The US dollar has gone back and forth during the trading session on Tuesday as traders are awaiting the results of the FOMC interest rate decision and of course the statement. While it is anticipated to be a 25 basis point cut coming out of the Federal Reserve, the reality is that the statement is going to be more important as it could give traders an idea as to where things may be going in the future. The more dovish that the market perceives the statement, the higher this pair should go as it could also lead more of a “risk on” attitude as the Japanese yen is considered to be the safest of all currencies.

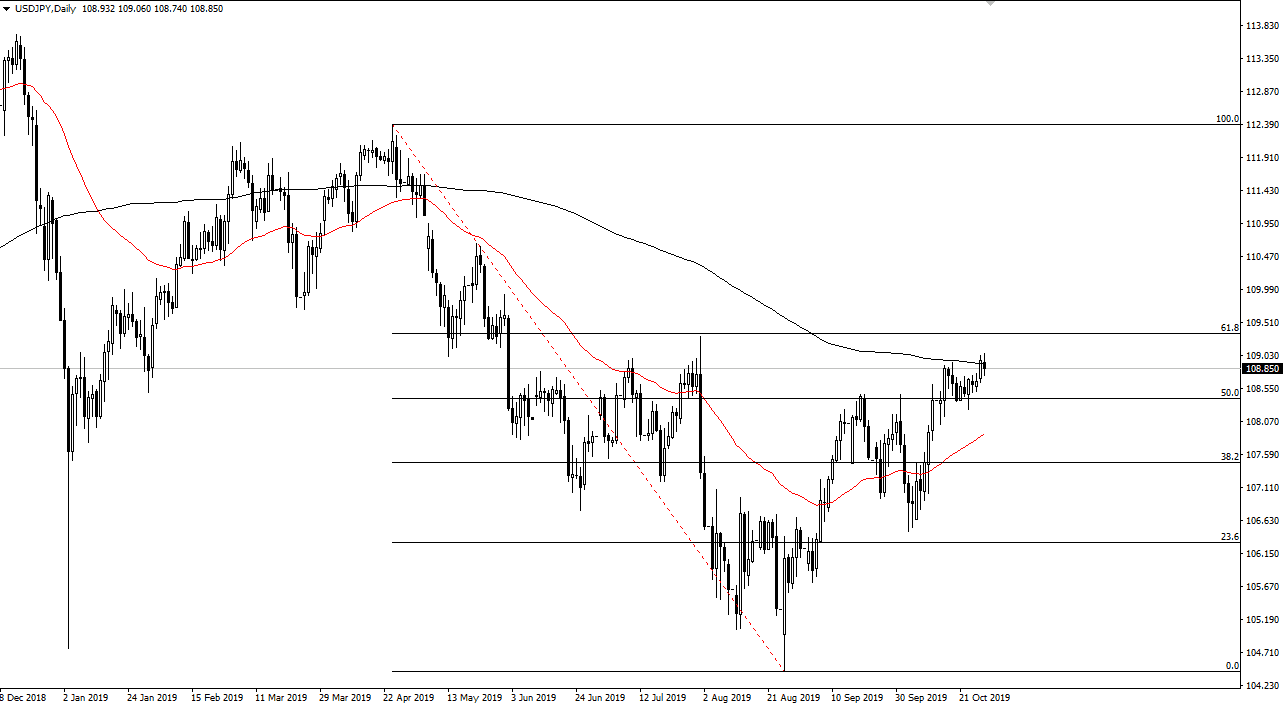

Looking at the technical analysis, the 200 day EMA should continue to attract a lot of attention, as we are currently trading right at it. The 200 day EMA quite often will determine the longer-term trend, and therefore if the market was to break quite a bit higher than that moving average, there are quite a few traders out there that will look at it as a potential reversal of trend, and obviously a very bullish sign.

On the other hand, if the market were to break down significantly, it could send this market much lower. That being said, the 50 day EMA should be somewhat supportive, and therefore it’s likely that the market will find a bit of buying pressure in that area. Ultimately though, I do think that the market is trying to break out for the longer-term move, and not only have we seen a lot of bullish pressure in this pair, but we have seen a lot of bullish pressure and what I quite often use as a proxy for what’s going on here, the S&P 500. The S&P 500 has recently broken above the highs, but now it’s just kind of hanging there as we wait to see what the Federal Reserve is going to do. This market should move right along with the S&P 500 so to be interesting to see what happens next.

To the upside, if we can clear the ¥109.50 level, it’s likely that we will continue to go looking towards the 100% Fibonacci retracement level which is closer to the ¥112.40 level. It’s obvious that we have a lot of choppiness in this area but it’s likely that we will continue to see more of a grind than anything else.