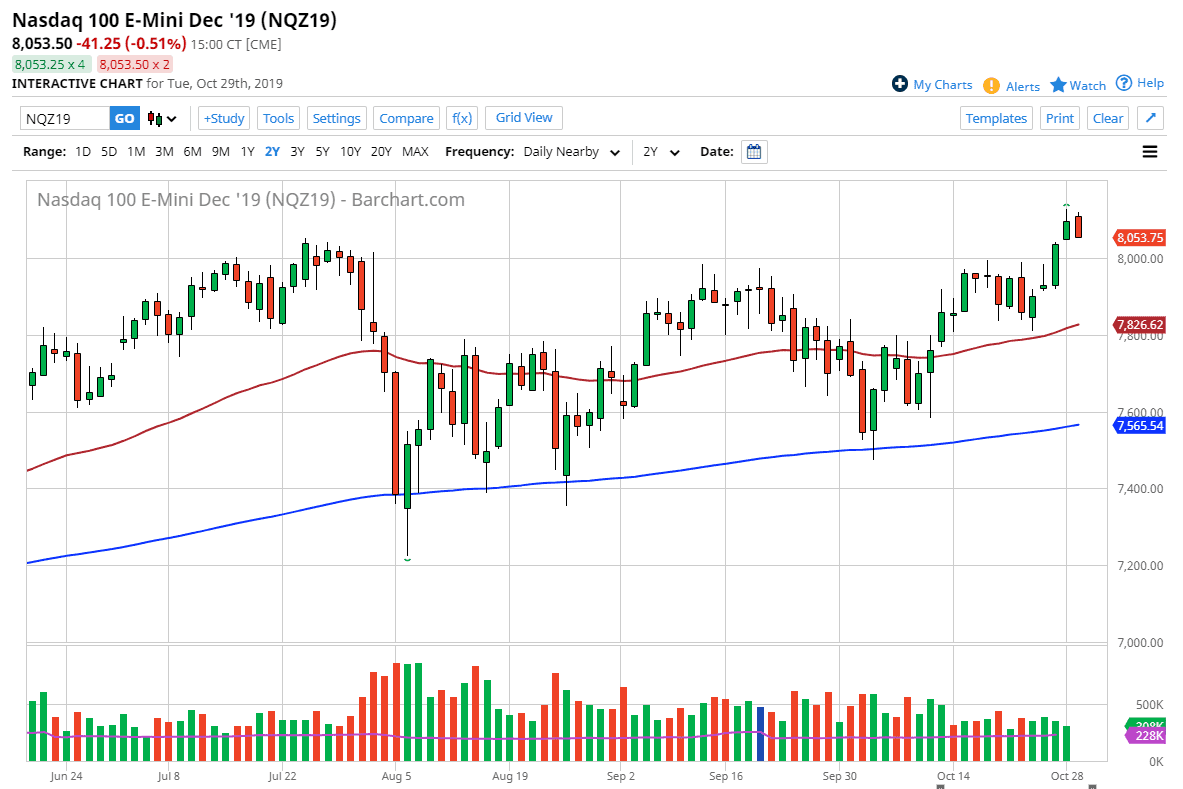

Looking at the NASDAQ 100, you can see that we have tried to rally significantly during the trading session but has also given back quite a bit of those gains as we struggled at the 3050 level. At this point, it’s very likely that level will be broken though, especially if we can get some type of extremely dovish comments out of the Federal Reserve. With that being the case, I anticipate that the market is going to continue to go higher as the central bank will not only cut the interest rate by 25 basis points but could start to talk about further expanded quantitative easing.

Ultimately, the market looks likely to continue to be very noisy, but I think given enough time we will more than likely show signs of bullish pressure on pullbacks, and as the Federal Reserve has been trained not to tight monetary policy, it’s very hard to imagine they will. We had seen Jerome Powell suggest that there were potential tightening measures coming, and the markets absolutely cratered to teach them a lesson. Wall Street is now running the Federal Reserve, despite how much the Federal Reserve pretends it not to be true.

Looking at this chart, the 3000 level underneath should be massive support, and therefore I would be very interested in seeing some type of bounce from there to start buying. Alternately, at the market does break out above the 3050 level, then it’s likely that the market will begin its next leg higher. The Federal Reserve showing a lot of dovish tone in the statement could be the reason for this market to go much higher, and therefore send a lot of fresh money into this market.

The 50 day EMA is currently trading near the 2970 handle, and that is an area that should offer a lot of support. At this point, I have no interest in trying to short this market as it has been so bullish. Quite frankly, the Federal Reserve would have to come out very hawkish to send this market lower and start to offer the opportunity to short this market. All things being equal, we should continue to go higher given enough time. It doesn’t mean that we won’t get the occasional pullback, but those pullbacks should be thought of as value propositions as the market continues to be supported by the central bank.