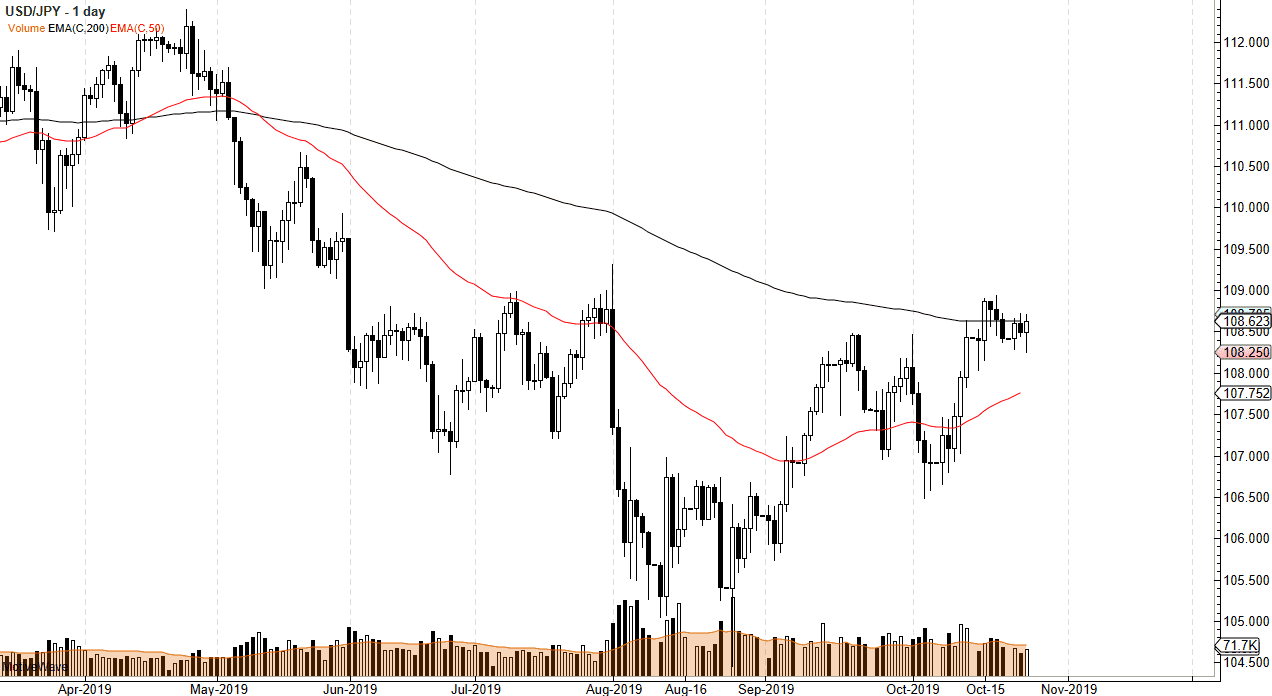

The US dollar initially fell during the trading session on Wednesday but found enough support near the ¥108.25 level to turn things around and form a bit of a hammer. Currently, the market is testing the 200-day EMA, which is a large indicator for longer-term trading. The fact that we are dancing around this area should show just how important this area is, and that we are perhaps trying to figure out where the next huge move happens. All things being equal, we are in the midst of earnings season in the United States and that should continue to cause a bit of transfer when it comes to risk appetite. That risk appetite will present itself in this pair as it tends to rise and fall with animal spirits on Wall Street.

It is worth noting that the 50-day EMA is below the ¥107.75 level and starting to slope to the upside. That could be a catalyst to rally from here but there isn’t much out there to move the markets higher or lower this point. If we break down below the candlestick for the trading session on Wednesday, that could open up the door down to the 50-day MA. If the market was to break above the ¥109 level, then I think that we will see the US dollar continue to gain against the Japanese yen, and perhaps more importantly see several other currencies do the same.

The Federal Reserve is expected to cut rates this month, and that could be weighing upon the US dollar a bit, but at the end of the day if the S&P 500 takes off to the upside and could build up enough momentum, that could send this pair higher. I think that the market has already priced in what the Fed will do as far as an interest rate cut, but now it’s going to come down to the statement. The earnings season hasn’t been bad, so that’s not what has been keeping the stock markets down. Remember, people will run to the safety of the Japanese yen when markets look a bit dangerous. Right now, markets don’t look like they are fearful, they look like they are bored. That is starting to play out in this pair as well, but eventually we will get a larger impulsive candle that we can follow.