The US dollar is slightly positive during the trading session on Monday, but it looks lackluster against the Japanese Yen to say the least. This is a market that continues to show signs of confusion, and that makes quite a bit of sense considering that the market is just below the 200-day EMA, an area that attracts a lot of attention from longer-term traders. Ultimately, this is a market that will continue to see a lot of noise, mainly because it is so highly levered to risk appetite. As a general rule, this market will rise and fall with stock markets, especially the S&P 500. If it starts the rally, it will be a major “risk on” type of situation. However, it is sitting at the recent highs and more importantly the 3000 handles. This has an influence on the USD/JPY pair, as it simply cannot break to the upside.

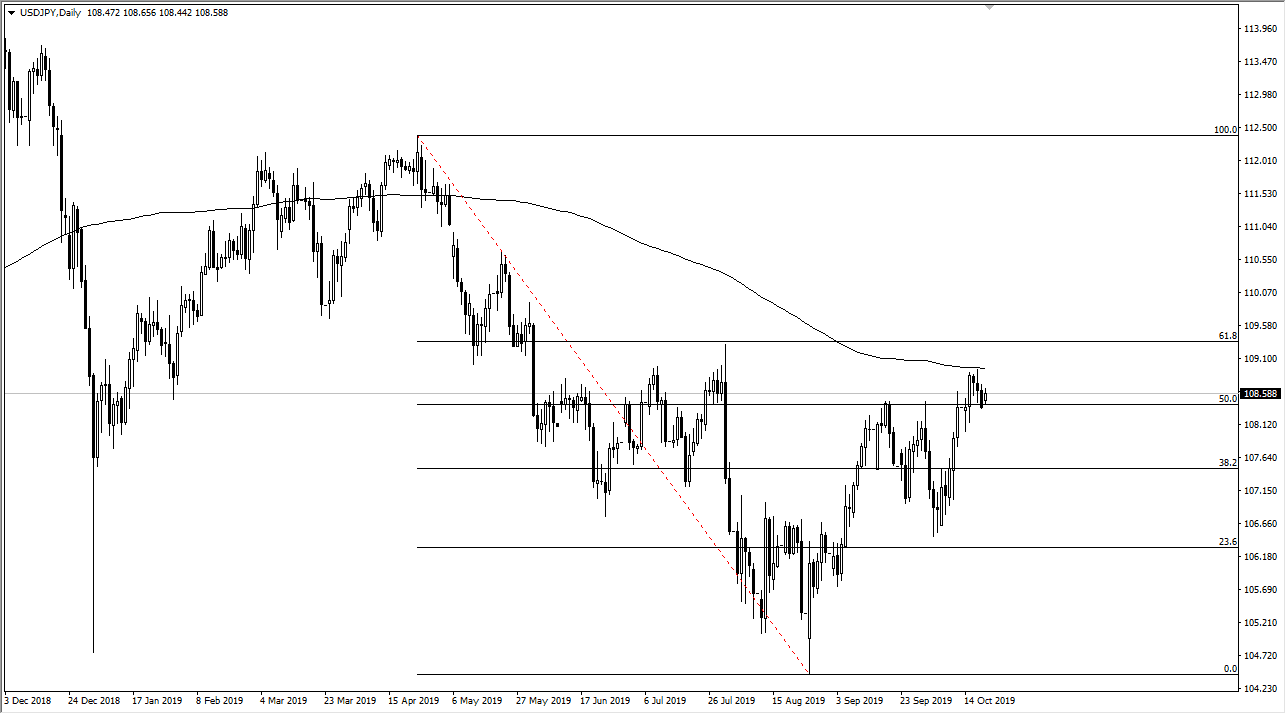

Looking at this chart, if the market can break above the 200 day EMA, the market should eventually rally towards the 61.8% Fibonacci retracement level, and then perhaps the ¥110 level. At this point, the market would be very bullish. All things being equal though, it’s very likely that we could rollover based upon exhaustion and the simple fact that the market doesn’t seem to have anywhere to be. Short-term back and forth trading makes a lot of sense, so looking at this chart through the spectrum of choppy back and forth trading is probably the best it gets.

At this point, the market has been back and forth enough that it will probably continue to see erratic short-term trading above all else. Earnings season is right in the middle of kicking the market around the same time, and as we just started the second week, we have some time to go. With that in mind, I think this pair will continue to go sideways in general, therefore we need to see some type of decision in the markets as far as risk appetite is concerned in order to take advantage of a move. In the meantime, this is a market that will simply be waiting for some type of larger economic move to get moving with any intensity. Until then, this is essentially going to be “dead money”, which is a nice proxy for the way the markets have moved in general.