The US dollar has gone back and forth during the training session on Friday, as we continue to dance around the 200-day EMA. But this is a market that is in desperate need of some type of catalyst to get moving, and as a result we will be paying attention to a lot of different things currently, not the least of which will be the US/China trade relations. Speaking of those trade relations, as we closed out the week it appears that the Americans and the Chinese are getting closer to signing some type of an agreement called “phase 1”, which is a step ahead. With that being the case, it the first thing that you would have to ask is why hasn’t the pair rallied? It’s generally a risk on/risk off type of currency pairs so the fact that it did not gain isn’t necessarily a good sign.

What I suspect that the market is waiting on is the Federal Reserve next week on Wednesday. That is the interest rate decision which is expected to be a rate cut in the United States. At this point, the rate cut of 25 basis points is probably already baked into the currency pair. That being the case, I wouldn’t expect much due to the announcement. The real question is going to be what kind of statement the Federal Reserve decides to put out. If it is overly dovish, that probably sends more money into risk appetite type of assets, meaning that the Japanese yen will probably lose value, sending this market higher.

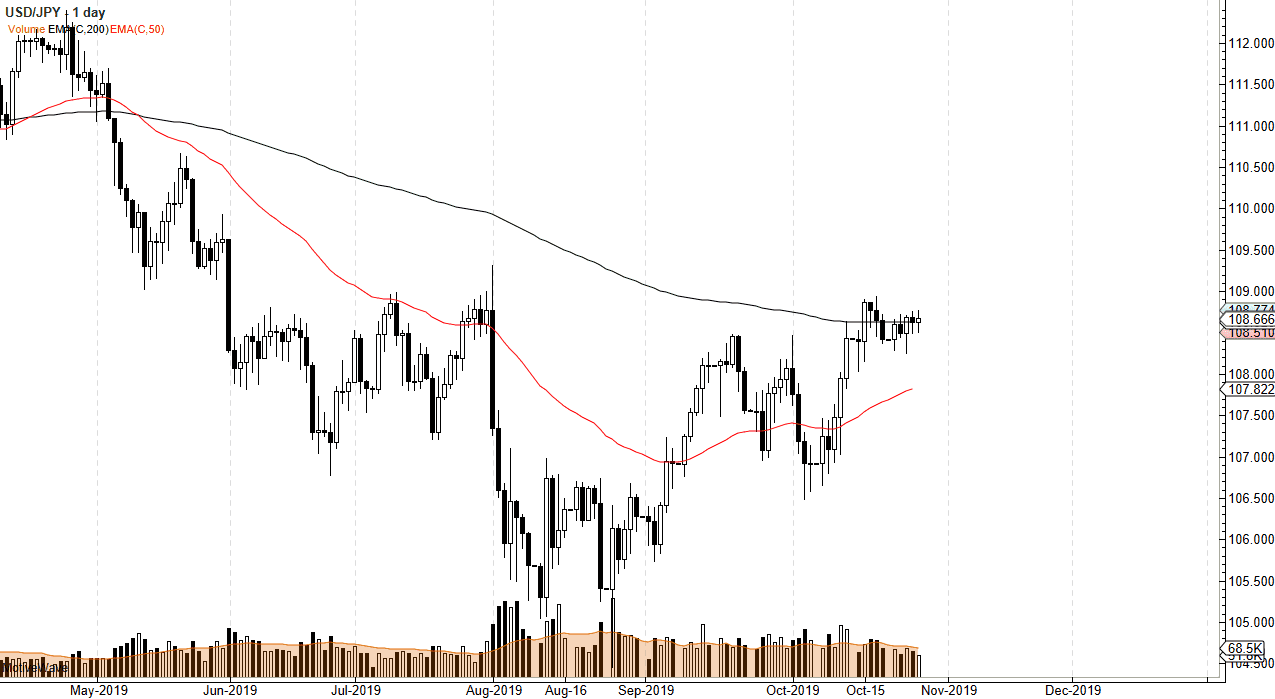

The ¥109 level continues to be resistance, and it would take a significant move above there to get this market moving towards the ¥110 level. Short-term pullbacks continue to find plenty of support near the ¥108.50 level, and of course possibly even the 50-day EMA underneath which is just below the ¥108 level. In other words, there are plenty of reasons to think that this market probably takes off to the upside eventually, but we just don’t have the reason to right now and it looks as if the next couple of days will probably be relatively quiet as we await that next catalyst. The ¥107 level is even more supportive and will attract even more attention for value hunters to get involved. At this point, I think the next couple of days will continue the pattern of being “that money.”