While China, for the first time, confirmed positive developments in its trade truce with the US, Brexit uncertainty has spiked after UK Parliament forced a delay on the vote of Prime Minister Johnson’s new Brexit deal. Financial markets started the fresh trading week with a mixed sentiment and the USD/JPY maintained its position below its resistance zone, following its breakdown, and above its 38.2 Fibonacci Retracement Fan Support Level with fading bullish momentum. Japanese economic data showed a bigger-than-expected contraction in exports for September which weighed on the Japanese Yen.

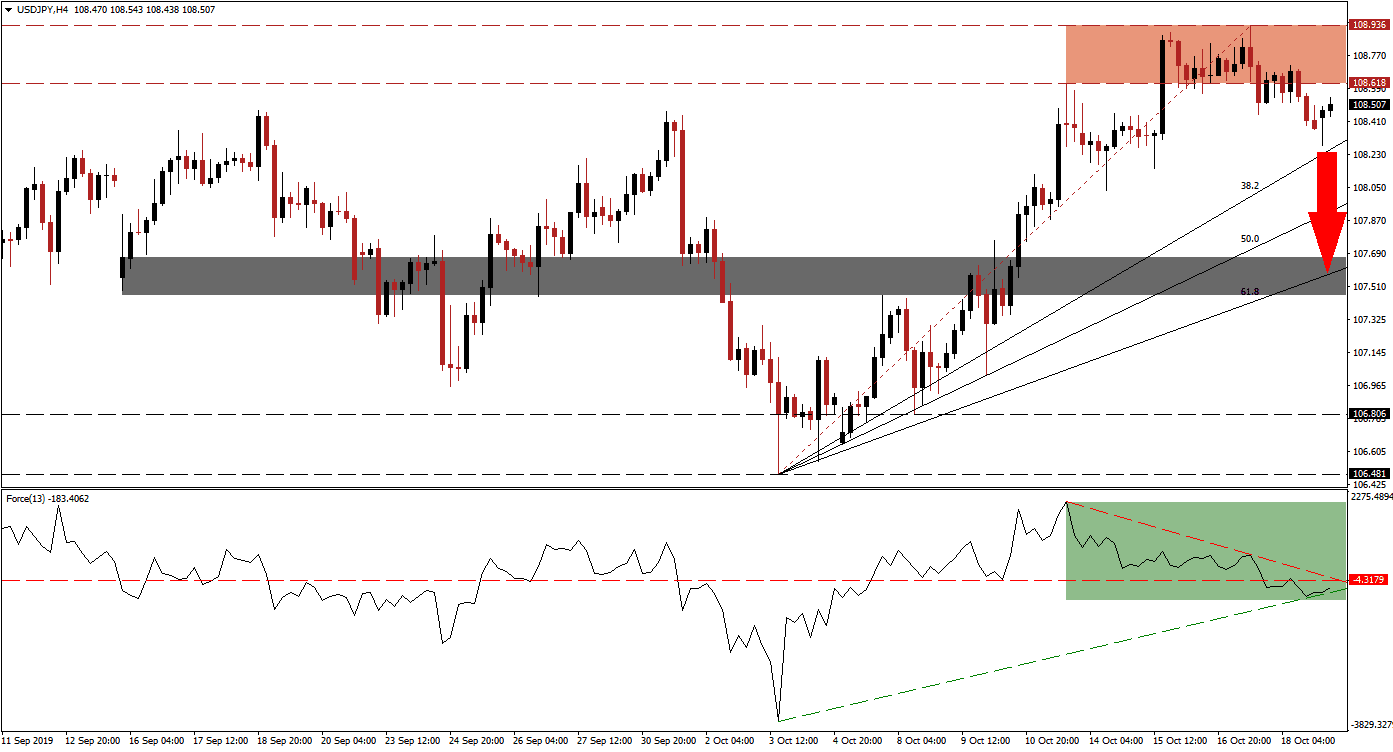

The Force Index, a next generation technical indicator, peaked after the USD/JPY reached the bottom range of its resistance zone for the first time which was reversed. The second push higher resulted in the emergence of a negative divergence which occurs when price action marches higher while the underlying technical indicator contracts. The Force Index has now moved into negative conditions, placing bears in charge of this currency pair; which also resulted in a breakdown below its horizontal support level and turned it into support. This technical indicator is now trapped between its ascending support level and its descending resistance level, as marked by the green rectangle, from where a breakdown is expected to materialize. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

This morning’s disappointment out of Japan’s economic data delayed a breakdown slightly, but forex traders should monitor the Force Index as a breakdown below its ascending support level is expected to lead the USD/JPY into a breakdown. The resistance zone which is located between 108.618 and 108.936, as marked by the red rectangle, is likely to reverse any attempt to extend the advance in this currency pair. A move below the intra-day low of 108.282, which marks the current low after the breakdown below its resistance zone, is expected to lead to the addition of new net short positions and also take price action below its 38.2 Fibonacci Retracement Fan Support Level.

Since the beginning of October, the Japanese Yen has come under selling pressure; this was partially driven by profit taking and partially by an increase in optimism that major geopolitical issues will be resolved. Risk-off sentiment is expected to return, which favors a stronger Japanese Yen due to its safe haven status, as the US economy is printing its own string of economic disappointments. The next support zone for the USD/JPY is located between 107.456 and 107.664 as marked by the grey rectangle; the 61.8 Fibonacci Retracement Fan Support Level is currently nestled inside this zone. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

USD/JPY Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 108.500

- Take Profit @ 107.500

- Stop Loss @ 108.750

- Downside Potential: 100 pips

- Upside Risk: 25 pips

- Risk/Reward Ratio: 4.00

In case the Force Index can maintain a breakout above its horizontal as well as descending resistance levels, the USD/JPY should follow through with a breakout above its resistance zone. This is expected to be a short-term development and a fundamental catalyst may need to spark a breakout. The next resistance zone is located between 109.624 and 109.922 from where this currency pair mounted a previous acceleration to the downside; this should be considered a good long-term short selling opportunity.

USD/JPY Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 109.100

- Take Profit @ 109.700

- Stop Loss @ 108.800

- Upside Potential: 60 pips

- Downside Risk: 30 pips

- Risk/Reward Ratio: 2.00