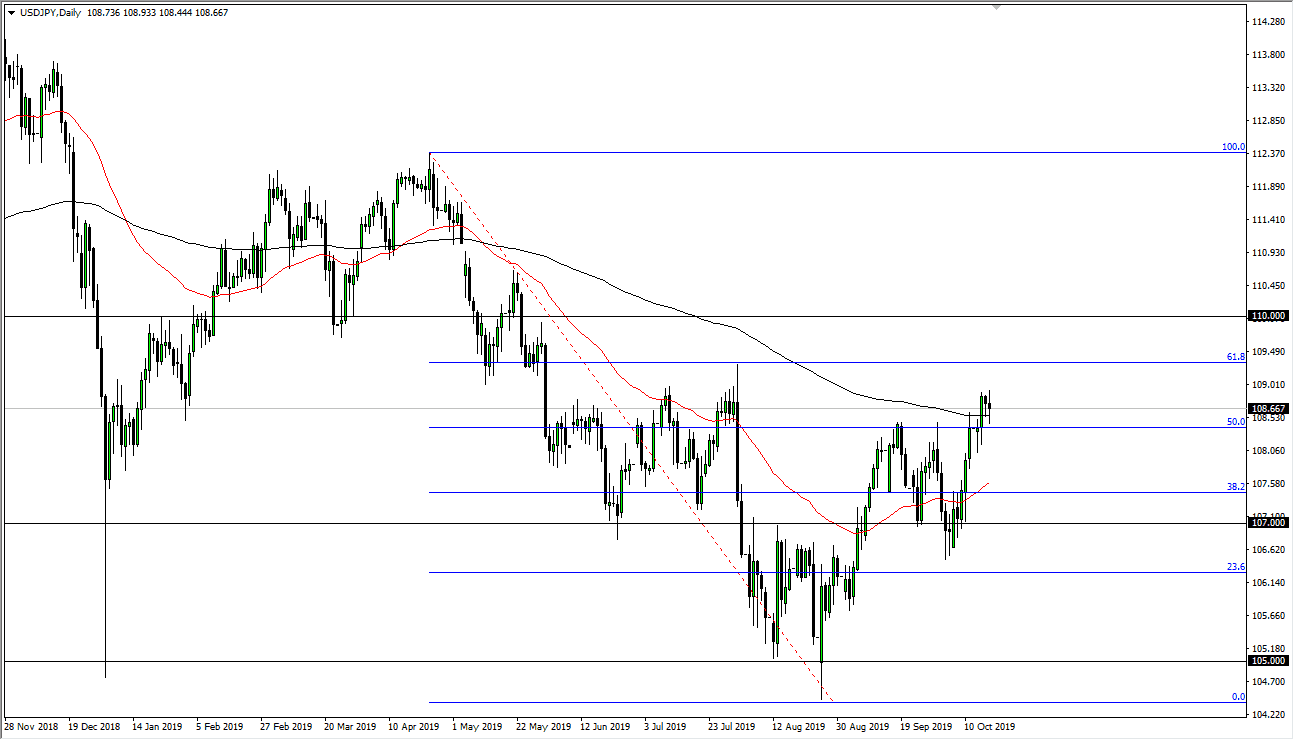

The US dollar went back and forth during the trading session on Thursday as we continue to dance around the 200 day EMA. The action during the day was very lackluster, but quite frankly is very likely that the S&P 500 will be a major influence as we are near the all-time highs and see a lot of resistance just above. I believe at this point in time it’s likely to be a scenario where the USD/JPY pair will continue to react to the risk appetite around the world, meaning that if the buyers step in and start picking up stocks, then this pair should rally towards the 61.8% Fibonacci retracement level. At this point, the market had seen that level offer massive selling based upon the breakdown candle.

The alternate scenario is that we break down below the bottom of the hammer from Monday, then it’s very likely that we could go down to the 50 day EMA. Looking at the charts, that is a very likely possibility, especially if the S&P 500 does rollover like it looks like it could. This doesn’t mean that the market is going to break down drastically, just that a pullback may occur. I also believe that the ¥107 level will of course be a barrier for sellers to try to break down through as well.

We are in the midst of earnings season in the United States, so it makes quite a bit of sense that this pair should continue to chop around in general. I believe at this point in time the market is at an inflection point, so that’s probably part of why we are seen very little in the way of range. Overall, this is a market that will continue to be noisy and move upon the latest headlines. With that being the case, the 200 day EMA is likely to be very important, and I think that the Friday close could be crucial as it will also give us the weekly close, to see where we are at. Expect choppy and noisy trading, but I would probably avoid trying to trade this pair until next week, as the Friday session tends to be a little bit light on volume anyway. In general, this is a market that continues to be erratic and vulnerable to the various headlines around the world right now.