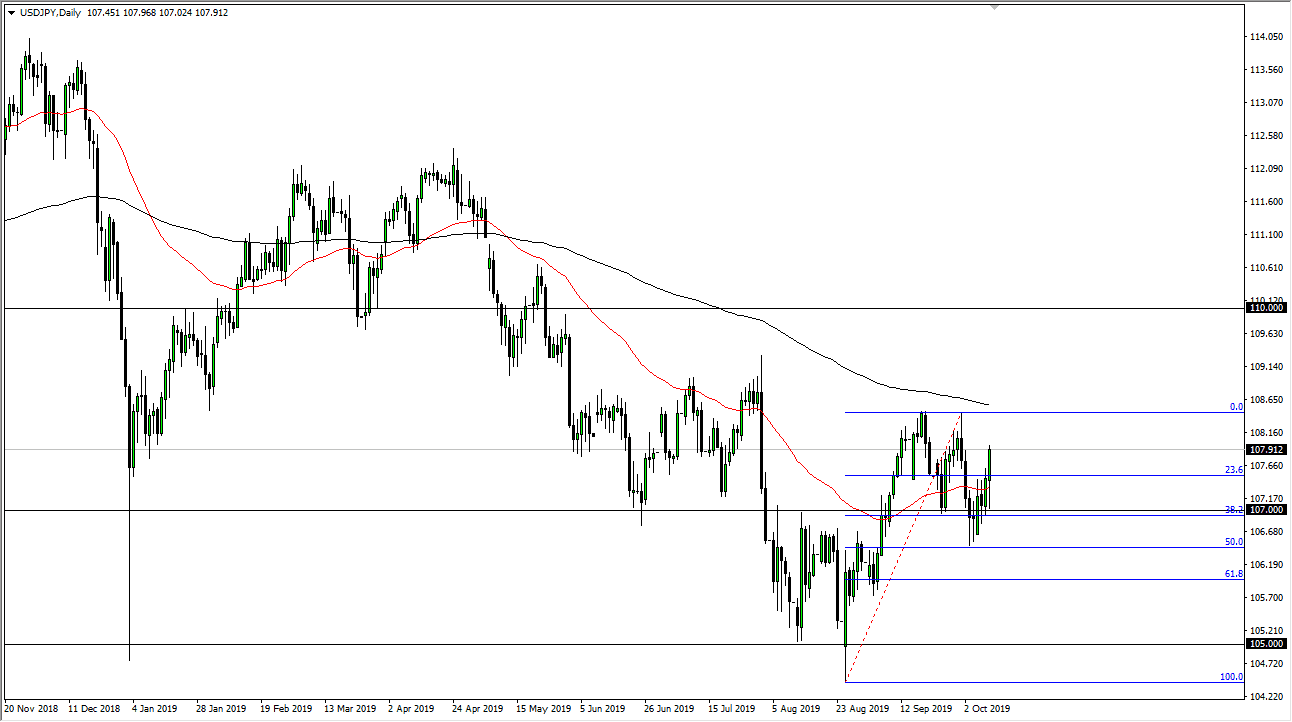

The US dollar has initially fallen during the trading session on Thursday as it was suggested on Twitter that the Chinese were going to be leaving the trade talks a day early. As that did not pan out to be true, traders came back in and started buying as the “risk on” trade came back into the forefront. By doing so, the US dollar rallied against the Japanese yen which is considered to be one of the safest currencies out there. We broke above the 50 day EMA and even closed towards the top of the candle stick. Typically, this will mean a bit of follow-through.

With all of that being said the 100 a .50 level above is significant resistance and it also features the 200 day EMA. That’s an area that tends to attract a lot of attention, so I do think that signs of weakness in that area will probably be sold into and possibly quite aggressively. Beyond that, if the US/China trade situation gets worse, and it very well could, that will probably make this market fall right back down. What I suspect is that by the end of the trading session on Friday, there will be some type of extension or perhaps even a small token offer by the Chinese to buy soybeans, and that’s probably about as good as it gets.

Within a couple of days, you can probably count on something being said that suggests things are going to get worse, and that might be where we turn around as well. Keep in mind that the talks are very likely to go on until the markets are well closed on Friday, so the real reaction probably won’t be happening until Monday. However that jives, that will perhaps fire up the next trend in one direction or the other. With that being the case you should keep your position size relatively small but recognize that the “risk appetite trade” is alive and well and is certainly crucial when it comes to this pair. To the downside, if we were to break down below the recent lows of the 50% Fibonacci retracement level it could open up the “trapdoor selling” and send this market looking towards the ¥105 level. If we were to break above the 200 day EMA, that’s a trend change and people will start aiming for much higher, with the ¥110 level being the most obvious target in the short term.