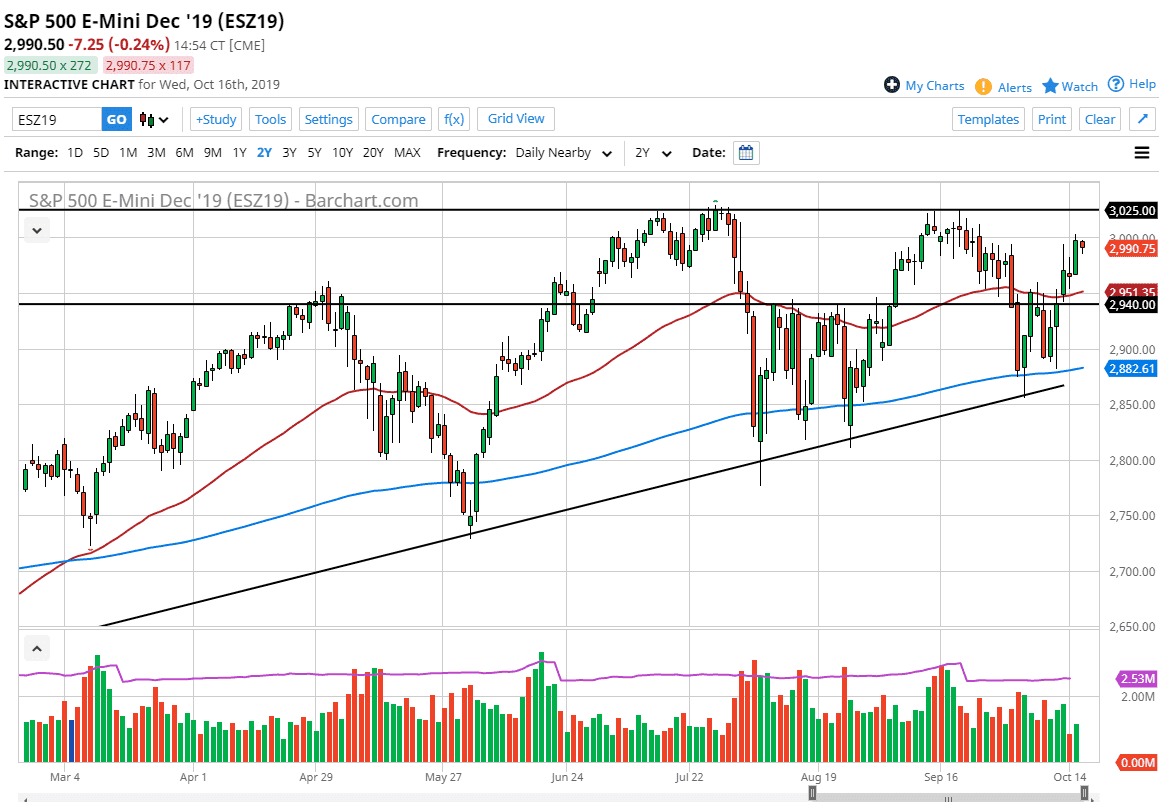

The S&P 500 has fallen just a bit during the trading session on Wednesday, reaching towards the 3000 handle. The 3000 handle of course is psychologically important, and it looks as if the level between there and 3025 should continue to offer plenty of selling pressure, but I do think that the market is going to continue to try to take it out. After all, it has been relentless on these rallies that continue to be based upon liquidity or simple lack of anything else to do for investors. The 50 day EMA which is painted in red should offer significant support at the 2950 handle, which of course is a midcentury mark anyway.

Underneath there, the market then goes looking towards the 200 day EMA which is painted in blue, and of course the uptrend line. At this point, short-term pullbacks should be thought of as an opportunity to pick up value. That being said, if we did break above the highs, it’s likely that the market should continue to go much higher at that point. In fact, it doesn’t take a lot of imagination to suggest that we have been trying to form some type of ascending triangle from the beginning of August the current trading. If that’s the case, it could measure for a move to roughly 3200.

Obviously, if we break down below the 200 day EMA and the uptrend line, somewhere around the 2850 level would kick off a massive bearish market and could break this market apart. Overall, this is a market that should continue to attract quite a bit of attention, especially now that we are in the middle of earnings season and the Federal Reserve is going to continue to cut interest rates and ease monetary policy. Ultimately, this is a market that will continue to react positively to the Federal Reserve actions, and possibly even strong earnings as they come. In other words, even though I do expect several pullbacks I think that every time you pull back, you should be looking for some type of value that you can take advantage of. There are multiple levels that could bring in value hunters, and at this point it’s very difficult to short this market as sellers have been crushed multiple times. If the market does break out, it could lead to a massive move as it would be such an obvious turn of events.