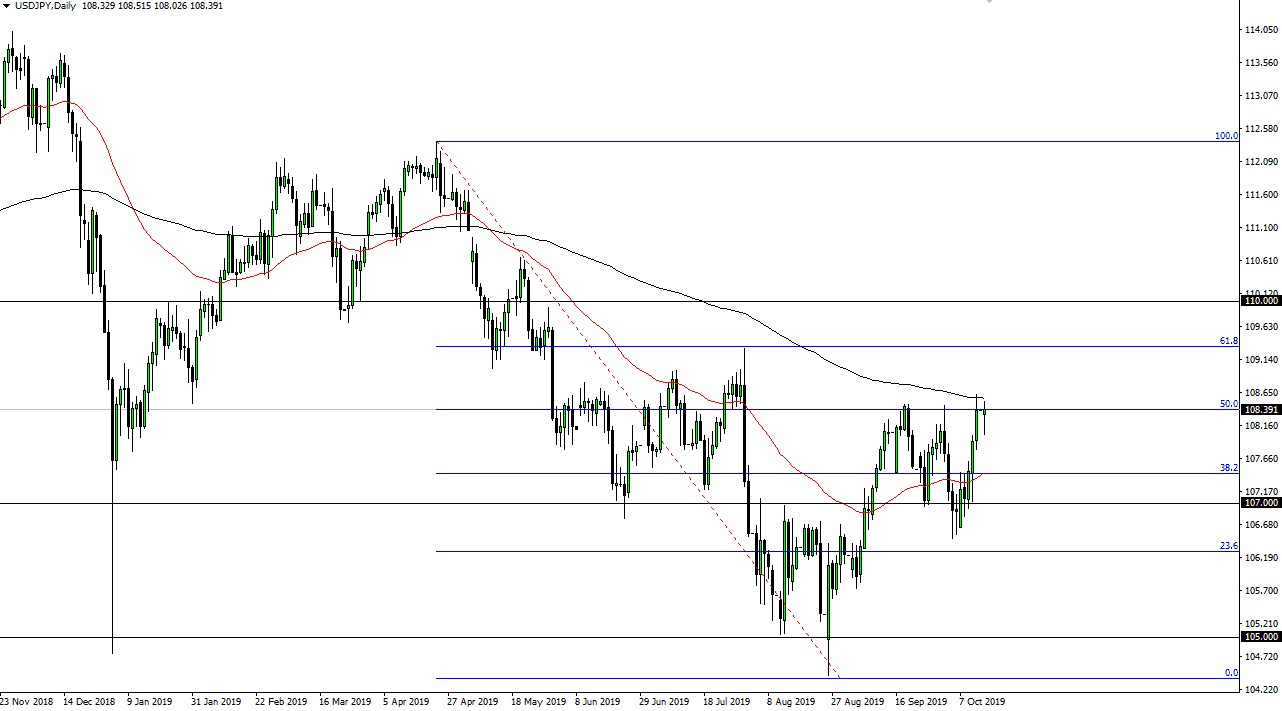

The US dollar is likely to find pressures going higher, as the 200 day EMA is sitting at the ¥108.60 level. That of course is an area that will attract a lot of attention, and as long as that’s going to be the case it’s likely that rallies will be sold into. At this point, I anticipate that if we can break above this area, it’s possible that the market could break out, but it would need to see some type of catalyst. I simply don’t see it but the structural candlestick of the session on Monday suggests that there are still people out there willing to buy this pair.

To the upside, if we can close above the 200 day EMA, that might be the buying opportunity. This isn’t to say that it will be easy, and I would fully anticipate a lot of noisy and nonsensical types of trades. After all, this is a risk sensitive pair, and there are plenty of headlines out there on both news sites and Twitter to not this market and other markets around. If we can break down below the bottom of the candle stick though, that essentially makes it a “hanging man”, and therefore is going to break this pair down and go looking towards the ¥107 level.

Ultimately, this is a market that I think will continue to be very choppy and difficult to deal with, and I think it’s an easier trade to take a break down below the bottom of the candle stick for Monday as it goes with the longer-term trend. It takes real courage to buy this pair right now, because we all know that it’s only going to take a random headlines to have money flowing into the safety currency such as the Japanese yen. If that happens, the market move lower could be rather drastic. On the other hand, if we were to break out to the upside it’s going to be a slow and difficult slog higher.

Another thing that’s thrown a bit of a wrench into the works is the fact that we are at the 50% Fibonacci retracement level. This is an area that of course will continue to attract some attention but it has been tested a couple of different times so I begin to wonder about the efficacy of the level.