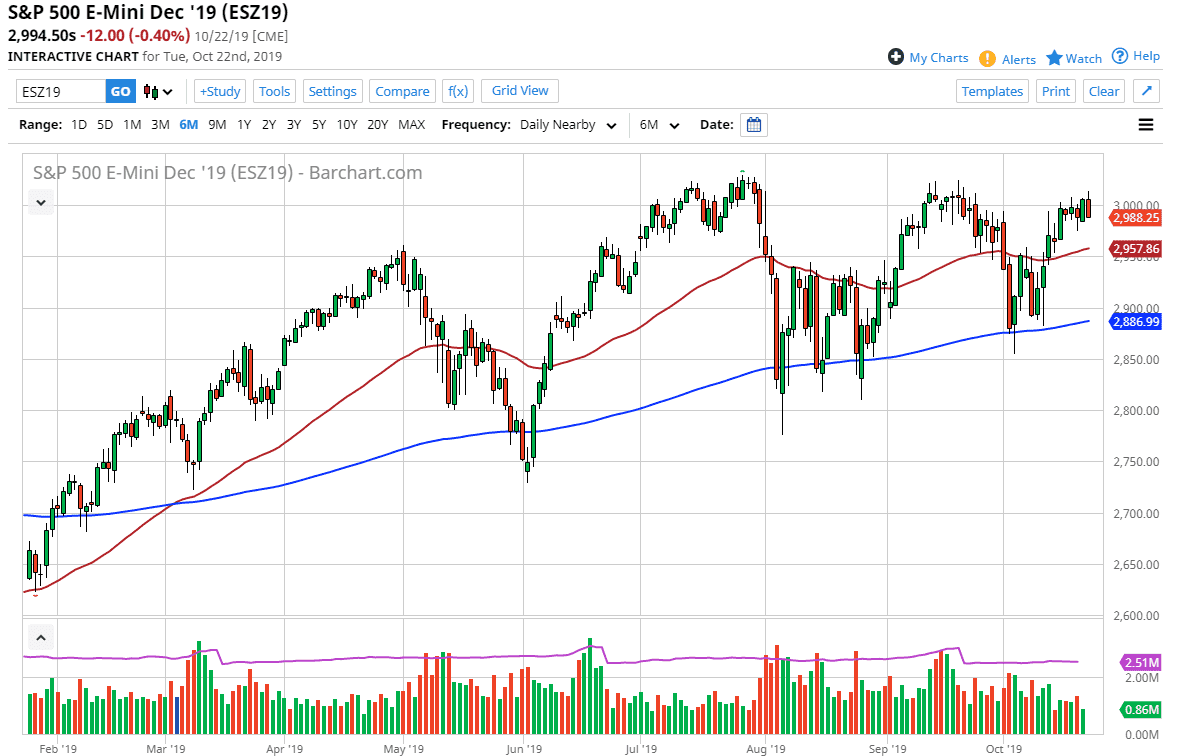

The S&P 500 initially tried to rally during the trading session on Tuesday but did pull back enough to show signs of exhaustion yet again at the highs. Above the 3000 level, there is obviously a huge barrier of selling pressure continue to work against buyers. However, you also noticed that every time we pull back buyers come back into the marketplace. This is my thesis going forward, that we will simply find buyers on these dips to take advantage of, as these pullbacks offer value in a market that is being supported by the Federal Reserve.

We are in the midst of earnings season and while that will have a certain amount of influence on the market, the reality is that it comes down to whether or not the Federal Reserve is not only cutting rates this month, but whether they are dovish. In the short term I suspect that the 50-day EMA is probably going to be rather significantly, closer to the 2960 handle. If we turn around and bounce from there, it’s likely that buyers would come back in and try to shoot through the ceiling again. Overall, this is a market that has found buyers on dips, and I think that the 200-day EMA would also be at a buying opportunity which is just below the 2900 level.

When looking at the longer-term chart, you can see that we are forming a bit of an ascending triangle, so I think it’s only a matter of time before we break out to the upside. We are building a bit of pressure, showing that we could break out to the upside. If we do clear the recent highs, then we could be looking at a move as high as 3300 given enough time. I don’t have any interest in shorting this market, and I think it’s only a matter of time before what we do break down, it’s interesting to see that the buyers will jump back into the market. I like the idea of picking up value going forward, as there is no reason to short this market, although we did close at the bottom of the range for the session which is typically bearish. I think at this point if you simply wait for some type of bounce on an hourly chart or something like that, then you could be looking at a buying opportunity.