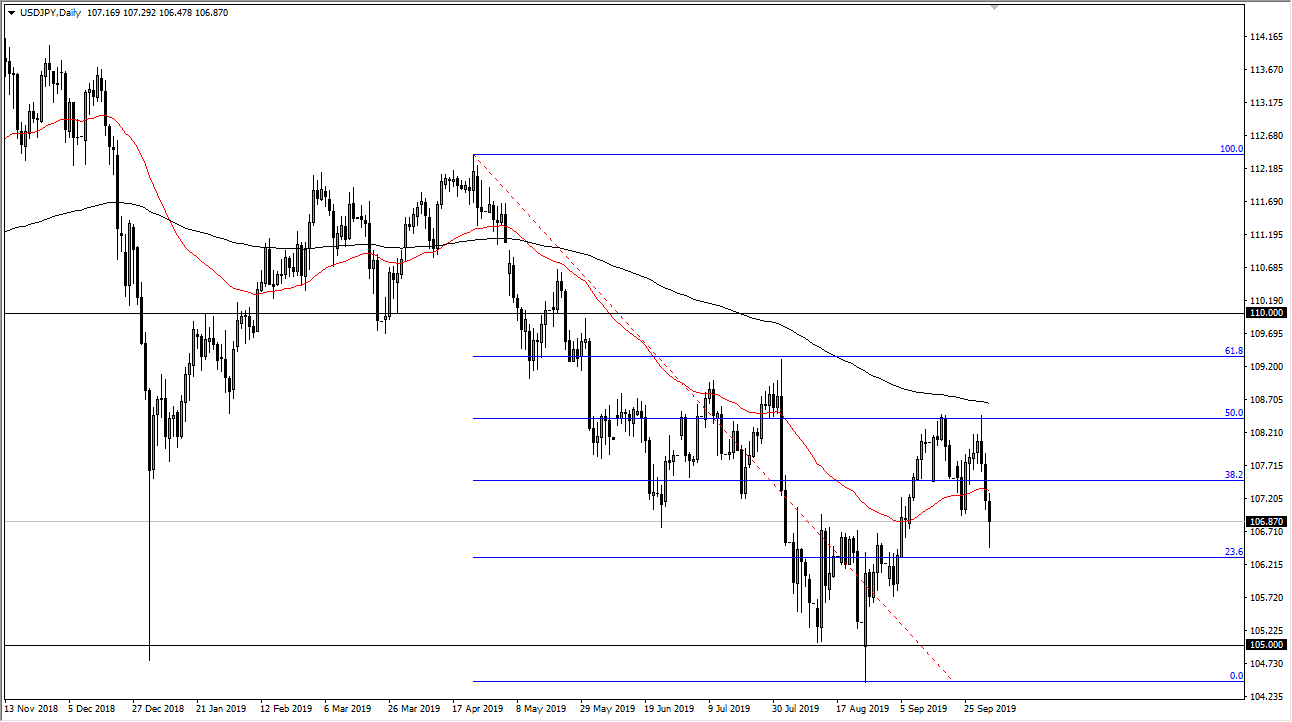

The US dollar has fallen a bit during the trading session on Thursday, reaching down towards a support barrier based on the previous consolidation during the month of August. The market did bounce a bit towards the end of the day, perhaps in preparation of the impending Non-Farm Payroll announcement. That obviously has a major influence on the US dollar, and then by extension a major influence on the USD/JPY pair.

Keep in mind that this pair is also a very risk sensitive as well, so if there is a general “risk off” move, that means that this pair tends to fall as people ran towards the safety of the Japanese yen, bank loans being repaid from that country, and of course JGB markets. Money flows directly to Japan to soon as we get trouble, and although the US dollar is a bit of a safety currency as well, it’s lower in the pecking order than the Japanese yen.

To the upside, if we get some type of positive surprised the 200 day EMA is sitting just above the 50% Fibonacci retracement level, at the ¥108.50 level, or where we have fallen from recently. I think this is a market that will continue to be very noisy and most certainly will be during the announcement at 8:30 AM New York time. Regardless though, we are essentially stuck between the 200 day EMA and the previous highs at the ¥106.50 level. While things are drifting a little bit lower, and I do believe that the longer-term likelihood, I suspect that short-term bounce could be in the cards. All things being equal, quite often these sessions are the worst for this pair because it will go all over the place and essentially in of the day relatively unchanged.

As we are in the longer-term downtrend, that also makes selling much easier than buying. The Japanese yen does look as if it is going to continue to strengthen against many other currencies, not just the US dollar. I have seen bullish pressure against the Euro, the Canadian dollar, and the New Zealand dollar as of late, which of course can’t be ignored as it shows relative strength in general. If we get a major “risk off move” in the form of the stock market selling off, that also could help this pair fall from here.