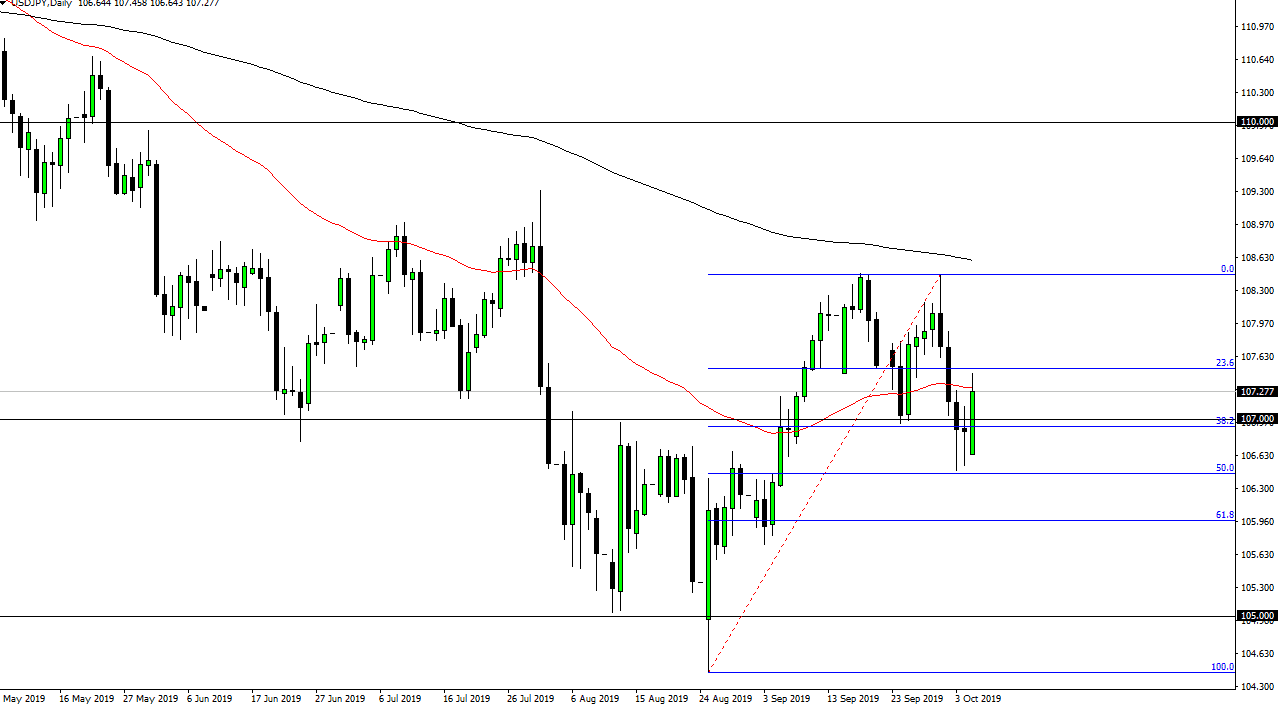

The US dollar has initially gapped lower during the trading session on Monday, but then broke towards the 50 day EMA above. At this point, it will be interesting to see whether or not the momentum to the upside can continue, and if we can break above the highs from the Monday session it’s likely that the market will go looking towards the ¥108.50 level again, the area where we have fallen from twice. That being said though, keep in mind that this pair is highly sensitive to risk appetite and financial markets, so one of the secondary indicators I use as the S&P 500.

If the S&P 500 were to break out to the upside and continue going higher, then I believe that the USD/JPY pair should continue to go higher. However, if the stock market breaks down rather significantly, it’s likely that the pair would break down, perhaps reaching below the ¥106.50 level. If we were to get down below there, the market probably reaches towards the ¥105 level, which would be a major round figure that will come into play and perhaps attract a lot of attention. At this point, I would say that we could go in either direction, and with the US/China trade talks going on during the week, it’s very likely that we will see a significant amount of back and forth.

The size of the candle stick is rather impressive, but at the end of the day it doesn’t seem like a market that is going to be easily traded due to the fact that headlines then of course the leaks will come out that the Americans or the Chinese are saying this or that, and that’s going to throw the market around. Ultimately, it’s very likely that this market continues to see a lot of back-and-forth, and obviously there is the possibility of a sudden surge in one direction or the other. I’d be cautious about position size at this point, because Murphy’s Law dictates that if it does move suddenly, it could very well move against you. To the upside, the ¥108.50 level is also reinforced as far as resistance is concerned by the 200 day EMA as well. Breaking above there would be a bit of a trend change, but not something that I would expect to see anytime soon. I suspect volatility is here to stay.