The US dollar fell a bit during the trading session on Friday but recovered after the jobs number came out slightly less than anticipated, but with strong internals. Beyond that, the unemployment rate is at historic 50 year lows, so that of course puts a bit of a “risk on” trade into vogue again. This drove the S&P 500 higher, which of course drives this pair higher.

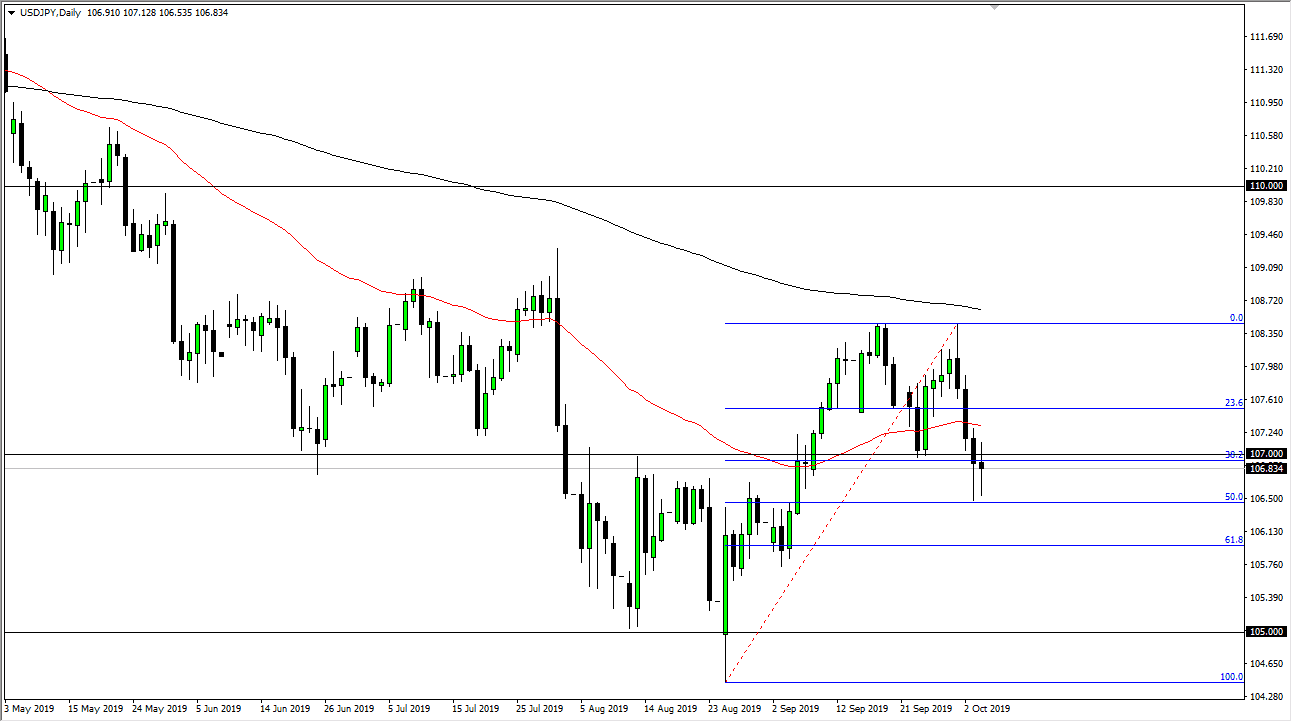

Beyond that, the 50% Fibonacci retracement level seems to be offering support, as it is at the ¥106.50 level, a scene of previous resistance. It’s essentially “market memory” that’s holding this market up, and now it looks like we could rally from here to go right back into the previous consolidation. That could send this market as high as the 108 .50 level which was the most recent high. Ultimately, I think this market continues to be very choppy and sideways overall, but I also think that eventually we have to make a decision about the 200 day EMA that’s just above that high and painted in black. If we can break above there, then fine, we would be in a bullish trend. However, until we get above there, it’s very unlikely that you can hang onto a long position for anything significant as far as time is concerned.

Breaking down below the 106.50 level could open up the door down to the ¥105 level, which is the previous support level. It’s also a large, round, psychologically significant figure, so it makes quite a bit of sense that it would attract a lot of attention. At this point, the market is very volatile, and that is typical as there are so many issues out there that can throw the markets around as far as risk appetite is concerned. Remember, the Japanese yen is considered to be one of the “safest currency” in the world, so as people get spooked, they start buying the yen. On the other hand, if we start to see signs of bullish pressure in places like the S&P 500 and commodities, this pair should follow right along with it as the Japanese yen get sold in order to find more yield. All things being equal, I think we bounce from here and then pulled back yet again as we continue to grind slowly lower longer term, but I do not believe that we are about to see some type of meltdown.