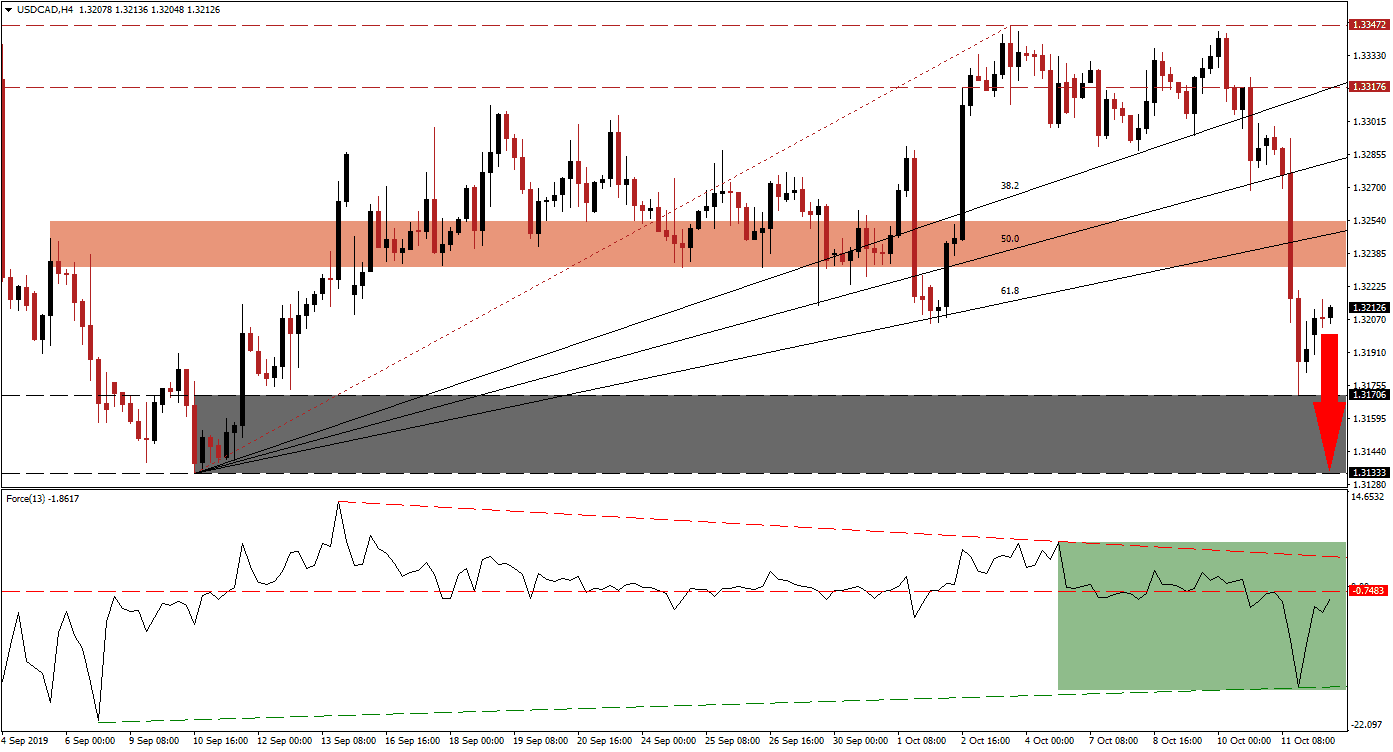

With another interest rate cut looming by the US Fed this month, the US Dollar is under bearish pressures. The US economy is weaker than most economists anticipated and the partial US-China trade deal will do nothing to alleviate the economic pain. The USD/CAD plunged from its long-term resistance zone through its entire Fibonacci Retracement Fan sequence, turning it from support into resistance. After reaching the top range of its support zone, this currency pair bounced higher which is not expected to last. As Chinese data indicated this morning, the global economic slowdown continues.

The Force Index, a next generation technical indicator, confirmed the breakdown sequence in the USD/CAD with a steep drop of its own. The reversal in this currency pair off of the top range of its support zone was mirrored by the Force Index which spiked higher, but it failed to complete a breakout above its horizontal resistance level and remains in negative conditions as marked by the green rectangle. Price action halted its reversal and bearish momentum is on the rise once again while a descending resistance level is closing in on this technical indicator. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Following the collapse in the USD/CAD, its short-term support zone was turned into a strong resistance zone and the ascending 61.8 Fibonacci Retracement Fan Resistance Level is currently passing through it. This zone is located between 1.32318 and 1.32539 which is marked by the red rectangle. Forex traders should keep an eye out for the price of oil which has an impact on the Canadian Dollar, a commodity currency, due to its big reliance on the commodity sector. Supply concerns remain following last week’s attack on an Iranian oil tanker in the Red Sea.

Canadian elections are only one week away and the uncertain outcome will prevent a bigger rally in the Canadian Dollar. The USD/CAD is expected to extend its current sell-off into its support zone which is located between 1.31333 and 1.31706 as marked by the grey rectangle in the chart. A sustained move below the intra-day low of 1.32050 is expected to provide the selling pressure to push price action into its support zone; this level marks the last time this currency pair was able to rally off of its 61.8 Fibonacci Retracement Fan Support Level, before it was turned into resistance. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

USD/CAD Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 1.32150

- Take Profit @ 1.31350

- Stop Loss @ 1.32350

- Downside Potential: 80 pips

- Upside Risk: 20 pips

- Risk/Reward Ratio: 4.00

A breakout in the Force Index above its horizontal resistance level, which will turn it into support, can lead to a breakout in the USD/CAD. Any advance is expected to remain short-lived and limited to its intra-day high of 1.32991; this level marks the high before the current plunge and is located above its 50.0 Fibonacci Retracement Fan Support Level and below its 38.2 Fibonacci Retracement Fan Resistance Level. Additionally, the 38.2 Fibonacci Retracement Fan Resistance Level has now reached the next long-term resistance zone located between 1.33176 and 1.33472; any potential advance should be viewed as a solid opportunity to enter short-positions in this currency pair.

USD/CAD Technical Trading Set-Up - Limited Breakout Extension Scenario

- Long Entry @ 1.32550

- Take Profit @ 1.32950

- Stop Loss @ 1.32350

- Upside Potential: 40 pips

- Downside Risk: 20 pips

- Risk/Reward Ratio: 2.00