USD/JPY rebounded from the 106.65 support level to the 107.46 resistance level in the first trading session of this week. This added to investors' optimism and consequently a return to risk appetite. US President Trump signed an agreement with Japan a deal that would benefit US farmers who were adversely affected by Trump's withdrawal from the Trans-Pacific Partnership Agreement in his first week in office. That agreement was approved by the Obama administration. The other 11 Pacific Rim countries, including major farm producers such as New Zealand and Canada, have advanced without the United States. Meanwhile, the new deal between the United States and Japan does not resolve disputes over the auto trade. Trump said the two countries continue to work on a more comprehensive agreement.

Trump has threatened to impose import taxes on foreign cars, claiming they pose a threat to US national security. At the UN General Assembly, Japanese Prime Minister Shinzo Abe told reporters that Trump assured him that there was an agreement to spare Japan from the tariff of new cars, which has not happened so far. Japanese carmakers are still disappointed that the US has kept its current car tariff at 2.5%.

The outcome of the upcoming round of trade talks between the United States and China later this week will move the Forex market strongly. Its failure, which is closer to market expectations, means more retaliatory measures between the two largest economies in the world, thus increasing the prospects for the global economy to enter a recession. This will reinforce the strength of the Japanese yen once again because it is one of the most important safe havens for investors in the event of increased global trade and geopolitical tensions. Conversely, in the event of an agreement between them, investor appetite for risk will increase and the pair finds the opportunity to make strong gains in a short time.

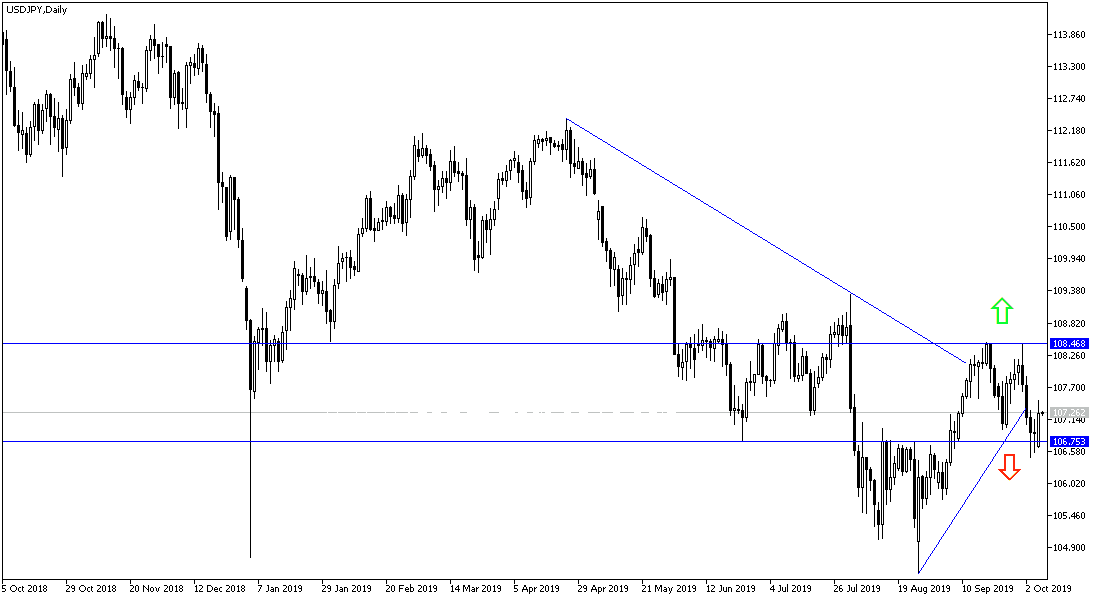

According to the technical analysis of the pair: The general trend of the USD / JPY price is still under downward pressure, and stability below the 107.00 support level will support the move towards stronger support levels down to 106.35, 105.55 and 104.80, respectively. The bullish correction will not strengthen without testing the 110.00 psychological resistance.

As for the economic calendar data today: From Japan, the average wage, household spending rate and current account will be announced. From the US, we will have the producer price index and remarks by Federal Reserve Governor Jerome Powell.