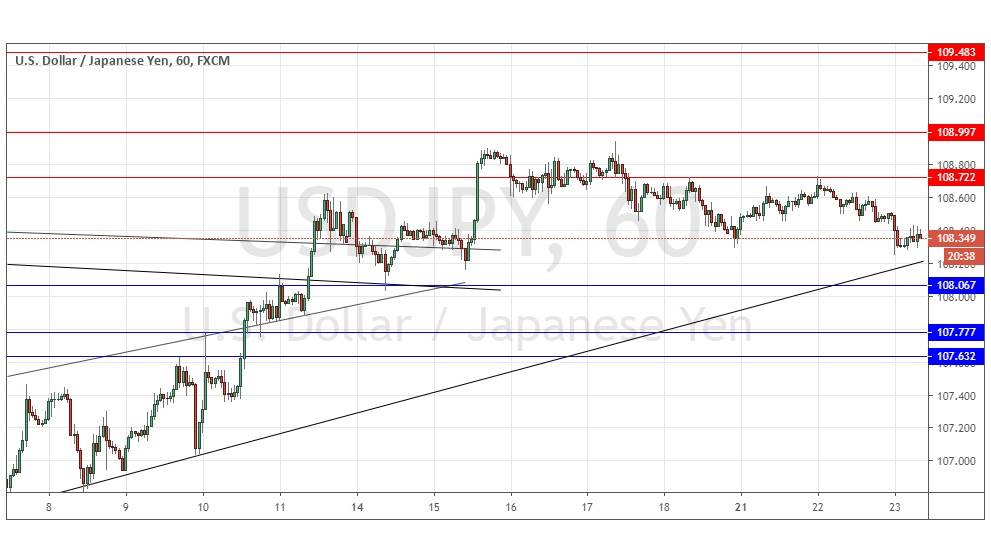

USDJPY: Strong support & resistance at 108.07 & 109.00

Yesterday’s signals were not triggered, as none of the key levels given have been reached yet.

Today’s USD/JPY Signals

Risk 0.75%.

Trades must be taken from 8am New York time Wednesday to 5pm Tokyo time Thursday.

Short Trade Ideas

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 108.72 or 109.00.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 108.07, 107.77, or 107.63.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

I wrote yesterday that the price was likely to drift down towards the support level at 108.07 where there might be an opportunity to enter a long trade if there was a bullish reversal there. This was a call in broadly the right direction as the price has inched lower, but not by much. There is potential support a little higher than the horizontal level at 108.07 with an old supportive trend line which has remained unbroken and is coming into play again, as can be seen in the price chart below.

The big picture is that the price is ranging in a very pivotal area, with strong multi-week resistance overhead, but does not seem to ready to fall yet. In the absence of any major scheduled news likely to affect this currency pair today, the nearby support and resistance levels are likely to hold, so either a long off 108.07 or a short off 108.72 will probably be OK trades today. I see greater long-term potential for such trades to run on the short side. There is nothing of high importance due today concerning either the JPY or the USD.

There is nothing of high importance due today concerning either the JPY or the USD.