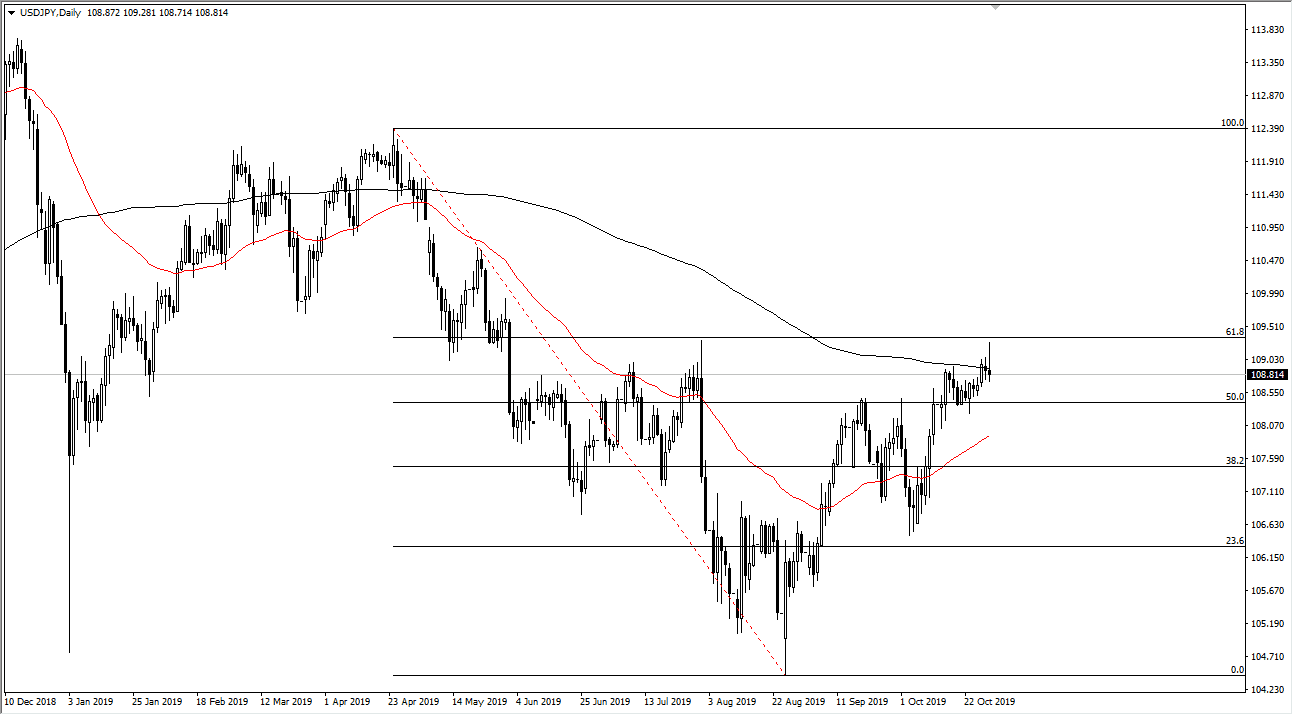

The US dollar rallied significantly during the trading session on Wednesday against the Japanese yen but turned around at the 61.8% Fibonacci retracement level to rollover again and form a shooting star. A lot of this will be due to the fact that the reaction was to the interest rate cut and the press conference afterwards coming from the FOMC. It is interesting to note where we broke down from though, as it is the top of the breakdown candlestick that sent the market much lower. Beyond that, it is also the 61.8% Fibonacci retracement level from the previous move, so that makes quite a bit of sense that traders will have looked at it as an important area.

The shape of the candlestick is a shooting star which of course doesn’t exactly invoke confidence, and therefore it would not surprise me at all to see a bit of a pullback from here, but I also recognize that there should be a certain amount of support near the ¥108.50 level. That level had previously been resistance, so now it should be an interesting place to see support. I think the market will continue to dance around the 200 day EMA, as the FOMC didn’t cause much of a jilt in the market that stuck. At this point, the most likely candidate for a catalyst will be the jobs figure on Friday, which seems to always have a pretty significant influence on this pair.

Keep in mind that the Japanese yen is considered to be the ultimate “safety currency”, as the market will run towards it in times of concern. The candlestick does not look very good, but it’s also at an area where you would expect a lot of noise so don’t be surprised at all to see a lot of choppiness. Looking at this chart, the 50 day EMA is currently moving nearly ¥108 level, so that’s an area that I would anticipate that there is a lot of support. With all that being said I look at pullbacks as potential buying opportunities as we have been grinding higher. Expect a lot of choppy and erratic trading behavior, but that’s pretty typical of this pair. The Thursday session will be extraordinarily quiet, as traders begin to think more about the jobs figure coming out on Friday. Position sizing will be crucial, but at this point it looks like finding value on dips makes the most sense.