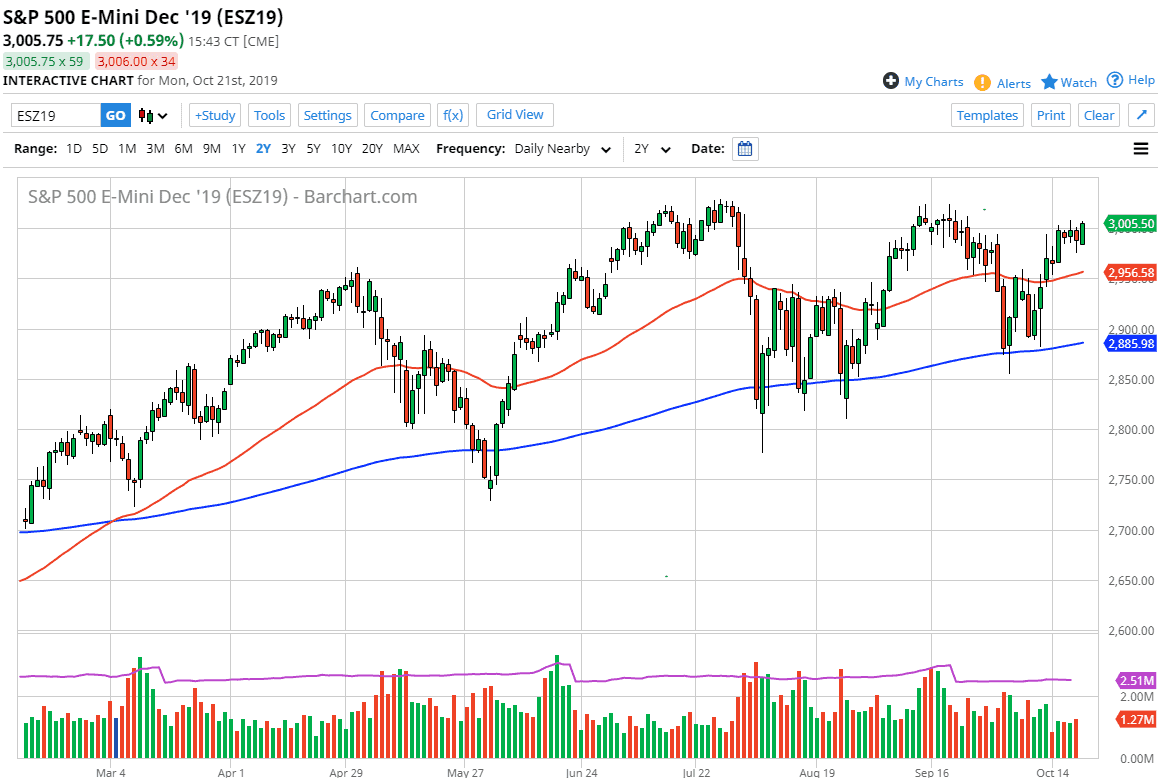

The S&P 500 has rallied quite nicely during the trading session, forming an outside candlestick. By doing so, the market looks as if it is going to try to take out the inside but let’s be honest here: the market has tried to break out before. There is a lot of noise all the way to the highs, and it’s likely that the market will continue to see a lot of trouble above there. At this point, I would anticipate a lot of selling pressure, but if we could break out to a fresh, new high is likely that the market could continue to go much higher.

To the downside, there is the 50-day EMA, and then should continue to offer a lot of support. It’s near the 2955 handle, which of course is supported by the 2950 level. While this chart does look very bullish overall, we have been banging against this area just above multiple times, and it’s very difficult to see how this suddenly breaks out, unless of course the earnings season pans out better than anticipated. Beyond that, not only do we have to worry about earnings, but we have to worry about future outlook for companies, and then of course is going to be a mixed bag.

The Federal Reserve looks likely to continue to liquefy the markets, and with an interest rate cut coming later this month, we already know that they are going to stand behind the market. The question now will come down to whether or not their language will be dovish enough to make the markets happy. Remember, at the end of the day the stock market has nothing to do with the economy or even how companies are performing, and more to do with what the Federal Reserve is doing. This is been the way the market has been acting for a decade now, and it’s difficult to imagine how this is going to change in the short term. Ultimately, we are in an uptrend so you should be looking at short-term pullbacks as buying opportunities but also recognize a breaking out is going to take a Herculean effort. To the upside, if we were to break out to the outside it’s likely that the market probably goes looking towards the 3100 level, perhaps even higher than that. In fact, I believe that the target to the upside might be increasing based upon the inertia building up.