The US dollar did very little during the trading session on Tuesday, as we continue to bounce around in the same very tight range against the Japanese yen. I suspect this is probably going to continue to be the case, so at this point I look at this pair as essentially being “dead money.” I have no interest in trading this market, because there are far too many things that cause confliction when it comes to attitude and momentum. In other words, there is no momentum.

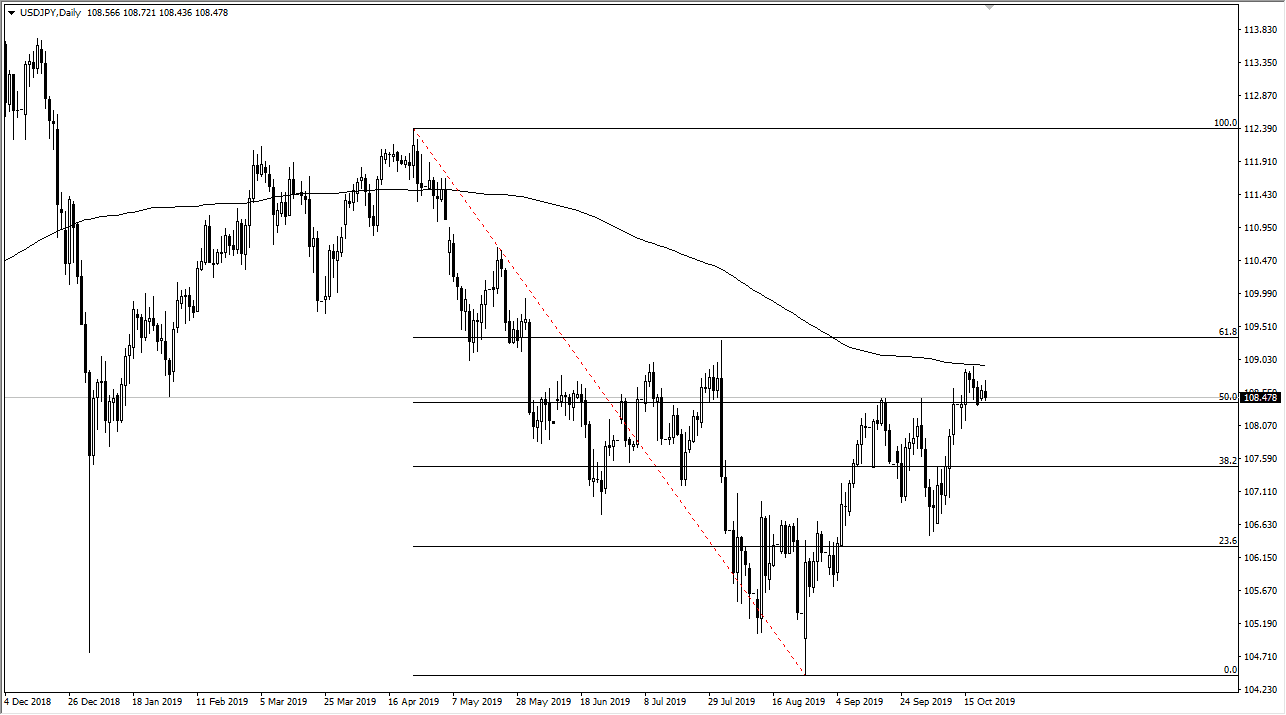

Keep in mind that the pair is highly sensitive to risk appetite, and especially to the S&P 500. As the S&P 500 can’t make any headway against the recent highs and is essentially stuck in a pattern of building more and more inertia to the upside, one would have to think that this pair probably drops and then bind buyers yet again. A breakdown below the ¥108.33 level could send this market down to the ¥107.50 level, and then the ¥107 level. On the other hand, if we were to rally, we would need to get a weekly close above the 200-day EMA to get excited. I think there is going to be a massive amount of resistance at the ¥109.50 level, based upon the significant breakdown that we have seen from that level back in July.

The Bank of Japan certainly is trying to do everything it can to weaken the Japanese yen as it has already suggested that more quantitative easing is coming. That being said though, this is a market that seems to be ignoring that and paying more attention to the headline of the day. At this point, algorithms are taken over and are starting to throw a lot of correlated markets back and forth. This is why the USD/JPY pair simply cannot move, because the S&P 500 algorithms tend to trade the same markets. In other words, they don’t know what to do and they are simply banging back and forth for a few ticks here and there. I would avoid this market until we get some type of significant candlestick, something that we desperately need at this point in time. From a longer-term standpoint, one would have to think it’s likely we go higher but there’s nothing on this chart to get me excited at this point and therefore I am flat when it comes to this pair.