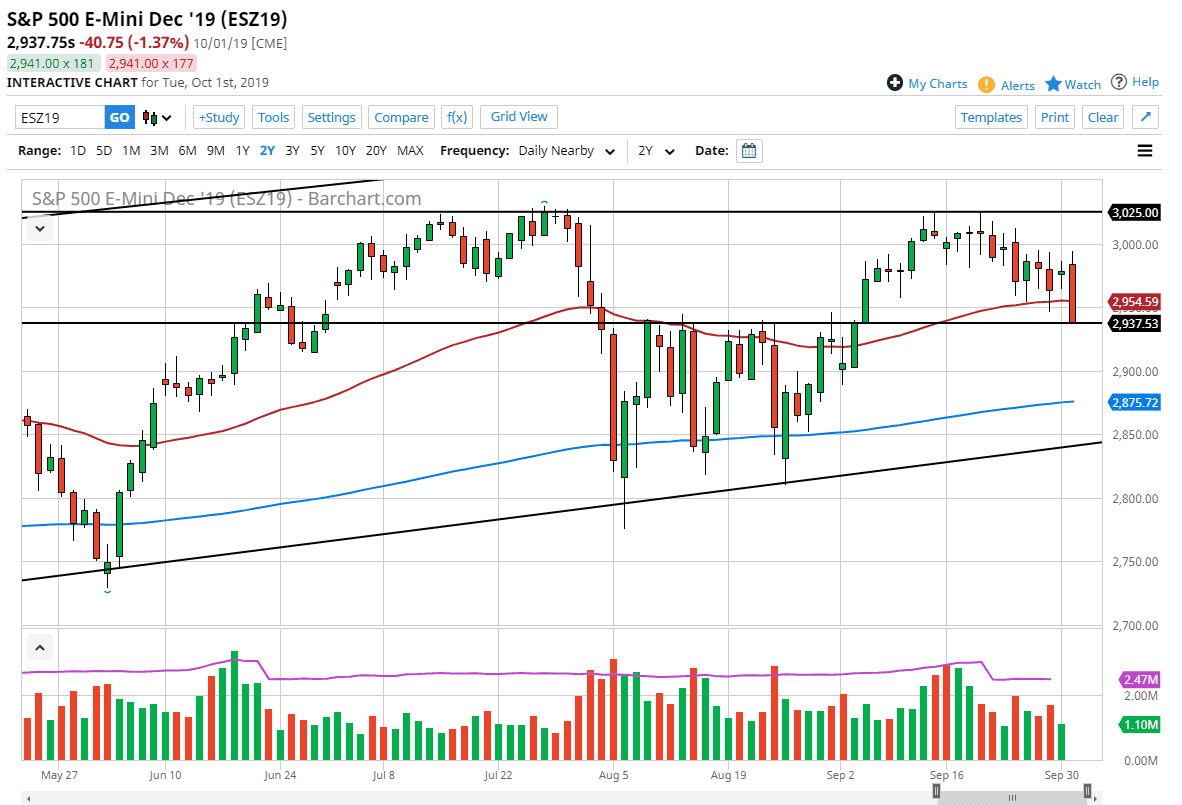

The S&P 500 initially tried to rally during the trading session on Tuesday but then broke down rather significantly. By crashing towards the 2940 level, we are testing major previous resistance and therefore by extension, support. The 50 day EMA has been broken through, and it looks as if the market will try to figure out whether or not it wants to go lower from here, or if the choppiness underneath this level that had been seen during the month of August will offer an opportunity.

A bounce at this point probably sends the market looking towards the 3000 handle above but there would be a lot of noise between here and there. This is a market that is heading towards earnings season so that might be a catalyst to go higher but at the end of the day the only thing that the stock markets are paying attention to these days seems to be the trade war and of course the Federal Reserve. Central banks continue to cut interest rates and loosening monetary policy and therefore stock market should react accordingly. That being said, the candle stick for the trading session on Tuesday was very poor and enclosed towards the bottom of it.

At this point in time it’s likely that the market will continue to see a lot of choppy and volatile trading, so at this point I think it probably comes down to whatever timeframe you’re looking to trade. If you are short-term trader, there’s a good chance that you may get a run lower, especially if we break down below the lows of the trading session for Tuesday. However, I would not be married to that position as I do think it’s only a matter of time before the buyers come back and support this market.

Beyond all of that, this is a market that has been played quite drastically from various angles and various people. Central bankers say the right thing at the right moment, and of course US President Donald Trump is quick with a tweet when the stock market looks to be a little too negative. Because of this, I suspect it’s only a matter of time before the buyers return by it comes down to your timeframe. If you are looking to trade daily candlesticks, then it makes sense. Otherwise, a lot of back-and-forth trading will probably be a main feature here.