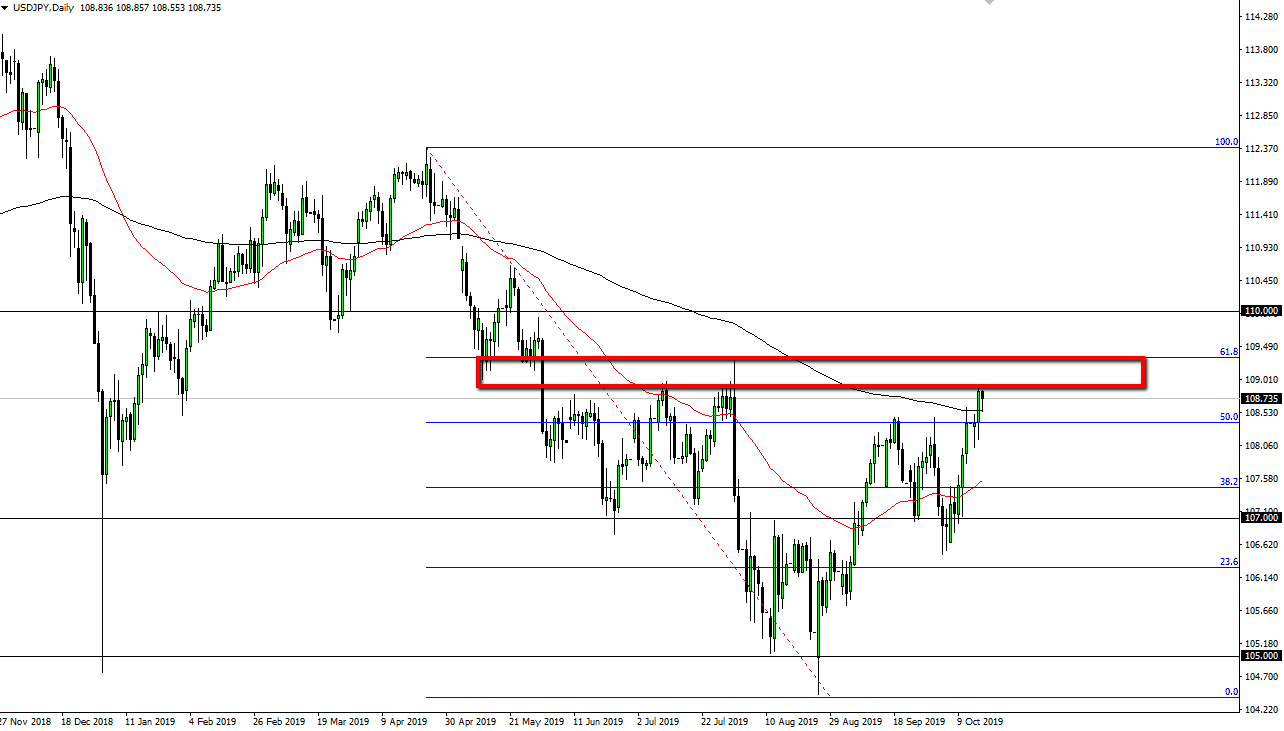

The US dollar initially fell during the trading session on Wednesday but found enough support at the 200 day EMA to turn around and show signs of life again. That being said, it looks as if the market is trying to break out to the upside. One thing that I do pay attention to is that in late July we had broken down significantly and formed a massive negative candle stick. We are now testing the top of that which should show quite a bit of resistance. Beyond that, we also have the 61.8% Fibonacci retracement level at the top of the candle stick. In other words, if we do continue to rally, and it looks like we may try to, that would be very difficult to overcome.

To the downside, if we were to break down below the Monday candle stick, it would show a significant break down of support and it’s very likely that the USD/JPY pair would reach down towards the 50 day EMA which is painted in red on the chart. The ¥107 level could offer significant support as well as well as a nice target. That being said, it looks as if the buyers are starting to take hold of this market, so it’s much more likely that we continue to grind higher, but the keyword here of course would be “grind.”

The ¥110 level above could be a significant target, but it’s going to take a lot of effort to get there. Remember that this pair is highly sensitive to other orchids around the world and more importantly risk appetite. Pay attention to the S&P 500 as an example, because it does in fact tend to be a nice proxy for this currency pair. Bonds also can give you a heads up, as interest rate differentials can determine where this pair goes, with higher interest rates in the 10 year note in America giving bullish pressure as well. At this point, the market looks as if it needs to make some type of decision, and the fact that we are dancing around the 200 day EMA which is a longer-term indicator, should not be a huge surprise based upon the recent price action. We have rallied quite nicely, but that doesn’t mean that we are simply going to continue doing more of the same without some type of pullback or fight ahead of us.