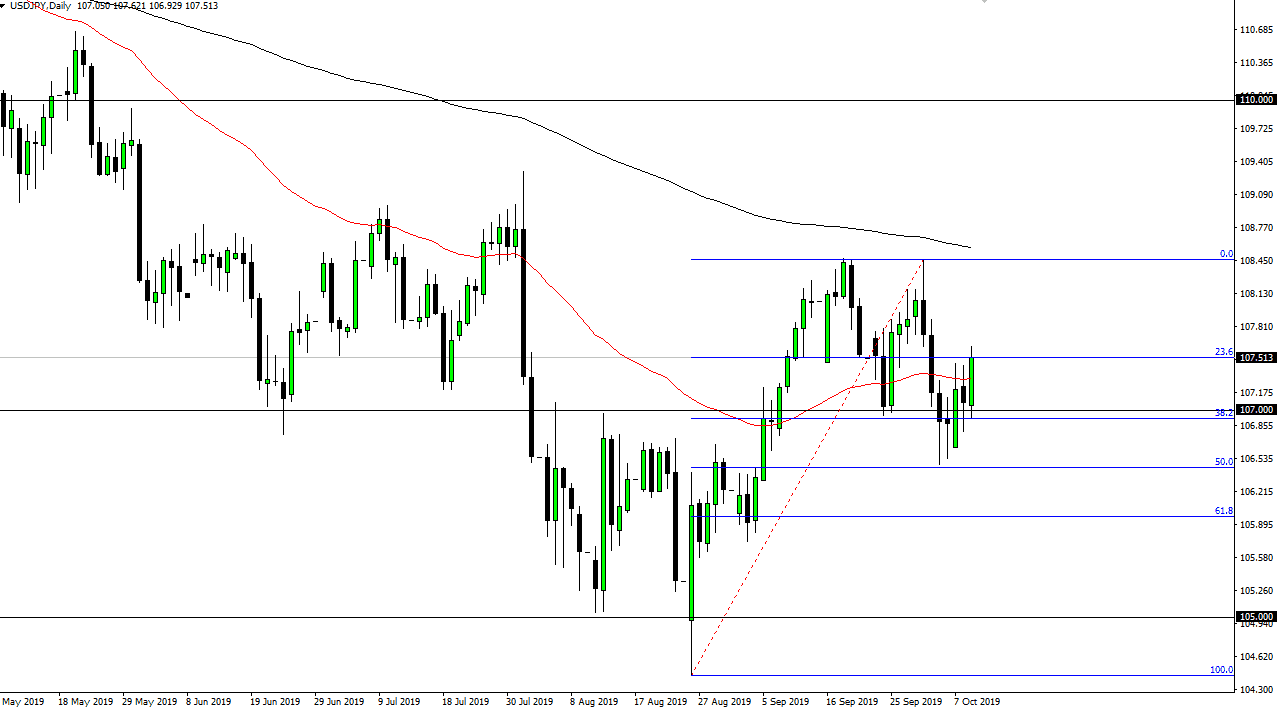

The US dollar rallied significantly during the trading session on Wednesday, after initially pulling back below the ¥107 level. By doing so, we then reached and broke above the 50 day EMA. Beyond that, we are now above the highs from the last couple of candlesticks, so it looks as if we have broken through a certain amount of resistance. That being said though, I think is going to be more of a grind higher than anything else. After all, this is a market that is highly risk sensitive, and we have the US and China talking over the next couple of days that will throw this market around.

All things being equal, this is a market that I do think gives us an opportunity to hold onto a longer-term position over the next several days, but I would also recognize that if we were to wipe out the candle stick from the trading session on Wednesday, then we are likely to slump from here. This is a market that is going to grind back and forth but over the longer-term I do think that we are more likely to go slightly higher than slightly lower. This is essentially a market that probably will offer something for everybody, which makes it a short-term traders market to say the least.

To the downside, if we were to break down and break through the ¥106.50 level, then we could unwind and go down to the ¥105 region. At this point, this is a market that would have seen a significant turnaround, and probably have some type of negative catalyst to push it down there. (I have a sneaking suspicion that I will have something to do with the US/China trade situation if it happens.)

To the upside, if we did somehow get some type of an agreement between the Americans and the Chinese, we could eventually take out the highs and wipe out the 200 day EMA which is pictured in black on the chart. That would be a very significantly bullish move and could lead into a much larger push higher. At this point though, it looks very unlikely to happen and I think we may get a day or two of a slow drift higher, before the market breaks right back down in a serious lack of confidence as there are so many potential negative headlines out there.