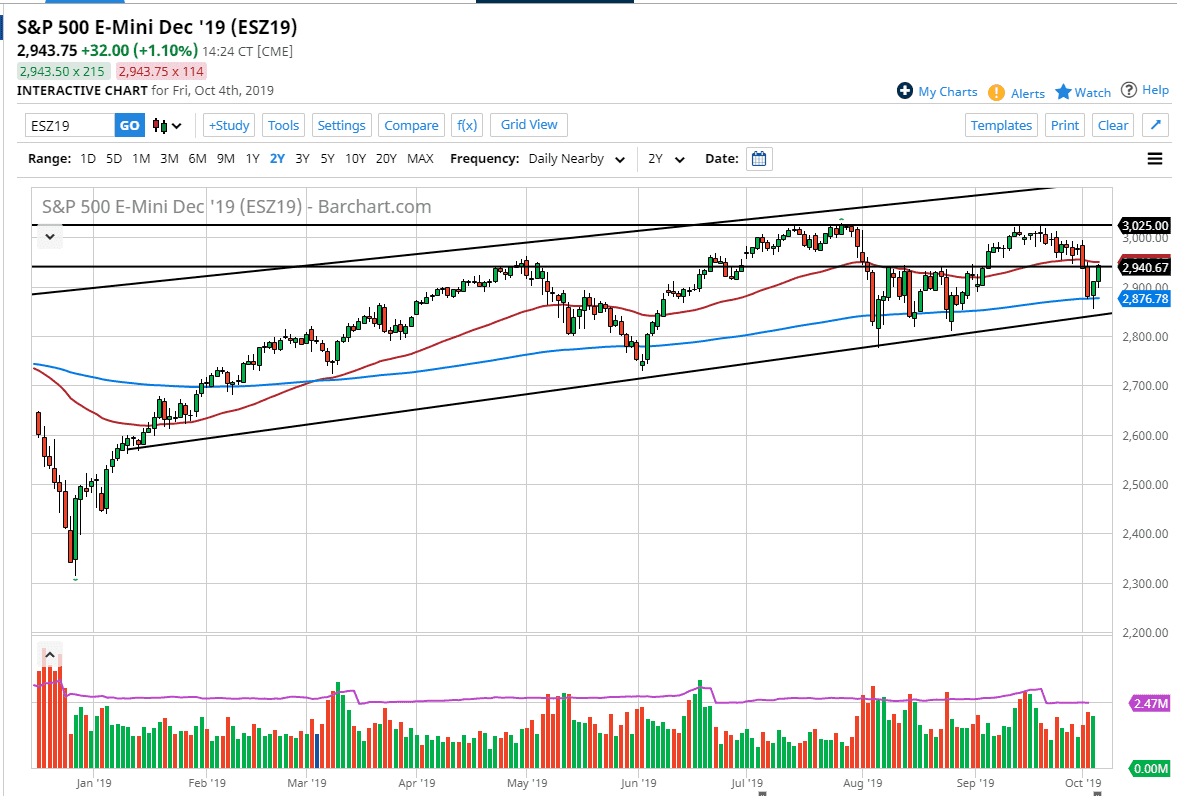

The S&P 500 has initially pulled back during the trading session on Friday but after the jobs number got out the way, the market found the 2900 level to be massive support. At this point, the market has broken above the 2940 level, and as a result it’s likely that we will get a bit of a fight here at the 50 day EMA. However, it looks to me as if the support has held and it’s very likely that we are going to continue to go towards the 3025 handle. That level of course is massive resistance, but if we can break above there then the uptrend can continue. One thing’s obvious though, that the market doesn’t want to break down.

This doesn’t mean that we will get the occasional fall off, we have seen that happen far too many times to think anything different. The uptrend line underneath continues offer support, just as the 200 day EMA is. The jobs number is reasonable, and the revisions very positive. Unemployment is at a 50 year low, so that of course is strong as well also. Ultimately, buying dips probably should continue to work but keep in mind that we will get the occasional headline out there that could throw things around.

Looking forward, we have the US/China trade talks in the middle of the week, and that of course will take center stage. If the headlines out of that meeting are positive, it’s very likely that the market will move right along with it. However, if things get contentious again, the S&P 500 should fall rather drastically. Ultimately, this is a market that will be headline driven still, and that should continue to be a major issue. Because of this, I am a bit cautious but I have to recognize that the overall trend has been to the upside so you need to simply look at the uptrend as our main guideline. If we were to break down below the 2800 level though, that would be the end of the uptrend and it would more than likely lead to a significant collapse in the S&P 500. So far, it looks as if the Federal Reserve is going to keep loose monetary policy out there, so that should continue to attract traders to the market. The fact that we sold off rather drastically three days ago and have found ourselves grinding higher since then is a good sign.