Global financial markets and investors eye cautiously the outcome of the high-level trade talks round between the world's two largest economies to find a chance to halt their trade war, which has slowed global economic growth, and could push it into recession unless an agreement is reached. Ahead of the meeting, the USD / JPY moved towards the 107.62 resistance level after a positive tone from the content of the Fed’s last meeting showed that the policy makers think that financial markets are expecting more US rate cuts in an exaggerated manner and that the rate cuts this year are a guarantee for US economic growth, which has the longest growth period in its history.

Members attending the meeting said they agreed that the policy is not on a predetermined course and will depend on the repercussions of the information received that affect the development of the economic outlook. The next Fed monetary policy meeting is scheduled for October 29-30, with the final meeting scheduled for December 10-11.

The most prominent opinions of the members of the meeting were from Kansas City Fed President, Esther George, and Boston Fed Chairman, Eric Rosengren, who preferred to keep the current interest rate unchanged. George and Rosengren noted that the recent economic data was largely positive, and with a policy stance unchanged, the labor market continued to strengthen along with strong economic growth, and inflation rising gradually to the Fed's 2 percent target. George and Rosengren also suggested that further policy stabilization during a period of high economic activity and higher asset prices could have negative consequences for financial stability. Meanwhile, St. Louis Fed President, James Pollard, favored a 50bp rate cut, confirming that the rate cut would be more consistent with the Fed's goals over time.

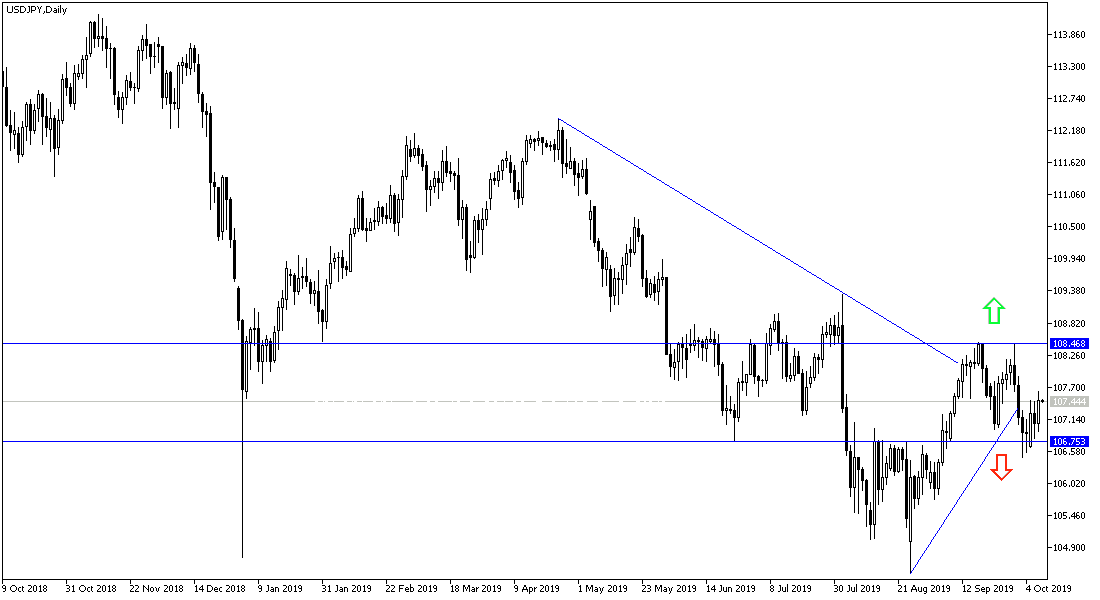

According to the technical analysis: Attempts for an upward correction for USD / JPY so far is still weak, and the reversal of downward outlooks will not strengthen without testing the psychological resistance 110.00, and the pair is still vulnerable to the re-test the support areas at 106.80 and 105.90, especially if the US-Chinese trade talks round failed to agree on a deal that ends the commercial dispute between them. The Japanese yen is the most important safe haven for investors in times of uncertainty.

As for today's economic data: From Japan, the PPI will be released. From the US, the consumer price index figures that measure US inflation as well as jobless claims will be released.