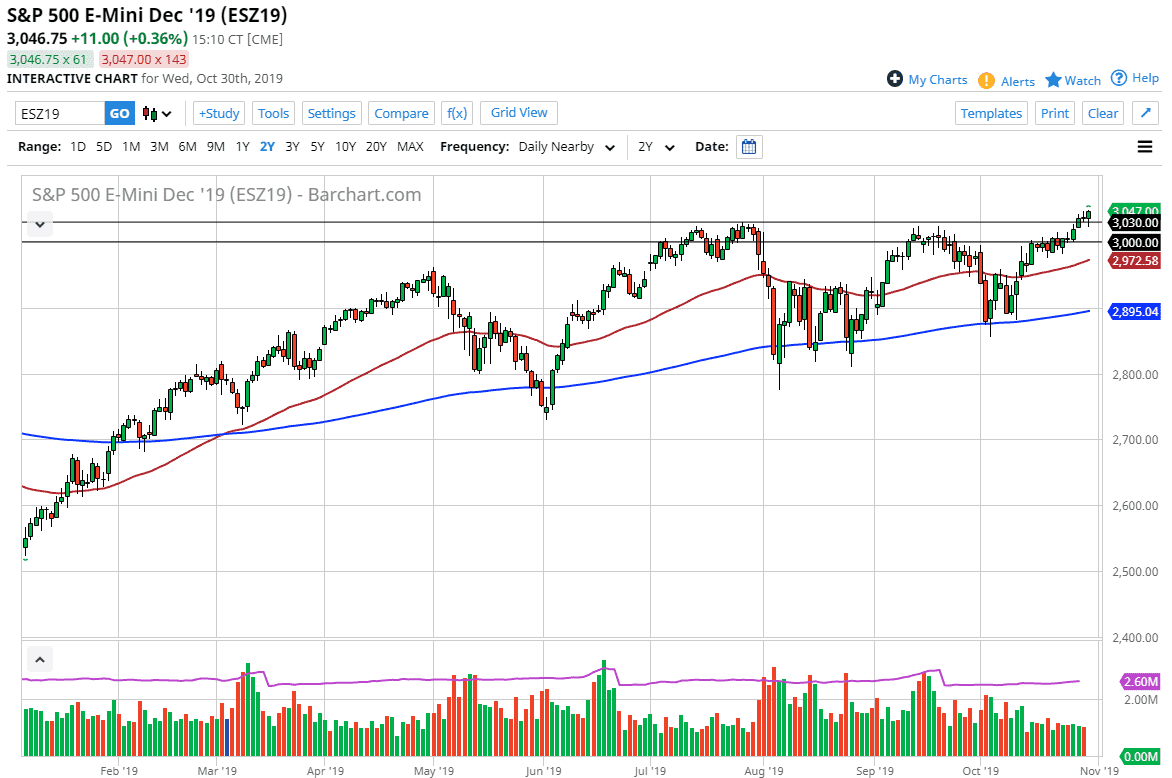

The S&P 500 initially pulled back during the trading session on Wednesday as we awaited the FOMC statement. Ultimately, the market has found plenty of buying opportunities on dips, and now it looks like it’s ready to go much higher. The 3030 level has offered support, and it now looks as if the ascending triangle has kicked off for a much larger move. All things being equal it’s likely that the market will continue to find plenty of buyers on dips as we have broken out to the upside of a major resistance barrier.

Looking for short-term pullbacks to show signs of support will probably be the way to go going forward as the Federal Reserve has cut interest rates and suggested at the very least, they aren’t looking to raise interest rates anytime soon. That’s exactly what Wall Street wants, and therefore it will celebrate by going long the market yet again. When you look at the ascending triangle, the market could be looking at a 250 point move, meaning a move to the $3250 level based upon the measured move of the pattern. The 50 day EMA underneath is starting to grant higher as well, so this might think it’s only a matter of time before buyers would come in on any type of sharp tip.

As you can see below, the 200 day EMA has been a scene where traders come back in to pick up the S&P 500 as well. Ultimately, this is a market that is bullish overall, and I think we should continue to find value opportunities on dips, as the Federal Reserve although not ready to cut rates further, left the door open in theory and therefore traders will continue to celebrate. At this point, the market is simply in an uptrend and you can’t fight that. Buying dips continues to work, and short-term traders will love this type of market now that we are above the significant resistance and finally broken higher. While the economy doesn’t necessarily show signs of ultimate strength here, the reality is that stock markets have absolutely nothing to do with the economy anymore, with all of this, expect choppy but bullish action going forward in all US indices, not just the S&P 500. Shorting isn’t even a thought as there is so much in the way of bullish pressure and support at various levels underneath.