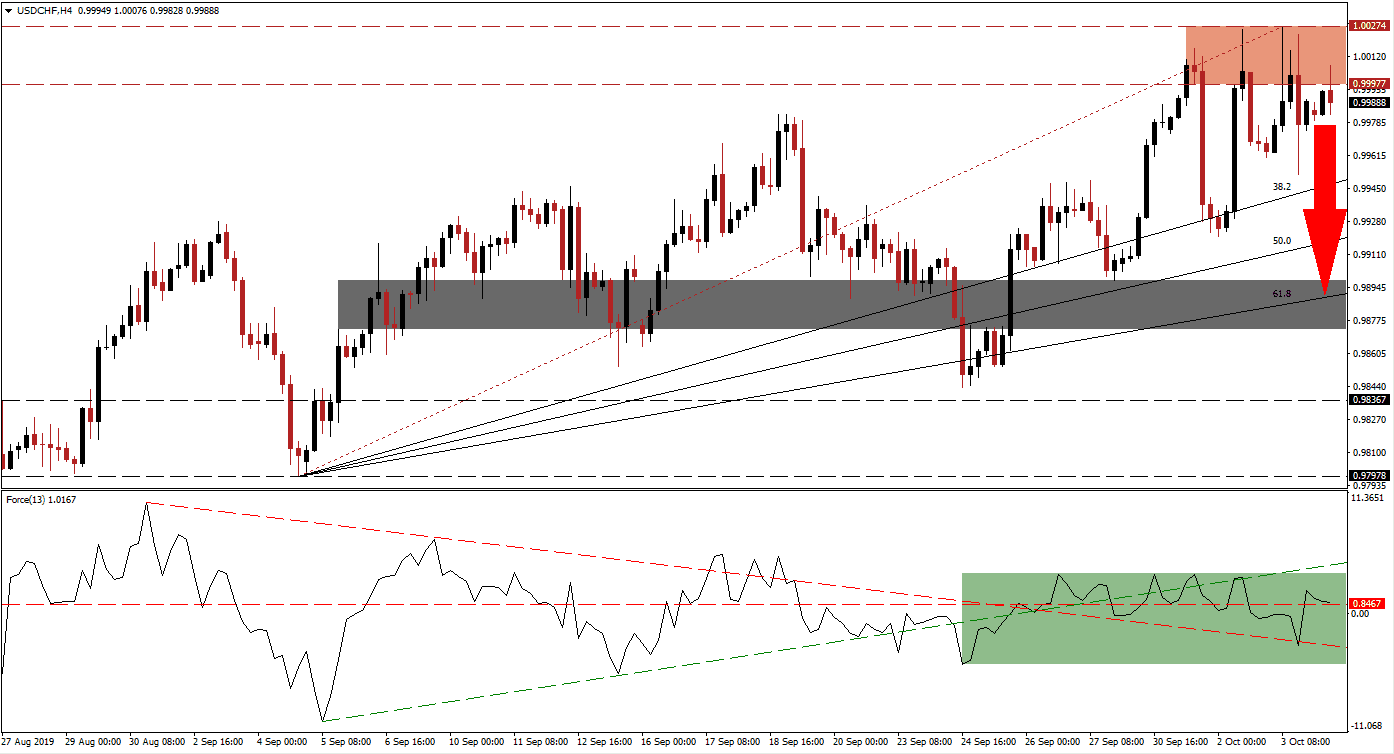

Volatility in the USD/CHF has picked up as economic data out of the US has disappointed and stoked recession fears. At the same time Swiss data came in weaker-than-expected which further added to price swings as this currency pair has been trading above-and-below the key psychological 1.00000 mark. The ascending 38.2 Fibonacci Retracement Fan Support Level is now narrowing the gap to the resistance zone which will apply pressure for either a breakout or a breakdown. Today’s US NFP data is also expected to provide a fundamental catalyst.

The Force Index, a next generation technical indicator, confirms the volatility in the USD/CHF as well as a developing bearish bias. After price action completed a breakout above its entire Fibonacci Retracement Fan sequence, turning it from resistance into support, the Force Index peak and moved below its ascending support level as well as above its descending resistance level. The move above its horizontal resistance level was reversed and this technical indicator is now trading above-and-below it. This is marked by the green rectangle and while the Force Index remains in positive territory, the bearish bias points towards more downside and a retreat into negative conditions. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Bullish momentum is fading as the USD/CHF has reached its resistance zone which is located between 0.99977 and 1.00274 as marked by the red rectangle. This zone has rejected an extension of the advance, supported by fundamental factors. While the current intra-day high and top range of the resistance zone represents a higher has as compared to a previous peak before price action corrected, the Force Index has not confirmed this and recorded a series of smaller peaks. The resistance zone is stronger then the approaching 38.2 Fibonacci Retracement Fan Support Level, suggesting a breakdown will follow.

Forex traders should now keep the intra-day high of 0.99826 in mind, the peak of a previous advance. A sustained move below this level is expected to result in the next series of sell orders as forex traders may opt to realize floating trading profits; if the Force Index confirms such a move with a correction into negative territory, a bigger correction in the USD/CHF should be expected. The next short-term support zone is located between 0.98729 and 0.98979 as marked by the grey rectangle; the 61.8 Fibonacci Retracement Fan Support Level is currently located inside this zone. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

USD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.99800

Take Profit @ 0.98750

Stop Loss @ 1.00100

Downside Potential: 105 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.50

Upside potential in case of a breakout above its resistance zone is limited and should be considered a solid short-entry opportunity. A fundamental catalyst such as today’s NFP report would be required to force more upside, which is highly unlikely given the latest economic reports out of the US. The next resistance zone following a breakout is located between 1.00978 and 1.01212 from where a strong correction emerged. Any advance in the USD/CHF above parity is expected to be a short-term event.

USD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.00300

Take Profit @ 1.00100

Stop Loss @ 1.00000

Upside Potential: 70 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.33