The US dollar will be very quiet during the training session on Tuesday against the Japanese and, as we await the Federal Reserve FOMC meeting announcement on Wednesday. This will have a massive influence on risk appetite around the world, and certainly will influence the value of the US dollar. That being said, the value of the US dollar does tend to move a bit different in this pair as if it is certainly a huge “risk on” type of move out there, that should send this pair higher as the Japanese yen will be faded.

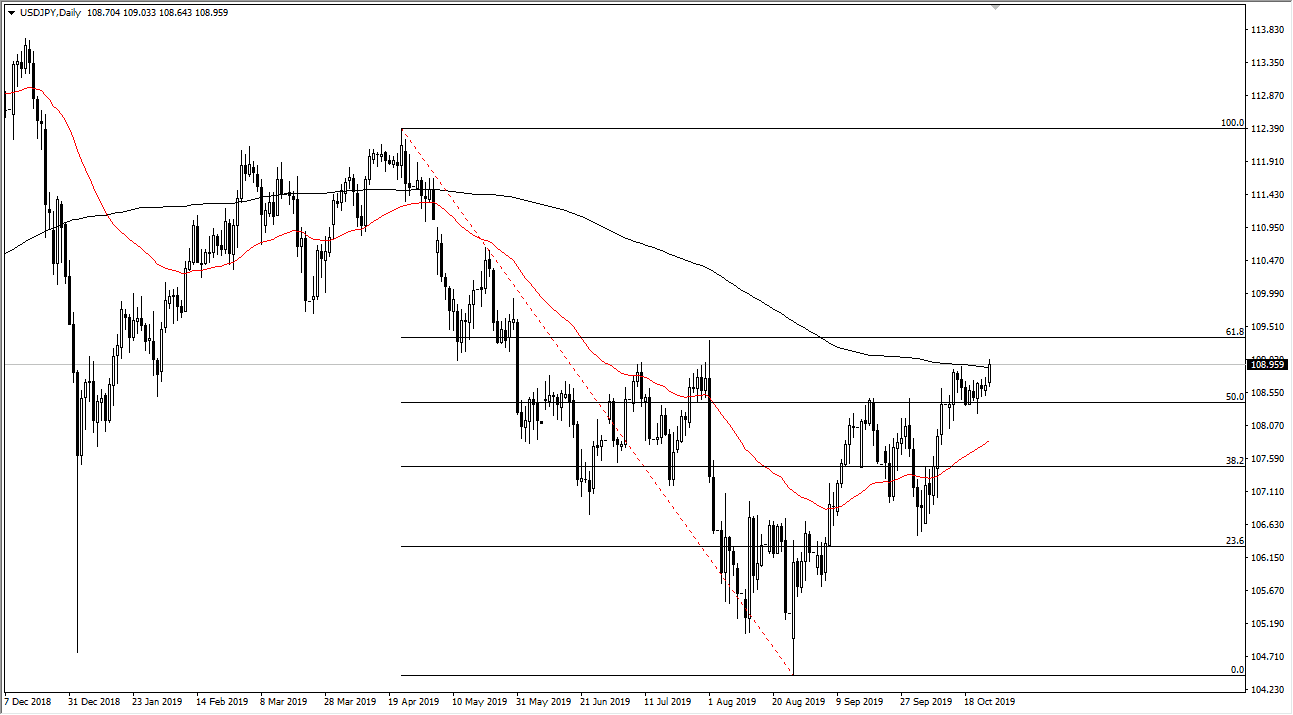

To the downside, the ¥108.50 level should continue to offer short-term support, just as the red 50 day EMA should be. Ultimately, this is a market that has been grinding away to the upside but also features a massive amount of resistance in this general vicinity, due to the fact that we had broken down so drastically from this general area. Beyond that, the 200 day EMA has offered resistance over the last couple of days, and I anticipate that this resistance will run all the way to the 61.8% Fibonacci retracement level above. This doesn’t mean that it can’t break out, just that it is going to be a massive undertaking.

In the meantime, I believe in pulling back simply offers value in this pair. The S&P 500 was strong during the trading session, and this pair does tend to move right along with that market. As there is more of a “risk on” type of vibe out there, this tends to have traders shunning the Japanese yen as it is considered to be the ultimate safety currency. This doesn’t necessarily mean that the US dollar will strengthen against everything else, it just will in this pair. On the other hand, if market starts selling off due to something the Federal Reserve does, this pair will probably break down rather stringently. If we were to clear the 50 day EMA, there would be a very negative sign in kids in this market screaming towards the lows again. That being said, it seems to be very unlikely for the Federal Reserve to do something like that, so at this point I think we will eventually try to break out but it’s going to potentially take several different attempts. If we break above the 61.8% Fibonacci retracement level, then it opens up the door to the ¥112 level.