The US dollar fell a little bit during the trading session on Friday, which quite frankly is a big surprise considering that it was testing the 200 day EMA against the Japanese yen. Remember, above all things this is a pair that is highly risk sensitive and can be used as a risk barometer in the Forex world. It also tends to have a high correlation with things like the S&P 500, so pay attention to the stock markets as well. If the S&P 500 can finally break out, and right now that’s an open question, then this market can rally as people move away from the Japanese yen. Having said that, the Bank of Japan is trying to push in that direction so it will be interesting to see if they get what they want.

The Bank of Japan suggested over the last 24 hours that they were going to increase quantitative easing, but this is something they’ve been doing for well over 20 years. In other words, it’s just more of the same so I think traders become somewhat immune to that as it’s the same playbook time and time again. In fact, you can say that perhaps the market spoke volumes when it didn’t bother rallying against the Japanese yen due to this announcement. In fact, there was almost no reaction in this pair.

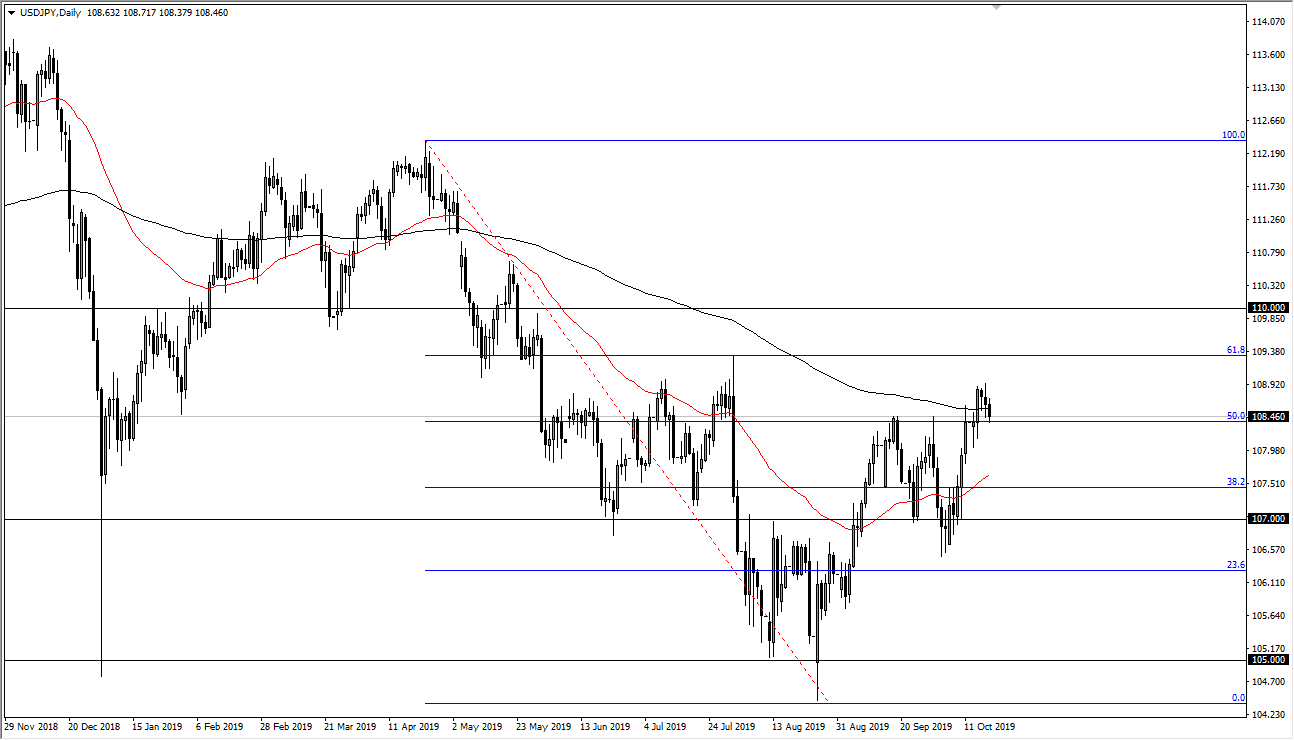

The 200 day EMA obviously attract a lot of attention so if we can break above it significantly, we will then try to take out the breakdown candle from late July that started at the ¥109.40 level. A break above that level opens up the door to much larger gains, but until then I think we’re going to see a lot of choppy sideways action, just as we are seeing in the S&P 500 currently

All that being said it is earnings season so we may get a bit of a “risk on” move by north American traders on the right announcements. That could be one thing that push as this pair higher, but right now I think it’s very unlikely beyond that, the US dollar has been struggling against most other currencies in the last few days, so that is no real impetus for this market to go skyrocketing to the upside. If we break down below the hammer candle from Monday, then I think it opens up the door to the ¥170 level in a simple consolidation play.