The US dollar broke down significantly during the trading session against the Japanese yen during Wednesday as the S&P 500 got hammered. However, the stock market is near the 200 day EMA and there are plenty of people out there willing to buy any type of risk. That being the case it makes sense that this pair will probably bounce a bit, unless of course there is some type of headline comes across the wires. Beyond that, the Friday session is the jobs number, so that means that it could be rather quiet on Thursday so therefore in less something actually happens I suspect that Thursday will either be a recovery day or just the simple grinding back and forth type of session.

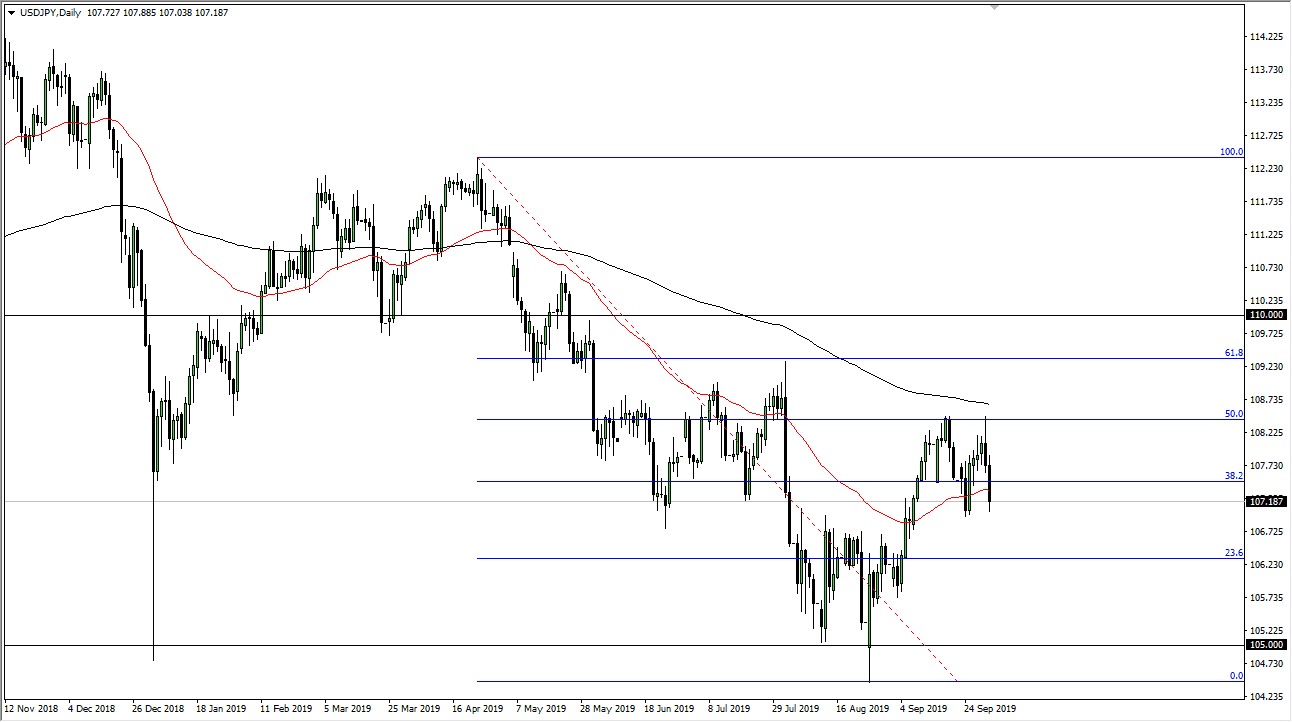

Keep in mind that this pair is highly sensitive to risk appetite, so if there is some type of negative headline crossing the wires, then it’s possible that this pair could drop down towards the ¥106.75 level underneath, which previously had been massive resistance. At this point, a break down below there opens up the door to the ¥105 level, but there would be a lot of noise between here and there. Ultimately, if we were to break to the upside market could go looking towards the ¥110 level but I also see a lot of trouble in the form of the 200 day EMA which is painted in black on the chart just above the most recent high. I think the next 24 hours will probably be choppy consolidation, and I wouldn’t be surprised to see Friday somewhat unchanged as well, as the nonfarm payroll days tend to be noisy to say the least.

Longer-term, we are in a downtrend so I’m not overly surprised if this market breaks down. That doesn’t mean that it ends up being a massive selloff, just a grind to the downside and should continue to test that low. I think there are so many risks out there it’s difficult to imagine a scenario where people would be overly charged for the upside as a lot of things would have to change geopolitically, not to mention economically. At this point, I think there’s more risk to the downside but in the meantime we may simply go sideways as this pair is known to do from time to time.